As the Federal Reserve's monetary policy likely shifts in 2023, a new investing narrative will emerge. That's how Senior Analyst Jon Markman sees the next few months unfolding, carving a path for mega-cap companies to potentially move 20%–35% higher.

In this segment, Jon and I talk about this period of weakness being a buying opportunity, why every tech company should be their own disruptor and a spot-on prediction that he made during our previous interview.

You can watch the video here or continue reading for the full transcript.

Jessica Borg (narration): While there's no crystal ball to predict market moves, Senior Analyst Jon Markman comes pretty close to making spot-on calls.

He reminded me of the one he made during our last interview.

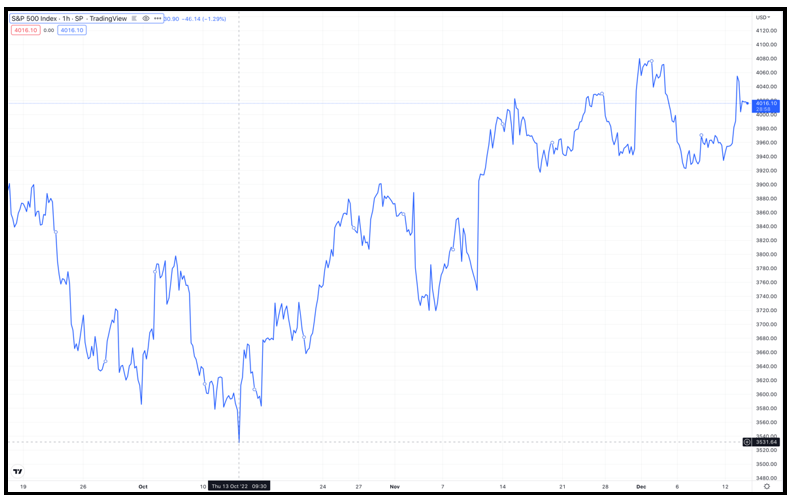

Jon Markman: Would you like me to talk about my prediction a couple of months ago in your video, when I said that Oct. 13 was typically the best day of all?

JB: Yes!

JM: Of all 365 days of the year, Oct. 13 seems to be the best single day to invest.

JB: I want to show folks a clip of that interview.

[Interview from segment on 10/9/2022]

[JM: Here's my advice. If the market goes down on Oct. 13, close your eyes and buy. Most people don't like to buy into lows. It's hard because stocks are going down, bonds are going down, commodity prices are going down. It's going to be really hard to buy, but it's a short-term opportunity. Try it and see if it works.]

JB (narration): And what happened since that interview?

Click here to view full-sized image.

JM: Did you see what happened on Oct. 13? It was the lowest day in the whole fall.

The market is up 12% since then, so I'm pretty happy about that.

JB (narration): Jon's track record is reflected in The Power Elite and Weiss Technology Portfolio. Members are sitting on triple-digit open gains on a number of positions.

Right now, there are some big names Jon sees going up next year, like Alphabet (GOOGL), the parent company of Google.

JM: GOOGL is an incredibly successful and well-run company.

One of the reasons that stocks have done poorly this year is interest rates have been rising, but if the Fed decides that they've gone too far and that it is done its job with crushing inflation, then rates will come down and that'll be tremendous for growth stocks, like technology.

You look overall at growth stocks or technology stocks; in general, they were shunned this year in favor of value stocks. But the page always turns. For whatever reason, it usually turns on a dime at the beginning of the new year and I think we'll have a reversal back to technology and back to growth.

And if that's the case, stocks like GOOGL are going to look incredibly cheap. GOOGL is only trading at around 17x its earnings and has gross margins north of 80%. It's an incredible bargain, to tell you the truth.

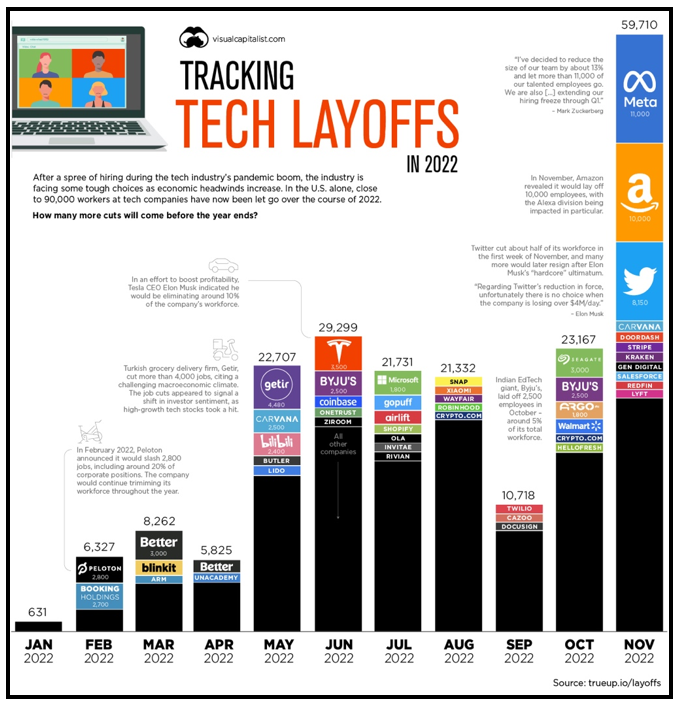

JB (narration): Alphabet's recent layoffs are not necessarily a sign of doom and gloom for the company.

