This Christmas Eve, investors are wishing Santa delivers steadier markets in the year ahead.

Investor sentiment never seemed to be break its bullishness in 2022 as all of the major indices were rocked by broad sell-offs, Federal Reserve-induced volatility and the debilitating impacts of inflation and ongoing supply chain issues.

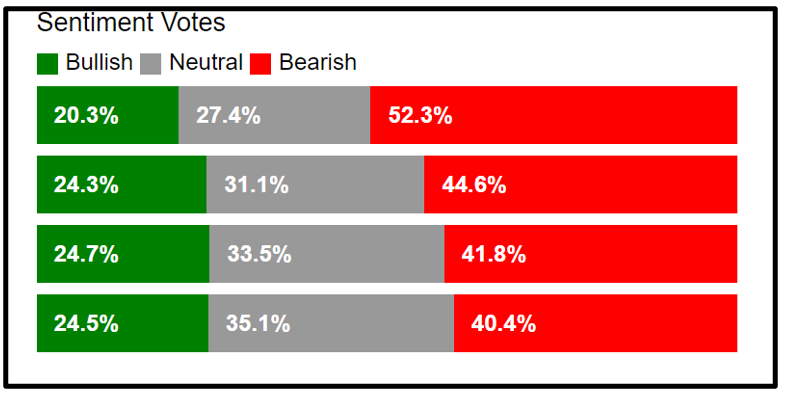

According to the American Association of Individual Investors' Sentiment Survey, the year ended with increased pessimism despite the S&P 500 regaining much of the ground it lost since January.

Click here to view full-sized image.

However, while sentiment remains in bear territory, our editors and analysts remain optimistic about finding the best opportunities for you in 2023. Here are this week's top stories from your favorite Weiss Ratings experts.

Medical researchers are using what they know about our immune system and computers to make startling advances. And this one stock is poised to win big from these incredible medical advances. According to Pulitzer Prize winner Jon D. Markman, there has never been a better time for investors.

How to Keep Riding the Energy Bull

Energy was the best-performing sector in 2021 and 2022. That makes many on Wall Street believe that its bull run is over and the sector will underperform in 2023. But Senior Analyst Sean Brodrick explains why this sector is set up for another great year to come, despite the recent bearish outlook.

VIDEO: Market Minute with Kenny Polcari

This week, we saw the Personal Consumption Expenditure Deflator (which came in at 5%, a bit lower than the previous 5.2%), a handful of housing data and the Q3 GDP. This all followed a flurry of U.S. and global central bank policymaking, another 50-basis-point rate hike by the Fed and a promise of continued rate hikes until the terminal rate is reached. Kenny Polcari, host of Wealth & Wisdom, breaks down what these macro data points mean for the market.

Mega-Cap Companies Will Regain the Spotlight

As the Fed's monetary policy likely shifts in 2023, a new investing narrative will emerge. That's how Senior Analyst Jon D. Markman sees the next few months unfolding, carving a path for mega-cap companies to potentially move higher. In this segment, he and Financial News Anchor Jessica Borg discuss how this period of weakness will be a buying opportunity, why every tech company should be its own disruptor and a spot-on prediction he recently made.

Until next time, wishing you a happy holiday season,

Jordan Chussler

Managing Editor

Weiss Ratings Daily