Make the Weiss Ratings Your First Investment Destination

|

| By Gavin Magor |

A reminder … and a warning.

We’re in the thick of holiday shopping, and the consumer spending numbers we’ve seen have been positive. But there’s more than what’s on the surface.

Holiday shopping began in earnest around two weeks ago on Black Friday, and consumers spent money like it was growing on Christmas trees.

But I wasn’t one of the shoppers who shelled out a whopping $38 billion in the five-day period between Thanksgiving and Cyber Monday, up 7.8% over last year.

But that doesn’t mean they are using money they already have to pay for it, though …

If you were to take that $38 billion at face value, which I’m not, you would conclude that consumer spending is strong, confidence is high and bank accounts are overflowing. So, it stands to reason that the economy must be firing on all cylinders, too.

But this is largely attributed to that façade I’ve been alluding to my readers for some time.

The Fed went overboard with hiking interest rates. Banks felt the brunt of the pain earlier this year with three of them going under. Now, it’s radiating down to consumers, who are gradually changing their spending habits and buying behaviors. That’s because higher prices for basic living expenses are eating into savings and even retirement accounts.

For some, that means not spending a cent this holiday season. Not because they’re going full grinch, but because they have to.

A WalletHub survey revealed that more than one in three Americans will not give gifts this year due to inflation. To make matters worse, nearly one in four Americans are still paying for items they purchased during the holidays in 2022.

The most popular ways to buy gifts this year involve using credit cards and buy-now-pay-later services like Affirm (AFRM), Klarna and Afterpay.

Adobe estimated way back in October that the use of “buy now pay later,” or BNPL, will ramp up by 17% this holiday season. Through Cyber Monday, shoppers already spent $7.3 billion with the help of these services.

On top of that, consumers are more likely to spend more when using BNPL. They spent $598 on average on Black Friday, versus $452 among those who didn’t use a deferred payment method, according to PYMNTS Intelligence, a data analytics company.

If you’re not familiar with BNPL, it’s like past layaway programs. If you pay the balance over a specified period of time, you don’t accrue interest. If you don’t, you’ll pay in more ways than one — just like with credit cards.

As of September, the cumulative record balance that reached $1.079 trillion on the 1 billion credit cards in circulation was — the highest since the New York Fed began tracking in 1999.

Plus, the average individual credit card balance is now more than $6,000, the highest in 10 years, a new report by TransUnion found.

For those who only pay “the minimum,” miss payments and carry balances month after month, that’s an enormous problem. Bottom line, using credit cards as their default purchasing choice can become very costly.

That’s especially true today as stimulus from the pandemic dries up, and savings accounts shrink. Many consumers struggling from the high cost of living are reaching for plastic just to make ends meet, making a zero monthly balance nearly impossible. Unfortunately, we can’t just print money when it runs out like Uncle Sam can.

In addition to delaying the inevitable, people are hunting for bargains more than ever — not so much for big-ticket items but at lower-cost discounted goods from retailers like Dick's Sporting Goods (DKS) and Academy Sports and Outdoors (ASO).

Some economists suggested that what we saw between Black Friday and Cyber Monday is consumers who’ve been pulling back on discretionary items waiting until that weekend to get the best deals.

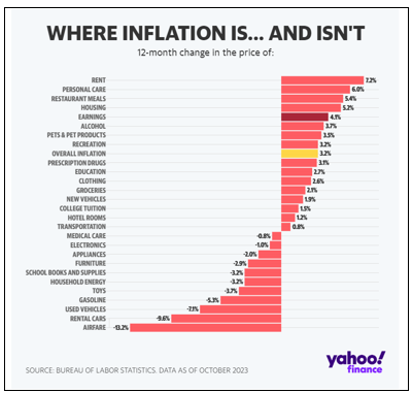

I’m talking about clothes, appliances, toys, furniture, electronics, jewelry, sporting goods, things of that nature that they had previously balked at. Ironically, these were the types of goods that showed the biggest decrease in prices in October’s inflation numbers.

Taking all of the above into consideration, I believe we’ll see a perceived healthy holiday shopping season followed by a spending dry spell to start the new year. It’ll probably stay that way until staples like rent, food, energy, etc. fall in price like their discretionary counterparts.

Harness the Weiss Ratings Capability’s

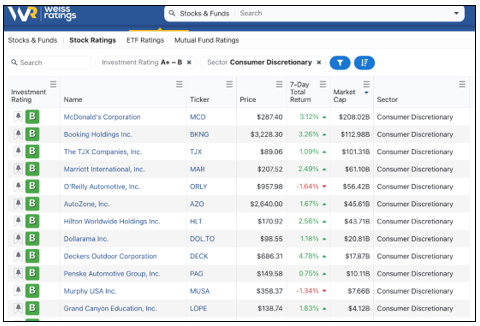

Perhaps I’m biased, but one of the best places you can look to for investing help is the Weiss Ratings. Say, for example, you wanted to look at highly-rated consumer discretionary stocks to play recent holiday shopping trends, it’d be at your disposal with the click of a few buttons.

After filtering for stocks rated “A” through “B” and in the Consumer Discretionary sector, I got 20 results. Here are some of them:

These are highly-rated names that I believe you should look at if you’re searching for consumer discretionary names.

Our ratings are extremely easy to use and can be a major asset to any investor.

Whilst you are making your investing lists and checking them twice — if you use the Weiss Ratings, I believe your investment horizon will be very nice.

Cheers!

Gavin Magor

P.S. Weiss Ratings can also help find bigger trends if you know where to look. In fact, Weiss Founder Dr. Martin Weiss is hosting an event tomorrow at 2 p.m. Eastern about just such a trend. I urge you to RSVP here. You won’t want to miss it!