|

| By Sean Brodrick |

It seems a lot of people on Wall Street turned negative on oil. Most recently, Goldman Sachs (GS) and Morgan Stanley (MS) lowered price forecasts.

The two banks now foresee Brent crude averaging less than $80 a barrel in 2025 due to rising supplies from OPEC+.

Man, I think that view is wrong. And if you want to bet against the big banks on oil, too — and get paid to do it — I’ll show you my “secret weapon.”

Oh, okay, it’s not THAT secret. It’s the Weiss Ratings. But it boggles my mind how few investors use this amazing tool.

And I’ll show you how Weiss Ratings can help you pick the best-paying oil stocks.

First things first …

In October, OPEC+ will revisit the 543,000 barrels a day of output they cut earlier this year. Big banks like Goldman and JPMorgan believe OPEC+ will open the spigots.

I see that as very unlikely.

OPEC leader Saudi Arabia needs higher oil prices to avoid budget deficits caused by all its spending on megaprojects and social safety nets. They’re going to extend at least most of those cuts.

The other factor is China. Its economy is weakening. After growing 5.3% in the first quarter, it grew just 4.7% in Q2. And there are more signs of weakening in cement sales, consumer demand, gasoline demand and more.

Why this is important for oil: China is the second-largest consumer of oil in the world, consuming 16.6 million barrels per day, about 13.2% of the world's total consumption. And it accounted for roughly 40% of oil demand growth in 2023.

The market seems to be pricing in an even worse slowdown for China. Again, that seems unlikely.

China is establishing new free trade zones, streamlining customs and promoting growth policies.

China has also rolled out a new policy to encourage more than $700 billion in annual spending on equipment upgrades. That alone could add half a percent to GDP growth.

I believe China is closer to the end of its pullback than the beginning. That, combined with continued production restraint from OPEC+ adds to an already tight global supply picture.

So, let’s look at that …

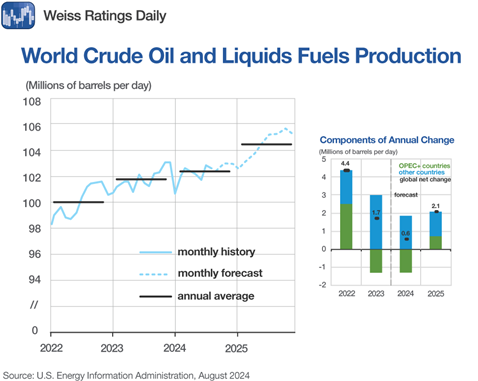

According to the Energy Information Administration, global oil production will increase by 2.1 million barrels a day in 2025. However, like the big banks, the EIA is counting on OPEC to crank up production.

My view is it’s just not in OPEC’s best interest to do so. Higher production means lower prices.

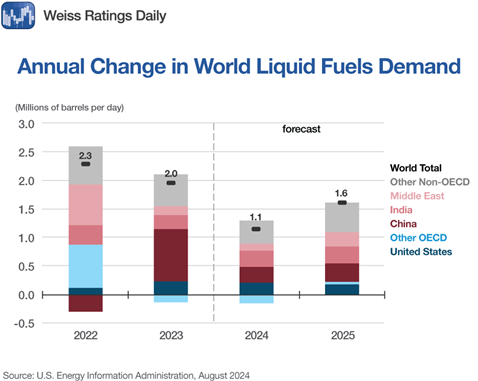

At the same time, the EIA is forecasting that global oil demand will rise by 1.6 million barrels per day next year. Like Goldman, the EIA expects China’s oil demand to slow down.

If the big banks and the EIA are wrong, oil profits will pump higher.

But what if they’re right?

In that case, I’d still want oil exposure. After all, just this week, we saw a political faction that controls the oilfields in Libya, which pumps 1.2 million barrels a day, threaten to shut down ALL the country’s oilfields and stop exports.

There are a lot of things that can go wrong with the global oil supply. You always want some exposure. But it’s good to be paid while you wait for oil investments to work out.

The way to do that is by picking up oil stocks that pay fat dividends. Let me show you how Weiss Ratings can help you do that …

- Go to the Weiss Ratings home page.

- On the right side, you’ll see stocks with their Weiss Ratings, organized by category. Scroll down that list until you get to “Top Energy Stocks.” Click on “See All.”

- You’re now on a list of all Weiss-rated energy stocks. At the top right of the list, click on the symbol that looks like a funnel. You’re going to add a filter. Click on “Dividend Yield.”

- You now have to say what kind of dividend you’re looking for. The S&P 500 recently had a dividend yield of 1.2%. I want higher than that. A LOT higher — I’m greedy! Click on “>=5%.”

- Now go to the right and click on dividend yield. It should show you dividend yields in descending order. Click on the words “Dividend Yield” if it doesn’t. Now, look for high single-digit yielding stocks with “A” or “B” ratings.

You can certainly add in whatever other parameters you want. I like companies that are growing earnings and cash flow.

One that catches my eye right off the bat is MPLX (MPLX), an oil & gas midstream company that yields 7.93% and has a Weiss Rating of “A-.”

Let’s see how MPLX has performed compared to the S&P 500 year to date.

The S&P 500 is up 18% since the start of the year, which is VERY good. The MPLX is up 23% at the same time, AND you get a fat dividend to boot!

There are many more highly rated, fat-dividend-yielding stocks to choose from. Take the Weiss Ratings for a spin yourself.

And something to keep in mind: When those on Wall Street get loudly bearish on something, they usually want weak hands to sell their shares.

I think that is what’s happening with oil. China’s economy will improve, and OPEC+ won’t want to boost production and see a resulting fall in prices.

And oil stocks that pay fat dividends are a great place to park your cash while you watch the action.

All the best,

Sean

P.S. Oil stocks that pay fat dividends are also defensive. After you watch this presentation, you might want to add them for even more reasons.