|

| By Gavin Magor |

We’re officially in correction territory, but it’s markets like these where investors can benefit in some of the biggest ways from the Weiss Ratings.

Since July 31, the S&P 500 is down around 9.8% as of this writing. AND it just pierced through one of my very important levels, the 4,180 level — one that has not been seen since May of this year.

So far, we’ve seen mixed earnings and mixed economic data reports. Ultimately, I am still very cautiously optimistic. But a lot remains to be seen.

The only constant in the markets is change, and that’s why staying nimble and adapting to the market we have — not the one we want — is crucial.

As the economy changes, so do our ratings, and we have some key upgrades based off earnings that I would love to share with you.

New Earnings, New Weiss Rating Grades

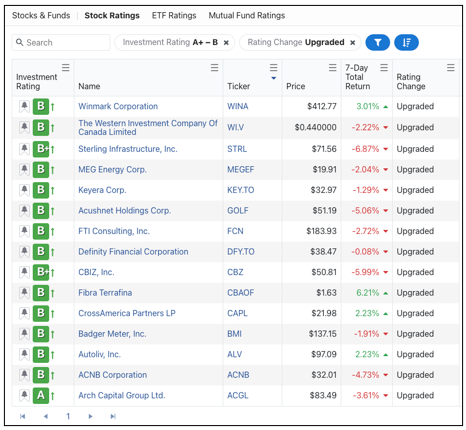

After a few easy filters on our Stock Screener page for investment ratings of “A” through “B” and “Upgraded,” I was able to find some names that have benefitted from recent strong earnings reports.

Here’s what populated:

In the above image are some of our new “Buy” rating upgrades. One that stands out to me is Winmark (WINA). The company just released its Q3 financials, and they were stellar. So, it’s not surprising to see that recent upgrade into “B” territory.

The Minneapolis-based franchisor posted EPS of $3.05 per share and revenue of $22.3 million for the quarter. Two days later, after being vigorously screened by our system, the stock was upgraded — primarily due to an increase in operating cash flow of 30% and an increase in the quick ratio from 2.93 to 3.64. Again, this is all listed next to its upgrade from last week on our ratings page.

Over the last five years, shares are up 173% — and 24% over the past three months. Despite being a “retailer” in an internet shopping-based world, the company appears to be asset-light and growing in a very responsible fashion. Wall Street is clearly starting to pay attention.

I’m intrigued by this name, and you should be, too. Let’s take a look at the chart:

Click here to see full-sized image.

On the technical side, things look even more beautiful … with volume remaining elevated recently and trading almost in tandem with both its 200-day and 50-day averages, which is bullish.

Be sure to explore all of our recent upgrades, but this one certainly is on my watch list, and that is thanks to our incredible stock ratings system.

Sure, upgrades are nice, but we’ve seen mixed earnings … so, let’s check on some of our major downgrades as of late.

Managing Downside Risk

If you know me, you know I aim for conservative first downs in my investing strategy … not high-risk Hail Marys. That’s why when I see a ratings downgrade, especially into “C” or below territory, I am very cautious with the name.

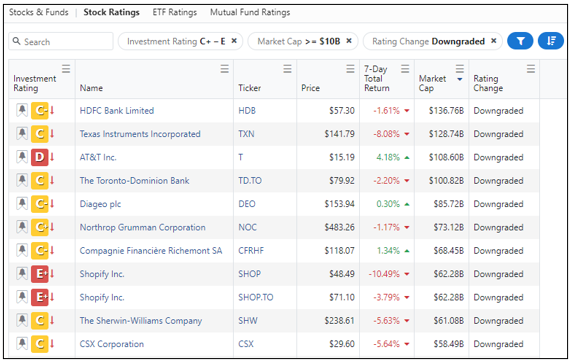

After several other easy filters on the Weiss Ratings Stock Screener with an investment rating of “C+” to “C”, “market cap above $10 billion” and a recent ratings change of “downgrade”, here’s what populated:

In the above list, you can see some major stock market names that we have recently downgraded. For example, AT&T (T) was recently downgraded from “D+” to “D” despite many analysts liking the earnings the company reported last week. EPS fell 40% to 48 cents a share, but beat expectations, sending the stock up last week.

Occasionally, our ratings disagree with the consensus view, and that’s exactly why we are unique. If there are some stocks you own in your portfolio that were recently downgraded, perhaps like AT&T, be sure to explore and see if it still belongs in your portfolio. I know that’s what I will continue to do. And if history is any indication, it is a wise move.

So, whilst the market stays chaotic, having a rational view of some of the names you are considering investing in doesn’t have to be. Seek clarity with the Weiss Ratings, and you’ll be better off.

Cheers!

Gavin Magor

P.S. Stocks can move in a hurry for more reasons than just a single earnings report or ratings upgrade. In fact, we recently put together a very special presentation about how one man — which you certainly know — can send stocks racing in a matter of seconds. Click here to check it out.