Google has a new internal program called Pitchfork, which uses machine-learning software to train code to write code, then fix and update that code automatically. The need for human software writers could be dramatically reduced.

Click here to view full-sized image.

JM: They're trying to put themselves out of business, which is exactly what a technology company should do. They should be their own disruptor.

JB: "Companies should be their own disruptors" is definitely the sound bite of the week.

JM: Thanks. Unfortunately, if it works — and I think it will work — the field will see a lot more electrical engineers and computer engineers looking for work.

During stressful periods like this,when you see people who are fired — people who need to feed their families, with their backs against the wall — they get very creative. They figure out new things to do. They create new companies and new products.

Those computer engineers really make something fantastic out of absolute necessity.

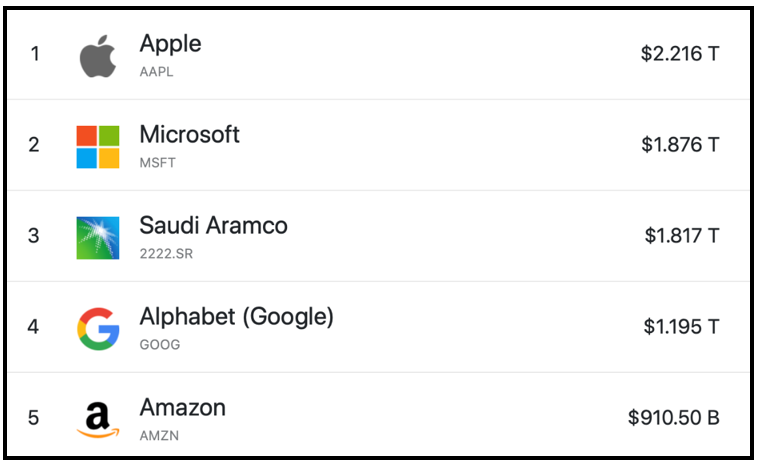

JB (narration): I know that you're a big fan of Apple (AAPL). Do you see it rising next year?

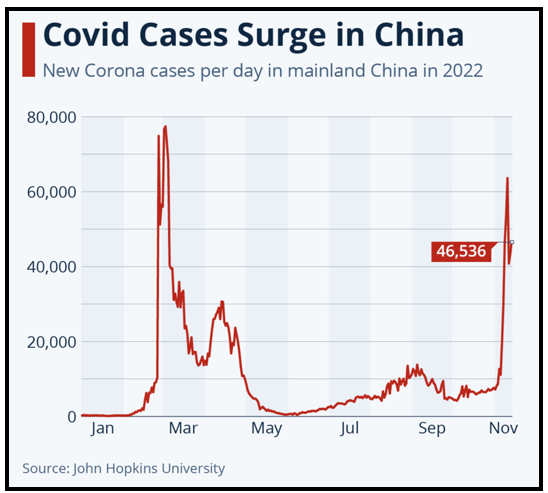

JM: Apple had a pretty tough year because there were a lot of expectations that a recession would prevent people from buying iPhones.

Also, there was this whole deal in China where China had a strict lockdown of its people and workers to avoid COVID-19.

Click here to view full-sized image.

But that lockdown is largely over, and inventories have been slimmed down, and Apple is the premier maker of handheld technology in the world today.

And so, I'm looking for this company that fell 26% this year to have a pretty good rebound in 2023.

JB (narration): Jon sees Apple as a bargain. Back in January, it was the first U.S. company to reach a market cap of $3 trillion dollars. It happened briefly, during trading.

JM: You could see a good 20%–25% gain in Apple this time next year.

Click here to view full-sized image.

JB (narration): Another stock to put on your radar: Netflix (NFLX). Jon says for long-term investors, this period of weakness is a buying opportunity.

JM: It is way oversold and deserves at least a 25%–35% rebound within the next six to nine months.

JB (narration): Netflix recently announced it's starting its first cheaper, ad-supported plan. Jon says digital advertisement should ignite growth.

JM: Netflix is not a company that will be taken over by a large company. It's not going to be bought by Disney (DIS). It's not going to be bought by Microsoft (MSFT).

They have done a fantastic job over the years of carving their own path and the path that they chose was to create all their own content. That's because it's the cheapest way to acquire it and then you own it forever.

And they've done a tremendous job of creating new content over the last year. They're going to do the same next year, according to what I hear.

The stock has gotten really cheap because of the expectation that their new revenue model with advertising was going to do poorly. But I think it's going to be a huge benefit for its customers on an artistic level, as well as to investors on a financial level.

JB (narration): Those benefits may be part of an overall shift in stock trends.

JM: Next year, we'll swing back to the big-cap growth stocks that got cheap during this period of unease.

JB (narration): Bottom line: Consider buying your favorite Big Tech stocks now,to gear up for third-quarter gains in 2023.

JB: Senior Analyst Jon Markman, it is always a pleasure to get your insights. Thank you so much for your time today.

JM: It's always great to talk with you, Jessica. Thank you.

Best wishes,

Jessica Borg

Financial News Anchor

Weiss Ratings