Line Up This 66% Gain Despite High Interest Rates

|

| By Jon Markman |

Interest rates are rising, and corporate leaders are worried about shrinking consumer demand.

Tesla (TSLA) shares plummeted last week after Elon Musk warned that higher interest rates are negatively impacting sales. Musk also spoke about the challenges of wringing out efficiencies in new products.

This is exactly why investors should buy Tesla.

Let me explain …

It’s easy right now to abandon shares of consumer durable businesses. Consumers are being squeezed by rising inflation and the subsequent increase in borrowing costs.

The yield for the 10-year Treasury note topped 5% this week, the highest level since 2007.

Thirty-year fixed mortgages jumped to 8% according to the Mortgage Bankers Association — again, a 16-year high.

And the average monthly loan payment for new vehicles soared to $725 in Q1 of 2023, the highest level in history.

Something Has to Give

Bearish investors say that consumers will simply curtail their spending. This is a logical conclusion. Unfortunately for bears, this does not mean that stock prices for all consumer-centric businesses must decline.

Stock prices reflect future sales and operational excellence for the underlying business.

Musk was clear last week that higher interest rates have caused customers to put off new vehicle purchases. Tesla sold 435,059 electric vehicles during Q3, an increase of 6.7% versus a year ago. This was below analyst forecasts of 455,000.

The trajectory of sales growth is slowing to be sure, yet the larger trend toward EV adoption shows no letup.

The entire automotive industry is transitioning to electrification. Ford (F), General Motors (GM), Stellantis (STLA), Volkswagen (VWAPY), BMW (BMWYY), Mercedes-Benz (MBGYY) and even Toyota (TM) have all announced major new investments in EVs.

Not a Fad, but a Real Trend

EV penetration in the United States reached 7.5% in 2022 as manufacturers sold 972,000 vehicles. Automakers sold only 652,000 EVs the previous year. And the International Council on Clean Energy reports that global EV sales reached 10 million units for the first time.

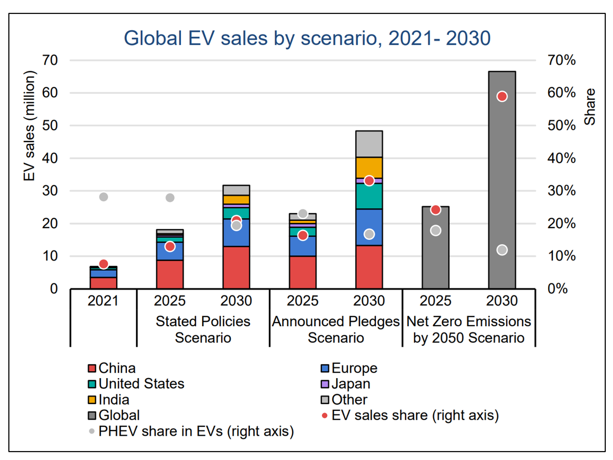

Most importantly, researchers at the International Energy Agency predict that global EV adoption will reach 60% by 2030.

Tesla is the undisputed leader in EV sales, with 65% domestic market share in 2022, and 17% globally. Moreover, the business is the most efficient maker of EVs in the sector. This operational excellence often goes overlooked.

Tesla shocked the automotive sector with the widespread adoption of “giga castings.” These skeletons made of specialty alloys replace hundreds of metal stamped parts, shrinking manufacturing capacity.

There is less need for expensive robotic welders and human workers. The giga factory located in Shanghai, China produces one new Model Y every 41 seconds. It is an operational feat that is unmatched in the industry.

Tesla leads in software, too. As vehicles transition to electrification, they become less about mechanical parts and more about software integration.

Tesla vehicles are vertically integrated, designed around proprietary software systems that range from design and systems integration, to supply chain management.

The current environment is challenging for consumers. Higher interest rates are clearly impacting spending. However, investors need to focus on the bigger picture.

The transition to EVs is happening. Tesla is the leader, and its position is strong due to early investments in design and manufacturing.

At $217, Tesla shares trade at 54.5 times forward earnings and 7.2 times sales. While seemingly high, these ratios are falling quickly as the company sells more EVs each year.

Based on the size of the expected EV market, Tesla shares could trade to $360 during the next 18 months, a gain of 66% from current levels.

All the best,

Jon D. Markman