|

| By Jim Nelson |

AI can do wondrous things.

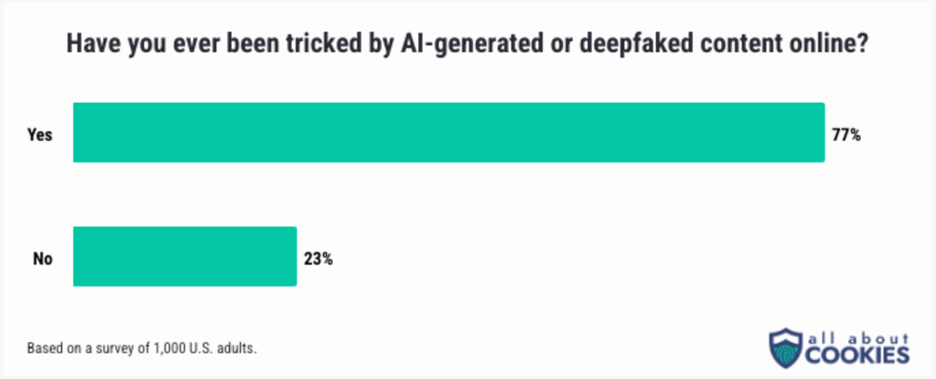

It can create images and videos that fool internet users.

In fact, according to a survey by All About Cookies, 77% of Americans say they’ve been “duped by AI content online.”

But it can also be used for good.

As startup specialist Chris Graebe has pointed out here before, it can be used to remove bias in the hiring process …

It can fight cyberattacks in ways no human could ever hope to achieve …

It can even augment your productivity and help you code something for your exact needs.

But can it make you money?

That’s what investors want to know most … and what they are experimenting to find out.

Here are three ways investors are trying to force market gains out of AI …

Ask Your AI Chat Buddy

The most common way — and arguably least effective way — is to ask your AI chat buddy.

ChatGPT, Claude, Gemini, Grok …

All of these are designed to help users search for information quickly and efficiently.

Some, including many of the experts here at Weiss Ratings Daily, interact with these large-language-model-based AI chatbots. But just for research help, not trading assistance.

Sure, they have become more reliable with each update.

But if you’ve ever used “Chad” or Claude, you know they are still prone to “hallucinations” at every turn.

Then there’s another problem …

Their datasets are often outdated!

Early versions of ChatGPT, for instance, had a cut-off date for its data — September 2021.

Even when their datasets get refreshed, the results can make you wonder whether it’s the right real-time data.

It’s easy enough for a human or a chatbot to find pricing data, price ratios and moving averages.

But a lot of the important stuff — the data that can really help you pick the right stocks at the right time — is still locked behind paywalls and remains proprietary.

So, we’re all agreed not to use chatbots to help with stock-picking, right?

We still like the idea of using technology to help with trading, though.

So let’s consider this second way to use AI for better investment returns …

AI Stock-Picking Tools

These have sprung up like weeds the past year and a half.

And they all operate slightly differently.

Take Magnifi.

It connects to your brokerage account and can help analyze your portfolio.

This is handy, as it can quickly see whether you are paying too much in fees. Or if you are too heavily invested in one asset class.

TrendSpider is based more on technical analysis.

It can help scan for specific chart patterns and company news.

You can also use it to backtest ideas.

Then there’s Danelfin …

It helps users analyze individual stocks, ETFs and more.

In fact, it ranks each investment on a 1-10 scale for likelihood of beating the market.

Any of these three tools are worth a first or second look.

But our Weiss Ratings members have access to a proprietary AI chatbot …

AI stock-picking tools …

And one more feature that those other apps and bots are missing …

Individual Stock Modeling

Nothing we’ve reviewed together so far has access to completely unbiased data and ratings.

Sure, some can glean info from publicly available data.

But none of them can use the 7+ terabytes of data Weiss Ratings has at its disposal.

This includes proprietary indices that evaluate growth, volatility, safety, risk, reward and more inputs.

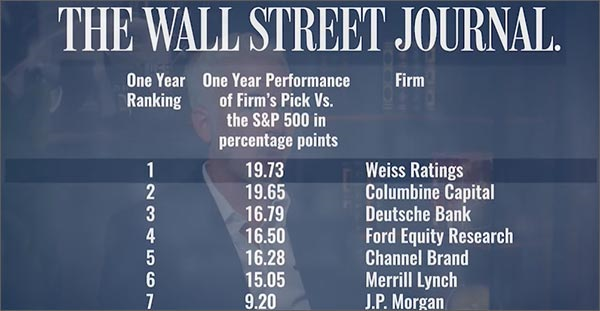

These alone have given Weiss Ratings bragging rights about decades of proven success.

But now, with a new AI-trading system that Dr. Martin Weiss recently revealed, it is even more powerful.

We call it IRVING, after Dr. Weiss’ father.

This AI also incorporates something I haven’t seen anywhere else … individual stock modeling.

That means thousands of stocks with tailor-made models predicting their likelihood of going up in the near term.

There’s so much more to it, you’ll have to watch Martin lay it out here, while you can.

But the short version is that when we tested all these combined factors, we saw mind-boggling performance.

This new system has shown it can beat the market by 94-to-1 over a 10-year period.

However, demand for this true AI-trading system is high.

So, unfortunately, we have to take this video explaining it all down tonight at 11:59 p.m. Eastern.

This might be the last chance to see it for yourself.

I hope you do so, while you still can.

Cheers!

Jim Nelson

P.S. You might not have thought about using an AI-trading system to help you reach your investment goals.

But IRVING’s AI is so much more.

It not only selects stocks to own for the next seven days … but we’ve built a user-friendly public interface that lets YOU ask IRVING about any stock in our coverage universe.

In other words, you not only get top stock picks but also an easy way to tap into our 7+-terabyte database to see why stocks earn high (or low) marks in our proprietary ratings system.

See how you can take IRVING’s AI for a test-drive right away.