Kick off 2024 with a Look at 2023’s ‘Buy’-Rated Winners

|

| By Gavin Magor |

The ball has dropped in Times Square, Auld Lang Syne has been gleefully sang by many around the globe, the firework smoke has settled, many New Year's resolutions have been made …

And it is officially 2024! Happy New Year!

It’s hard to believe, and time certainly does fly. From rapid technological advancements in AI to tremendous breakthroughs in the Space Race, there were some incredible moments from 2023, and I am very confident that 2024 will be even more momentous.

Here at Weiss Ratings, we were at the forefront in many ways, such as introducing historic AI performance-boosting technology to some of our services. That cutting-edge mentality will only grow this year.

The markets are closed today for New Year’s Day, but our Weiss ratings never sleep.

2024 may have more uncertainty, but one thing is now factual: 2023 was a very historically strong year for the markets.

The S&P 500 ended up around 25%, and the Nasdaq ended up around 44%. For some context, the S&P was up more than that in only four years over the past two decades.

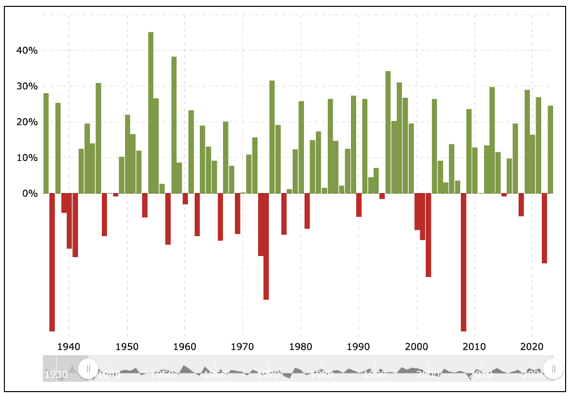

Here’s a yearly performance chart of the S&P 500 going back to 1930.

As you can see, the market, in historical terms, boomed in 2023. And whilst it certainly ended the year strong, up 17% since Oct. 31, and with the Santa Claus Rally fully delivering this year, 2024 is a year with plenty of uncertainty.

Traders remain optimistic thanks to interest rate-cutting hopes, a declining inflation rate and strong consumer spending, but all these major economic factors are driving the market on somewhat dubious assumptions.

Sure, us analysts are generally happy with the data we saw toward the end of the year, but there is still far more we have to see to officially declare a “soft landing.”

One thing I can officially declare right now is the power of the unbiased, reliable, safe and accurate Weiss ratings for all things financial: stocks, banks, ETFs, mutual funds, insurers and cryptocurrencies.

Let’s take a look at the year-to-date performance of the stocks currently without a “Buy” range.

2023’s Top ‘Buy’ Performers

To earn a Weiss “Buy” rating, a stock must undergo a rigorous stress test with a massive bias toward safety. And sure, some of these names below were upgraded into “Buy” territory midway through the year, but is still speaks volumes about performance.

I think it is very important to take a look at some of these names.

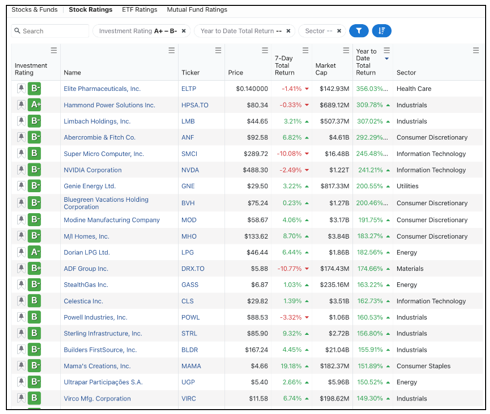

On our stock screener page, I filtered for stocks with an investment rating of “A” through “B-” and then sorted by Year-to-Date performance as of Dec. 28.

Here are the top 20 names that populated:

As you can see in the above image, I also included the “Sector” column, and although there is generally a broad diversification among sectors, there are more industrials and informational technology Names.

That’s not a major surprise, and it’s actually a strong correlation with the broader market as the technology sector had a massively strong 2023 in terms of performance, largely driven by the incredible hype surrounding AI technology.

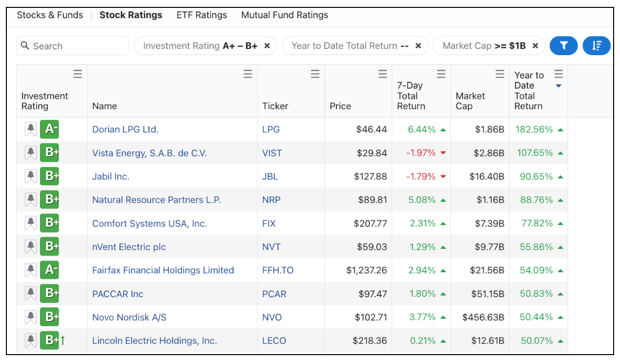

Further filtering this list, I wanted to find the best performers in the “A” to “B+” range, and with a market capitalization of over $1 billion.

Here are the results:

The top name was Dorian LPG (LPG), a name that I am very happy to report many of our premium members were able to capitalize on in a big way this year. Nothing makes me happier than being able to bank our readers big gains based on our research. We do the heavy lifting for you so to speak.

That said, our ratings have been 100% free for all investors to use since 2020, but I must say that our premium publications are where investors can really reap the full potential of our investment research. In the image above, you are seeing many names that were on the radars of our premium members toward the beginning of the year.

We do what we do to help investors become their best versions of themselves. In 2024, perhaps a New Year’s resolution is to focus more on your investments. There is no other source in the world that I would recommend for that purpose more than Weiss Ratings incredible database.

As always, be sure to explore, research and utilize our vast investment ratings on our Weiss Ratings site. 2023’s market performance was historically one to adore, but in 2024, there will be much more with the Weiss ratings.

Cheers!

Gavin Magor