IT or AI? This ‘Twofer’ Means We Don’t Have to Choose

|

| By Michael A. Robinson |

I recently celebrated my 40th anniversary — though not in the way you might think.

You see, in June 1984, I moved to the Bay Area. Two reasons drew me to the region …

First, after analyzing the technology sector for many years, I wanted to get directly involved in Silicon Valley.

And second, I wanted to race J-24 sailboats on San Francisco Bay, the world’s most exciting sailing destination.

All these years later, I’m constantly reminded how my passion for sailing dovetails nicely with my love for using high-tech stocks to crush the broader market.

For example, as a small boat skipper, I would occasionally get the chance to “slipstream” a larger yacht — to get behind a bigger boat and let its draft pull me along. It’s a neat maneuver that provides good speed with very little extra effort.

The thing is there’s a company that’s currently slipstreaming behind one of the world’s biggest tech giants.

Today, I’ll reveal the details of this formation and explain how we can profit from their maneuvering with a stock that has beaten the broad market by more than 160% …

Microsoft Pivots its Focus

The tech giant I’m referring to is Microsoft (MSFT). And while it’s long known for selling software for personal and business computers, the company recently pivoted its focus to workflow automation — the practice of automating a collection of manual processes and tasks.

To do so, Microsoft’s cloud-based software works on a set of pre-defined criteria or conditions.

The idea is to tap workflow automation so that organizations save time and money by reducing human input, as well as the risk of employee errors.

For investors, workflow automation is a field worth targeting.

According to Acumen Research, the sector will grow 23% a year through the end of the decade. At that point, it’ll be valued at nearly $78 billion.

A Failure to Communicate

That level of growth is exciting. But this sector’s attractiveness also stems from the fact that it enables us to tap into the modern hybrid-work world. That’s because automation software can reduce employee turnover.

One of the most common reasons employees leave a company is a lack of communication with management. And with millions of workers still logging hours remotely, it’s easy enough for team members to get signals crossed.

For its part, Microsoft had a compelling reason to join forces with the company I hinted at earlier. Not only is it a company that focuses on workflow automation …

But it’s now involved in two of the biggest trends in technology — information technology (IT) and artificial intelligence (AI).

Introducing ServiceNow

Let me introduce you to this “twofer.” It’s ServiceNow (NOW).

Based in Santa Clara, this software company offers a cloud-computing platform designed to help enterprises manage their digital workflows.

Its software tracks and manages services provided by IT departments. And its self-service tech portal enables company employees to access administrative and workflow tools.

ServiceNow is the definition of a “connected company.”

It works with more than 8,100 global enterprise firms including 85% of Fortune 500 firms. Notable clients include Kraft Heinz, NASCAR, Bayer, Delta and Fruit of the Loom.

In recent years, ServiceNow expanded its core business into software for human resources, customer relationship management and security sectors.

And even more recently, the company ventured into the fast-growing market for AI. Here’s how …

The Time for AI is ‘Now’

Along with its products, ServiceNow has a comprehensive platform appropriately called the Now Platform.

Essentially, this platform enables clients to use AI to connect and automate the work that moves their businesses forward.

Clients can harness AI to reduce costs, streamline workflows and diminish repetitive tasks.

And they can use it to automate tools for routing and prioritization to keep teams working on the right things.

They can also receive real-time insights to help answer questions and resolve issues. And data is kept safe on the Now Platform with multilayer encryption.

Not only is ServiceNow incorporating AI into its lineup, but it’s also investing heavily in the technology.

In July 2024, the company invested in Prodapt — a leading telecommunication services and technology partner.

Prodapt will focus on the development of new industry-specific AI-enabled solutions for ServiceNow’s clients.

That same month, ServiceNow teamed up with Boomi — a leader in intelligent AI integration and automation. This partnership will enhance ServiceNow’s customer experiences.

Finally, the company acquired Raytion to enhance its generative AI-powered search and knowledge management capabilities on its Now Platform.

Simply put, ServiceNow is bundling AI conversational tools with its premium products.

This is a forward-thinking approach, as analysts say most enterprise software makers won’t monetize conversational AI in a material way until late next year.

Bottom line: ServiceNow presents a great “twofer” investment — in IT services and the breakout market for AI.

And don’t look now, but the company boasts some great fundamentals …

On the Rise

Annual revenue is on the rise. In 2021, revenue was around $5.8 billion. In 2022, revenue reached $7.2 billion. And last year, revenue was just under $9 billion.

During those three years, ServiceNow also grew per-share profits by 35%. Continuing at that rate, they would double in just about two years.

And remember, as profits rise, so do stock prices.

