Amid the current climate of uncertainty, one thing is clear: Investments that can weather any market conditions are ones to target.

In this segment, I interview Director of Research & Ratings Gavin Magor about the cutting-edge data every investor should use and his new service, All-Weather Portfolio.

The portfolio is centered around a select few stocks and exchange-traded funds that can offer protection in bad times and outperformance during good times.

You can watch the video here or continue reading for the full transcript.

Jessica Borg (narration): You can find 52,000 investments rated on the site.

Gavin Magor, director of research & ratings, makes sure they stay accurate and uninfluenced.

JB: You always emphasize that the ratings are unemotional. There are no emotional ties to any stock or company.

Gavin Magor: Everything that we do is based on fact. It's based on an independent view of things. We have our models and we follow our models. We don't inject our personal view into the ratings.

JB (narration): He oversees a renowned team of data scientists, analyzing algorithms and indicators of a company's strength or weakness, opportunity and/or risk.

GM: We have so much data, it's mindboggling. I'm assured it's in the terabytes range. And we take data from several different sources.

We gather that for many, many years and we look back at the patterns that have been formed and we've developed our models. We have many different models.

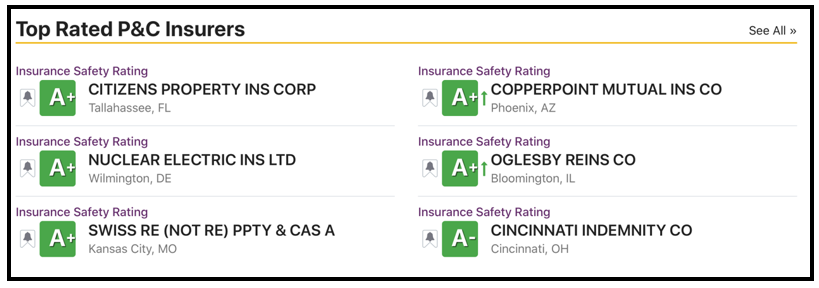

JB (narration): One source is the National Association of Insurance Commissioners.

GM: We're looking atthe filings that they have to make on a quarterly basis. The same things go for the banks and the credit unions. We go to the source of the data.

JB (narration): The Weiss Safety Ratings — from "A" to "E" — are easy for investors to make sense of.

GM: If you're looking at an "E-", we see that those sorts of companies — if they are a bank or an insurer — there is significant risk involved.

Let's take a property and casualty insurer. In Florida, hurricane season comes along … and if you're a property and casualty insurer and you've insured too many houses in one area that suddenly get struck by a hurricane, you're at risk, no matter what other protections you've taken.

JB (narration): It's simple to weed out the stocks with strong fundamentals.

GM: It would be fair to say that Weiss, as a general rule, is very conservative with our ratings.

We know that opportunities can be taken with a low-rated stock.It happens and it is real, but those opportunities come with high risk.

However, recognizing a stock that is on the way up, recognizing a trend, recognizing their performance — you can then look into those and say, "Okay, I understand that this is where it is now, but I am going to watch it and I'm going to see if that changes over time."

We're trying to give you those tools that allow you to make that choice.

JB (narration): Gavin started at Weiss nearly 15 years ago and has seen all sorts of market conditions.

JB: Gavin, you joined Weiss Ratings at a pretty momentous time.

GM: When I first came in to join Weiss, it was just before the housing collapse and financial crisis developed.

So, things went completely pear-shaped, as we say in the U.K. I don't think you say that in the U.S., but things went pear-shaped. That means it went very bad, very quickly.

JB (narration): He helped warn consumers about banks and insurance companies that failed.

The new service that he's leading aims to protect investors from those types of black swan events.

GM: I believe that the black swan events are blips in the market. But they can be serious blips if you react to them incorrectly.

If you believe that the world is coming to an end and you sell everything off at the bottom of a market, and you wait until everyone's saying, "Well, it's now higher than it ever was," and then you get in because it's up now, you've wasted tremendous opportunities in between.

And what we're trying to do is make sure that you're positioned well, no matter what happens. It's going to go up when things are good and it's going to hopefully outperform the overall market.

And if things turn around, we have a strategy that will try to protect your investment.

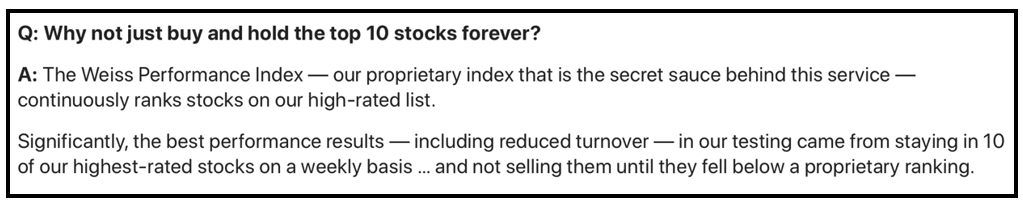

JB (narration): At any given time,the portfolio will hold roughly 10 of the highest-quality stocks, along with two exchange-traded funds.

The makeup will be adjusted based on signals of a bear or bull market. These are signals generated from the team's breakthrough timing model.

JB: The All-Weather Portfolio is an excellent retirement portfolio. It is not for day traders.

GM: We're certainly not looking for a huge turnover with the stocks involved. We're really aiming to make this a portfolio that, over a period of time, you would do very well.

The best thing about this is, although we are directly involved in this, we are strictly sticking to what our modeling provides. So, if our model doesn't bring up a particular stock that may be a crowd favorite, we won't be recommending it. It's not going to be on the list.

There may be stocks that are surprises to people. There might be stocks that people might not have heard of. However, at the end of the day, we believe in it.

JB (narration): And decades of back-testing prove that you can, too.

JB: Director of Research & Ratings Gavin Magor, thank you so much for your time and insights today.

GM: Thank you.

Best wishes,

Jessica Borg

Financial News Anchor

Weiss Ratings