|

| By Nilus Mattive |

From where I sit, central banks cause more problems than they solve.

Rather than letting market dynamics work naturally, they try to manage things as they see fit … often times rewarding big financial firms at the expense of the common man.

Essentially, they favor the system over the people.

This is not surprising since there has always been a revolving door between Wall Street and the Fed. (And the same goes for the U.S. Treasury.)

I could go on at length about the number of policy mistakes central bankers have made in the modern era and how much damage they’ve caused.

Suffice it to say, we’ve seen several major asset bubbles just since the year 2000 — and all of them were caused to some large degree by reckless monetary policy.

Same with inflation. You need only look at your grocery bill or think about what you used to pay for a gallon of gas when you first started driving as a gentle reminder.

Central bankers aren’t stupid, mind you.

The problem, as I just mentioned, is that they are deeply entrenched in the financial system.

They are supposedly independent operators. But, philosophically, they are still bankers who work at the behest of the government.

Take the latest Fed decision to cut rates.

With inflation still running substantially higher than the Fed’s stated objective, but the labor market also starting to show some signs of cooling, the vast majority of FOMC voting members opted to cut rather than hold steady.

The message was clear: They’d rather risk even more inflation … and keep pumping up already-overheated assets like stocks … than see the economy weaken at all.

This is the same choice the Fed makes every single time it is faced with such a dilemma.

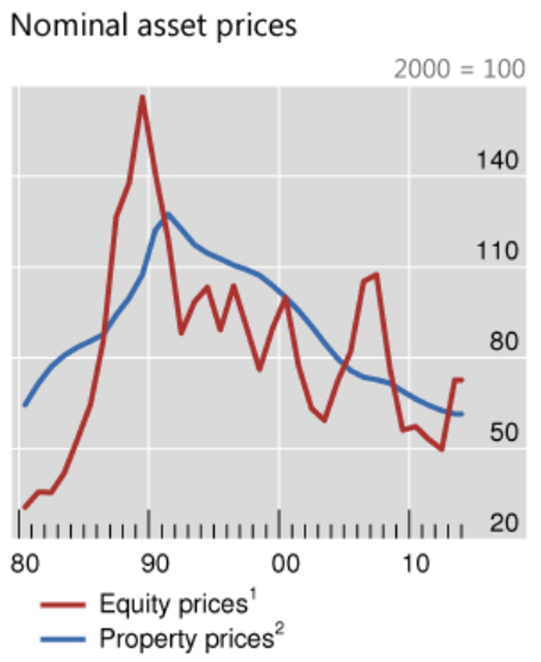

And it’s the same choice that Japanese central bankers made in the late 1980s and early 1990s — one that created a massive bubble across stocks and real estate, then imploded in spectacular fashion.

The damage — especially the psychological damage — of that collapse was so severe that it has taken several DECADES of ultra-low interest rates to even get things back on track.

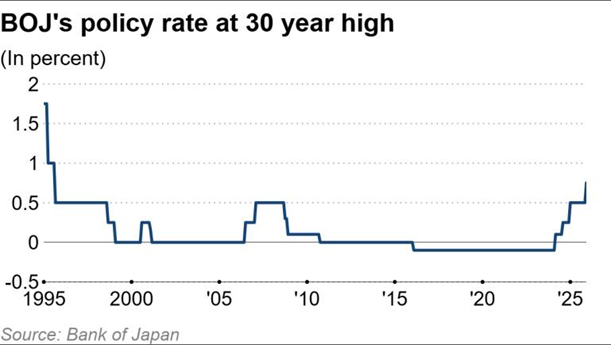

Finally, after a hike on Dec. 18, the Bank of Japan’s interest rate target is back to 0.75% — a level that is still extremely low by any measure but the highest it’s been since 1995.

Perhaps the biggest irony of all this is the fact that investors (including Japanese investors) have been using ultra-low interest rates in Japan to fuel their speculations in other financial markets around the world.

This so-called “yen carry trade” has added more fuel to the Fed’s fire, sending large amounts of money into riskier assets like U.S. stocks and cryptocurrencies.

There have been signs of a gradual unwinding, but nothing disorderly … yet.

But as we head into 2026, here are two important takeaways …

First, what happened in Japan in the 1990s could easily happen in the United States.

So far, the Fed has always managed to print money even more aggressively after every past bubble popped.

However, the current environment feels very much like the final conclusion of the other rolling bubbles we’ve been experiencing over the last 25 years …

An “everything” bubble spurred on by unprecedented money printing and never-before-tried stimulus efforts.

Speaking of which, the Fed didn’t just cut rates.

It also quietly announced yet another round of quantitative easing — the experimental strategy of buying government debt in the open market and loading it onto the central bank’s balance sheet.

If they keep lowering rates from here, which is clearly what many in Washington want, the bubble could grow bigger still … but for how long?

Well …

Japan’s efforts to finally get back to somewhat normal interest rates could end up pricking ballooning asset prices in the U.S. and elsewhere!

In his post-meeting announcement, Governor Kazuo Ueda didn’t lay out a specific path going forward. He merely said future rate hikes could happen depending on conditions.

Market participants found some relief in that. However, it also sets up the potential for a major surprise in the first half of 2026 …

One that could create shockwaves throughout global financial markets.

Indeed, we have since gotten a summary of what policymakers talked about during their most recent meeting.

More future rate hikes were a topic of discussion, with at least one of the nine members saying they were especially appropriate because Japan is still the cheapest source of money in the world.

If liquidity from Japan keeps drying up, that could pose a big problem for risk-on assets.

In fact, even if market participants merely start ANTICIPATING future rate hikes from the BOJ, we could see aggressive selling of things like high-flying tech stocks and many cryptocurrencies.

This is why I continue to recommend keeping the bulk of your money in more conservative assets …

And maintaining broad diversification to everything from precious metals to international stocks and bonds.

Best wishes,

Nilus Mattive

P.S. That doesn’t mean you can’t make money while staying safe.

My colleague and friend, Sean Brodrick, just updated several reports with his top precious metals stocks to own for 2026.