Mining Legend Explains Why You Should Buy Gold Now

|

| By Sean Brodrick |

There’s a lot of noise as gold breaks out to new highs over and over again.

How about I give you a chance to listen to a guy who took a gold company from a market cap of just $50 million to over $8 BILLION!

That's a 15,900% increase!

Do you think that would be someone worth listening to?

I think so.

I’m talking about Rob McEwen.

He’s the mining legend who took Goldcorp from an undiscovered stock to one of the world’s largest and most successful gold mining producers in the last cycle.

Goldcorp was swallowed up by Newmont (NEM) in 2019.

Mr. McEwen could sit back and laze the day away. But he is very active in gold mining right now.

And he has some thoughts on what investors should be doing.

Last week, I attended the Beaver Creek Precious Metals Summit in Colorado.

That’s an exclusive, invitation-only investment conference for institutional investors, analysts and senior management of mining companies.

It’s focused on gold and silver. But you’ll also find copper, other base metals, platinum group metals and even energy metals there.

The summit is designed to facilitate networking, deal-making and industry insights in an intimate, high-quality environment far smaller and more selective than the major conferences.

Around 200 carefully vetted junior and emerging companies present their stories.

And it was my luck to get to sit down with Mr. McEwen and hear his story.

And you get to hear his insight, too.

Here’s an interview I recorded with Mr. McEwen at the conference …

Let me show you something Mr. McEwen touched on — junior gold miners.

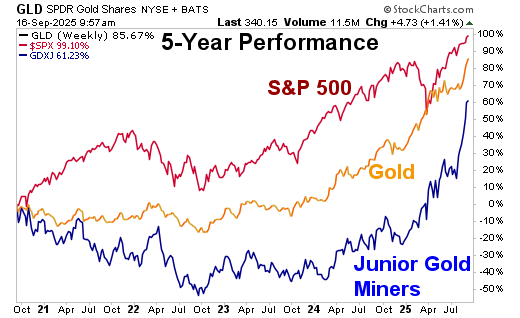

For years, gold miners — including the junior miners — underperformed the S&P 500 and gold.

Here’s a five-year performance chart, showing how gold lagged the S&P 500 over that time frame, and junior miners trailed both …

Five years is “long term” for this hyperactive market.

Notice what’s happening on the right side of that chart.

Gold and miners are starting to play catch-up to the S&P 500.

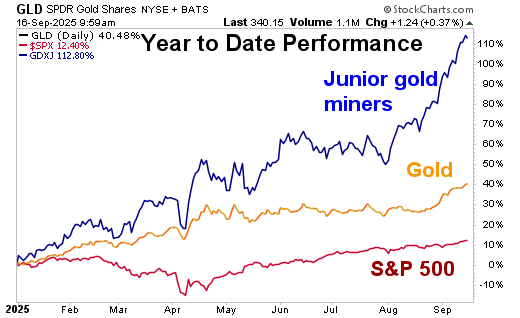

Now, let’s look at a 2025 year-to-date performance chart.

Holy cow!

As of yesterday morning, the S&P 500 was up 12.4% — not bad.

But gold, as tracked by the SPDR Gold Shares (GLD), was up 40.48% at the same time.

And the VanEck Junior Gold Miners ETF (GDXJ), a basket of the best junior miners, surged a staggering 112.8% at the same time!

As Mr. McEwen explained in our interview, he thinks this rally has a long way to go.

So do I!

Why? Along with Mr. McEwen’s point that gold and miners are dramatically underowned by investors, here are three more major forces driving the yellow metal higher right now.

Force No. 1: The Fed

Today, we’ll hear the latest from the Federal Reserve.

The market is expecting a rate cut today, with another one or two later this year … and another two or three in 2026.

Rate cuts tend to drag on the U.S. dollar.

Since gold is priced in dollars, this tends to push gold higher.

Why is the Fed cutting rates?

The U.S. labor market has shown clear signs of weakness.

Initial jobless claims surged to 263,000 in early September (the highest since October 2021), August payroll growth fell to just 22,000 and revised data show 911,000 fewer jobs were created in the past year than previously reported.

Bottom line: The current monetary environment is highly supportive for gold.

Force No. 2: Geopolitical and Economic Uncertainty

A climate of economic anxiety persists due to ongoing global trade tensions, notably the U.S.-China tariff disputes, which have disrupted supply chains and promoted economic nationalism.

Investors are flocking to gold as a safe haven amid unstable equity markets, renewed Middle East and Ukraine conflict risks and persistent global inflation.

You think prices at the grocery store are going up? It’s worse in many other countries.

Political instability means investors hedge risk, and one way they do that is to buy gold.

And the primary reason why gold is going higher is …

Force No. 3: Central Bank and Institutional Buying

Central banks are buying gold hand over fist, on pace to scoop up 1,000 metric tonnes of gold in 2025.

This makes four years in a row of large-scale buying as they diversify away from the U.S. dollar and U.S. Treasurys.

This isn’t short-term. A whopping 71% to 76% of reserve managers surveyed expect to increase gold holdings in the next 12 to 24 months.

That shows this is a sustained structural trend.

I’ve previously covered why central banks are shifting to gold.

Tariffs, U.S budget shenanigans and the way Uncle Sam uses King Dollar as a cudgel all make gold very attractive to central bankers.

This is the trend that underlies gold’s big move so far — a move that should send gold first to $4,100 an ounce, then to $6,900 and perhaps beyond.

So, maybe listen to Mister McEwen and do the smart thing: Buy gold juniors.

The easiest way to do that is using the VanEck Junior Gold Miners ETF I mentioned earlier.

Pullbacks can be bought.

And if Mr. McEwen is correct, you don’t even have to wait for pullbacks.

The gold party is just starting, and it has a long way to go.

It’s a party you’ll want to attend.

Another, better, way to play this bull market is through individual junior miners.

But it’s important to invest in the right ones.

I can help. I recently put together a brand-new report with my favorites. You can find out more here.

All the best,

Sean