|

| By Jon Markman |

Mark Zuckerberg used to be the most hated corporate leader in the world … and a detriment to shareholders. Elon Musk, please be more like Mark.

Shares of Zuckerberg’s Meta Platforms (META) reached a record high earlier this month, while Tesla (TSLA) shares plummeted as investors focus on mostly false narratives dedicated to destroying Musk.

This is a terrific investment opportunity, as today’s post-earnings bounce reflects.

Musk and Zuckerberg seem to share mutual disdain, judging by their exchanges on social media platforms.

Musk mused in a June 2023 exchange on X that an ultimate fighting-style cage match might be the best way to hash out their differences.

Thankfully, nothing came of this. Zuckerberg playfully accepted, then skillfully demurred from the distraction.

Zuckerberg is a talented, accomplished chief executive. Unfortunately, this skill did not stop him from becoming a symbol for all that is wrong with the corporate world in 2017.

He was scapegoated by left-leaning political activists for the election of Donald Trump because Facebook, a Meta business, allowed extensive political advertising on its platform.

And later in January 2019 at a conference in Brussels, Apple (AAPL) CEO Tim Cook, lobbed thinly-veiled accusations that Zuckerberg was the face of surveillance capitalism … a blight to personal digital privacy.

Cook later did everything in his considerable power to fight for users, or so it seemed. In reality, Cook was laying the groundwork for Apple’s own digital ad platform that would compete with Facebook.

Regardless, Meta shareholders suffered.

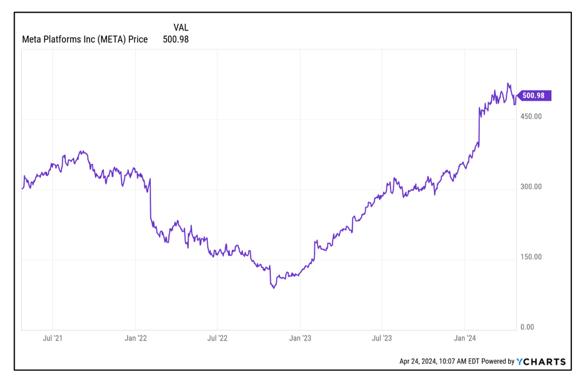

CNBC reported in 2022 that the changes at Apple could cost Meta $10 billion in revenues. The stock declined from a high of $383.90 in 2021 to a low of $88.32 in 2022 … to the delight of writers at the National Public Radio. Investment analysts warned the worst lay ahead.

In October, Morgan Stanley (MS) researchers cut the firm’s price target nearly in half, to $105. Analysts at TD Cowen and KeyBank downgraded shares based on rising costs and challenged revenues. Predictably, the analysts got it dead wrong. Shares were at the exact bottom.

Analysts deeply misunderstood the appeal of Meta’s platforms: Facebook, Instagram and WhatsApp.

Even as disconnected pundits wrote about how much regular people despised the services, the platforms continued to grow.

And this is still true.

Zuckerberg’s Lesson to Musk

Zuckerberg noted in February that monthly active users for at least one Meta platform reached 3.98 billion. For perspective, the total number of people connected to the internet is 5.35 billion, according to a 2024 report at Forbes.

Zuckerberg got the business-end of Meta turned around because people like his products. He is innovative and a talented visionary.

Customers love Musk’s products.

S&P Global researchers in March noted that Tesla customers are by far the most loyal in the automotive sector, despite the deluge of anecdotal stories about vehicle panel gaps, cold weather range and battery replacement.

Car and truck buyers are also most likely to switch to a Tesla from another make, a finding that is not surprising.

The appeal of Tesla vehicles, in addition to being fun to drive, is innovation. A Tesla is a software-defined vehicle, or SDV.

SDVs are like smartphones, as compared to flip phones. Over-the-air software updates allow Tesla to fix maintenance issues, constantly improve existing features and add entirely new functionality.

The company announced in April that its Full Self Driving, or FSD, package is available for $99 per month to the entire North American fleet. No additional hardware is required. FSD is a simple pay-as-go monthly software subscription.

The genius of SDVs is a testament to Musk’s vision. He is building fully-digital businesses that are light years ahead of legacy competitors.

Unfortunately for shareholders, this story is getting lost. Musk has become the focus, and a lot of activists are constantly distorting reality to destroy him.

For the sake of shareholders, Musk needs to be more like Zuckerberg.

Musk is certainly capable of making these changes. He is arguably more talented than Zuckerberg, and his goals are more mainstream.

The success of his electrification agenda forced all of the major players in the global automotive sector to begin electric vehicle plans. Helping the world transition to sustainable energy is a goal most people support.

Elon, if you’re listening, it’s time for you to put your head down and start focusing exclusively on the business of Tesla and relentlessly creating shareholder value.

It is the best way to silence your critics.

Last week’s layoffs and the rollout of the $99 FSD subscription are both good places to start.

You should also focus on explaining the longer-term robotaxi story.

Tell investors why Tesla is the future of automotive transport.

Lastly, be the innovator who sells smartphones when the rest of the world, and your media critics, are pushing flip phones.

The truth will win out.

All the best,

Jon D. Markman