|

| By Jon Markman |

The man who co-authored the original graphical internet browser believes artificial intelligence moves the web away from search and toward answers, with big implications for investors.

Two weeks ago, Marc Andreessen met with podcaster Lex Fridman to discuss the future of AI. Andreessen, now a successful venture capitalist, predicted core self-interests will accrue benefits to larger firms.

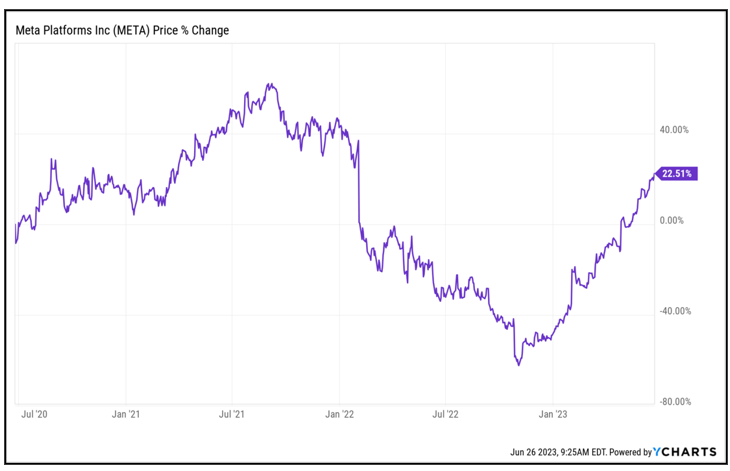

Investors should accumulate Meta Platforms (META) into weakness.

Buzz about AI during 2023 has been the principal driver of the stock market rally. Investors can thank OpenAI, a San Francisco-based startup.

OpenAI is the company behind ChatGPT, a chatbot that has taken the world by storm for its ability to carry on conversations; write code on-the-fly with no more than a simply natural language prompt; and compose essays, poetry and song lyrics.

ChatGPT is based on generative pretrained transformer, technology invented in 2017 by Alphabet (GOOGL). Following a $1 billion investment from Microsoft (MSFT), OpenAI supercharged ChatGPT by culling massive amounts of data from free books, discussion boards, Wiki pages and other sources. Then the startup sent its large language model to a NVIDIA (NVDA) supercomputer. The results proved to be magic.

However, large technology companies have not been sitting around, waiting to be disrupted.

Big Tech Going

Big on AI

Alphabet used ChatGPT in 2018 as the basis for LaMDA, an AI chatbot trained with even larger LLMs using the full power of the Google Cloud. And in April, Mark Zuckerberg, Meta Platforms’ founder, pledged to bring AI agents to billions of people, according to a report at the Verge.

Big Tech platforms have the data and the deep pockets required to train LLMs on supercomputers. It is a distinct advantage over most startups.

This is the basis of Andreessen’s unconventional take on the future of AI.

Andreessen helped in 1993 to write Mosaic, the base code for the Netscape web browser. After Netscape was acquired by AOL in 1998 for $4.3 billion, Andreessen and his partner Ben Horowitz became noted angel investors in the Bay Area. Their namesake venture capital firm was officially founded in 2009.

He learned from his time at Netscape — and 25 years of venture capital — that the clearest path to business success is the largest possible market available for a product or service. The path there powers through economies of scale to reduce prices. This idea that sellers are motivated to reduce prices by self-interests is a core principle of capitalism.

In his YouTube conversation two weeks ago with Fridman, Andreessen hit on the price history of electricity, radios, televisions, personal computers, mobile broadband and smartphones. All of these new technologies quickly declined in price to reach larger markets.

ChatGPT is currently free to consumers.

Meta Platforms Came to AI

out of Necessity

The Menlo Park, California-based firm was hard hit when Apple (AAPL) changed the way iPhone users were tracked on Facebook and Instagram, Meta’s flagship social media platforms. In February 2022, CNBC reported that those changes led to a revenue loss of $10 billion.

In May, Zuckerberg said that Meta now uses AI to determine which ads are shown on Facebook and Instagram. The algorithm runs massive simulations to guess what ads will have the best conversion rates. This data is even more valuable to advertisers than tracking iPhone users browsing history.

The second AI opportunity at Meta is agents. These digital chatbots are what comes next after internet search. They will offer answers instead to user queries, as opposed to 10 ad-supported blue links.

It’s the transition Andreessen is talking about.

At the time of writing, META is trading around $288/share. The stock trades at 19.9x forward earnings and 6.2x sales. Revenues in Q1 grew at 6% year over year, reversing three quarters of declining sales. Monthly active users rose to 3.6 billion.

Click here to see full-sized image.

Meta is the ultimate mass market product. It is free to users and a great AI success story.

Savvy investors should consider buying shares of META on a pullback toward its 50-day moving average at $247.

Thanks for reading,

Jon D. Markman

P.S. AI stocks have taken the market by storm. But is this the right time to buy? We’ll try to help clear the fog around AI investing on Tuesday, July 11 at 2 p.m. Eastern at our Artificial Intelligence Town Hall. Click here to claim your seat for this free event.