New Investing Technology for an Old-Fashioned Investor

|

| By Gavin Magor |

In terms of my lifestyle, I guess you could call me a bit of an old-fashioned guy … but my preferred investing style is anything but.

I dress up when I fly, I keep the house in pristine condition through hard work both inside and out, I prefer to write handwritten letters over sending emails … and my days always start off with a freshly-brewed steaming hot cup of tea.

But far more importantly, I always try to show respect, I am very hard-working and diligent and family is extremely important to me.

Those may be seen as “old school” … but my investing methods are cutting-edge.

With decades of experience working in the financial industry, I realize that we are now at a new day and age, and those that are not embracing newer technologies to their advantage are getting left behind.

And in many respects, 2023’s stock market has been …

The Year of AI

In years past, the original thought of artificial intelligence creeped me out. The thought of a robot or something like that in my house … no thanks!

But what we’re seeing now is the first phase of AI adoption into our lives … and it’s been remarkable to see. I’m talking about assisted driving … AI helping doctors save lives through new cancer treatment suggestions … and AI being incorporated into investing strategies.

Those are examples of some incredible ways AI is impacting our lives already, and in terms of the stock market, you better believe there have been some giant AI gains.

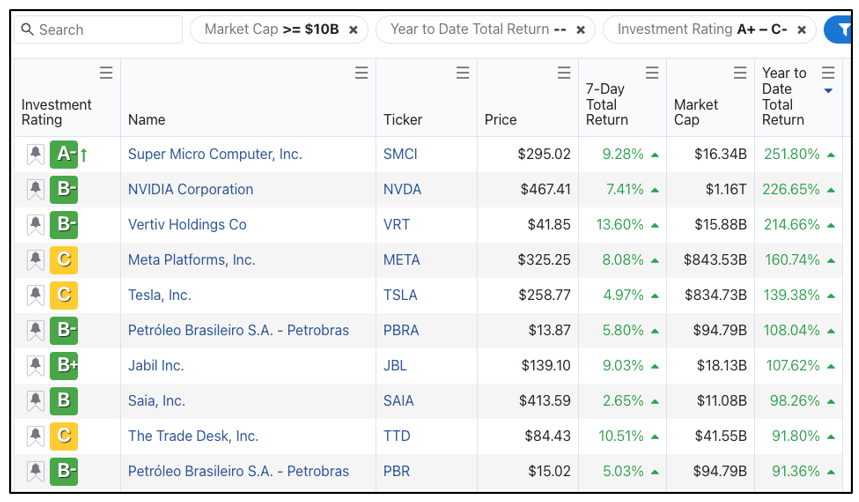

Let’s take a look at some of this year’s top gains for stocks with a market cap larger than 10 billion, and that are rated “C-” or higher:

After a few easy screeners on the Weiss Ratings page, here’s what populated. As you can see, there are many tech names listed, and they have been driven higher due to their valuations increasing based on future demand from AI.

Interestingly, the top name on the list is Super Micro Computer (SMCI) and it’s a name that my premium subscribers were able to bank two rounds of big double-digit gains on because they got in earlier this year.

Make no mistake: The first half of 2023 was Nasdaq’s best first half since 1983, and the reason was AI.

But here at Weiss, we’re no stranger to this new technology. For the past decade, my team of analysts has been working on an AI strategy to help bolster returns, and their results have been remarkable.

In model runs with AI technology, results have been 2.077 times better. You see, the AI model runs allowed modeling that humans could never replicate as they’re able to make on-the-spot decisions using an exorbitant amount of data.

The product we’ve just launched that incorporates this incredible AI tech is called Weiss Intelligence Portfolio.

Weiss Intelligence Portfolio Has Untapped Potential

In the 50-plus year history of Weiss Ratings, Dr. Martin Weiss said there may never have been a more anticipated product release, and that’s because none of Weiss Ratings products have used AI-assisted trading strategies before.

Now, I will still be the editor of the new product, but our picks will be entirely driven by our data and AI technology. I am extremely confident that our future results will not only mirror our past results — and those are some spectacular gains — but they will even likely surpass them.

Just this past week, I had an urgent sit-down with Dr. Martin Weiss. We talked about just how powerful this new AI tool is and how we’re already using it to fuel bigger and more predictable gains. If you happened to miss it, click here now.

So, while I’ll remain an old school guy, my investing will be anything but!

Cheers!

Gavin Magor

P.S. One last important point: I will be sending you my Weiss Ratings Daily issues on Mondays now, not Fridays anymore. I feel like there is no better day to write to you about our incredible ratings technology than at the start of the week.