|

| By Gavin Magor |

Today, I want to let you peek behind the curtain.

I want to share what I’ve been telling my Weiss Intelligence Portfolio Members for months now.

And I want you to profit with us!

But first, I need to set it all up …

It’s sticking around ... and it just won’t quit!

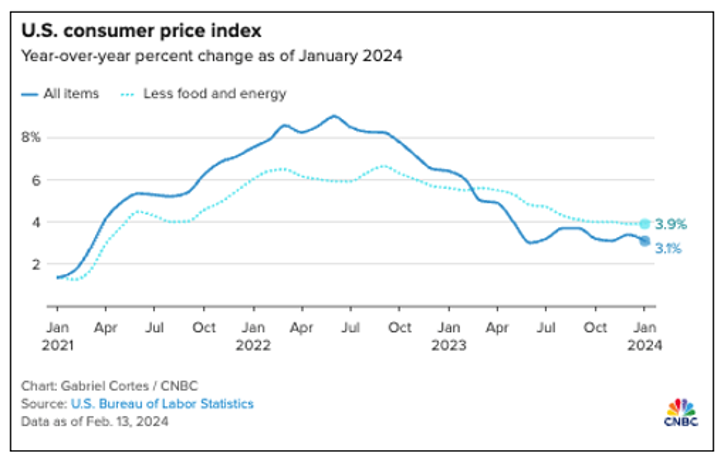

I’m talking about inflation, of course. If you think investors already scaled the Wall of Worry associated with higher inflation, I wish I shared your optimism.

Now, inflation may not be as high as it was last year. But it’s still considered a hurdle for markets.

That became very obvious from investors’ reactions after news broke on Feb. 13 about the Consumer Price Index for January rising by 0.3%, instead of falling as expected.

Few corners of the market were spared, as the Nasdaq fell 1.8%, while the Dow Industrials and S&P 500 each dropped 1.4%. Those losses marked the worst one-day performance in the large-cap index since June 2022 and since March 2023 for the Dow.

Interestingly, utility stocks (usually considered a good inflation play) led all decliners in the S&P 500, down 2.9% on the day. The consumer discretionary and materials sectors followed suit, down 1.6% and 1.4%, respectively.

The Russell-2000 Index, a tracker of small-cap companies, also fell 4.1% after showing early life in 2024. Small caps tend to be closely tied to the health of the domestic economy. So, they are an important barometer to watch.

As would be expected, the interest-rate-sensitive two-year Treasury yield rose 4.65%, its biggest jump since March 2023.

One month’s worth of inflation data isn’t a game changer. However, it may be enough to fuel a short-term shift in trends as investors’ fears rebound.

And unsurprisingly, the recent Producer Price Index data did not help fears as it also rose more than expected, gaining 0.1%, following a 0.2% reported drop.

In the broad market, look for an extended period with no changes to interest rates. It is entirely possible we will not see anything until Q3. Even then, more than two 25-basis-point reductions would be a surprise.

Join the Fort of Sanity

However, in our Weiss Intelligence Portfolio — which I tend to refer to as our fort of sanity — Members always rely on our trading models (including our proprietary AI Performance Booster) to alert them about necessary buys and sells based upon a stock’s potential to out- or underperform the market.

Considering that the shift from cash into stock markets across the globe has been the most pronounced since November 2021, it’s not the time to panic or make rash decisions.

Investors remain eager — albeit cautiously optimistic — for the market to resume a sense of normalcy.

Besides, our Members can attest that our current portfolio is chock-full of stocks in inflation-proof sectors, characterized by their ability to maintain or increase profitability — or, at the very least, hold up better than others.

They include stocks in the following sectors:

- Energy

- Technology

- Industrials

- Healthcare

- Financials

- Consumer Defensive

- Consumer Cyclical

- Communication Services

- Basic Materials

If this sounds like a service you’d like to join — one that guides you and alerts you to make necessary trades based on reliable trading models to fortify your portfolio, then click right here to join Weiss Intelligence Portfolio today!

Indeed, we call it the “fort of sanity” for a reason — a very good reason. In fact, our Members are currently sitting on solid open gains of 74%, 44% and 42%!

So, if you’d like to see your portfolio fortified regardless of what the broad market and economy are doing, then join us today in the fort of sanity.

That’s all for today. I’ll be back with more soon.

Cheers!

Gavin Magor