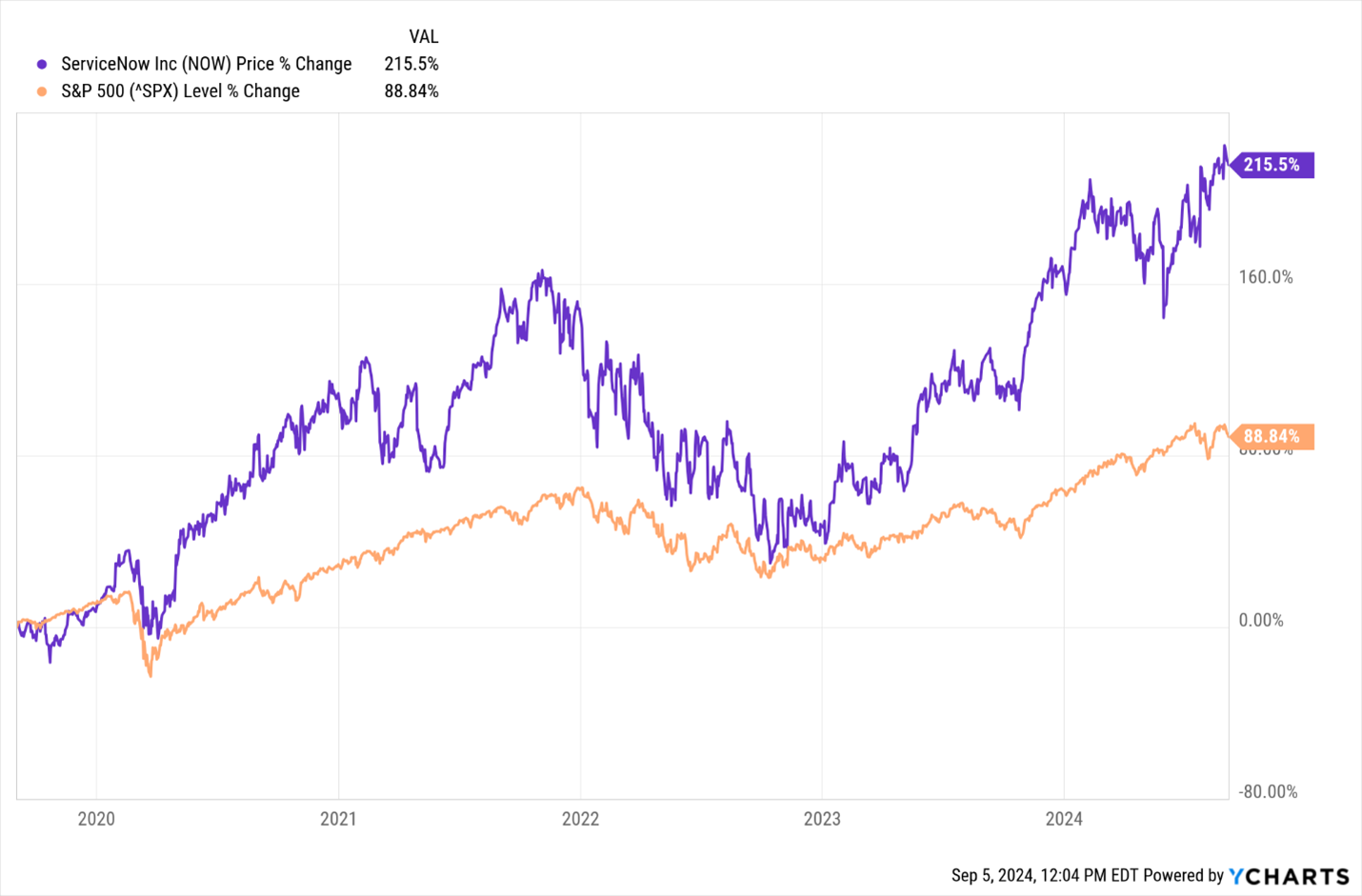

No wonder that over the last five years, NOW is up 216%, beating the benchmark S&P 500 by 127%.

It’s like I keep saying. The road to wealth is paved with tech.

And you’ll get there a lot faster with investments in winners like ServiceNow.

Best wishes,

Michael A. Robinson

P.S. ServiceNow could be a great play on the AI boom. But it isn’t the only one. In fact, I just identified one I’m already calling the “Next Nvidia.”

I know. Bold of me. But if I have you even a little curious, I urge you to come to a special presentation on Tuesday, September 10 at 2 p.m. Eastern. However, you have to secure your free spot as a Weiss Member by clicking here.