|

| By Sean Brodrick |

Day after day, I’ve heard Wall Street “experts” call for a massive stock market correction. They were wrong last year, and they’re wrong now, too.

Fireworks aren’t just for the 4th of July. We should see the rally continue this month, too.

The stock market should sizzle again in August … and not just from the summer heat.

In other words, it’s a good idea to buy stocks this July. I’ll show you why in three charts.

Why You Want to Buy in July …

Especially This One!

July is an EXCELLENT time to own stocks. That’s because the first 15 days of July are the best two-week trading period for the S&P 500.

Here’s a chart showing the returns of the S&P 500 since 1950, split into two-week chunks.

In more recent history, the S&P 500 is up an incredible nine years in a row in July and up 11 of the past 12 years.

It helps that this is a presidential election year.

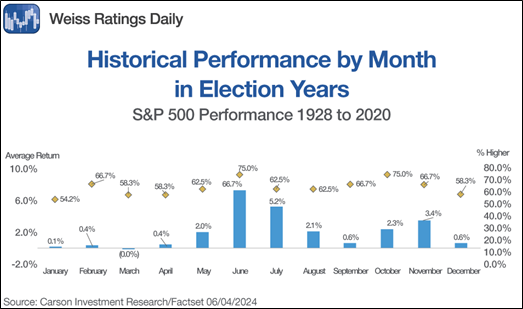

Stocks typically outperform in presidential election years anyway, as you can see from this chart …

I like to play cycles anyway because it makes picking winners so much easier. It’s nice to know the Presidential election cycle is on our side.

Finally, history says that same election-year outperformance should deliver big gains in July and August.

This chart from Carson Research shows monthly performance in an election year.

June, July and August are historically the best three months of an election year. Sure enough, last month saw the S&P 500 rise 4.3%. If history is a guide, July and August should be up, too.

Carson's research adds that when the S&P 500 is up by a double-digit percentage by mid-year — and this year, it’s up more than 14% — the full year is NEVER lower. And the S&P 500 ends the year up 25% on average.

More good news: Out of all election years since 1952, 2024 experienced the best first-half start.

Add it all up, and it sounds like a long, hot summer of profit potential to me.

2 Hot July Buys

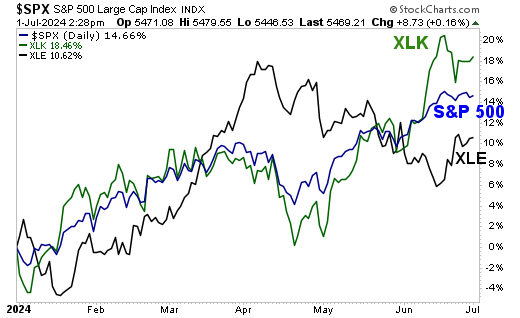

The easiest way to play this is to buy the S&P 500. If you want outperformance, technology led other sectors higher last month. That would be the Technology SPDR (XLK).

It has gained 43% from its October low. But now it is trading at 33.5 times forward earnings! Many might consider that overvalued compared to the S&P 500, which trades at a forward P/E of 22.6. So, tech might be a bit pricy.

If you think money will start rotating into the laggards, energy looks cheap.

The Energy SPDR (XLE) tracks a bunch of the best stocks in that sector, with a forward P/E of around 12.

Here is the performance of these three funds so far this year.

You can see that energy outperformed through April, then started tumbling.

The XLK led the S&P 500 higher all year.

Now, the XLE is finally turning higher again.

No one has a crystal ball to see what will outperform going forward. However, the presidential election year cycle is on our side, and other historical patterns also point to higher prices.

I strongly believe this will be a long, hot summer of profit potential!

All the best,

Sean

P.S. While two cycles coalescing like this is great on their own, adding in a model that has been able to beat the S&P 500 by a factor of 51x over the past 10 years gives you a huge leg up. To learn more about this third element, click here.