|

| By Mike Larson |

Last week, Wall Street was really hoping for the “Powell Pivot,” but it wasn’t meant to be.

Instead of signaling satisfaction with progress on the inflation front, Federal Reserve Chairman Jerome Powell did the opposite last Friday.

Instead of backing off on his plans to hike interest rates, he promised to “use our tools forcefully” in a speech at the Fed’s annual retreat in Jackson Hole, Wyoming.

And instead of celebrating a newly dovish central bank, investors listened to Powell warn about “some pain to households and businesses” ... and then ran for the hills!

The Dow Jones Industrial Average plunged more than 1,000 points by the end of the day, then shed another 184 points on Monday. Plus, the dollar and the CBOE Volatility Index both shot higher.

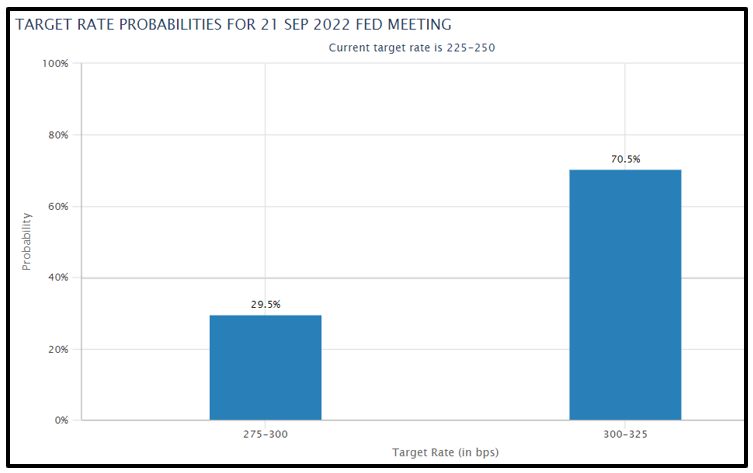

Meanwhile, in the interest rate futures market, speculation about the Fed’s next move ramped up. The CME’s FedWatch tool now shows that bond investors are pricing in about a 70% chance the Fed will hike rates another 75 basis points at its Sept. 21 meeting.

That would be the third straight move of that magnitude, something we haven’t seen in decades.

Yet, as Dr. Martin Weiss noted on Monday, even another aggressive hike would leave the Fed’s benchmark rate far below the nation’s inflation rate.

Is it any surprise then that there isn’t much that’s working well?

Or that the SPDR S&P 500 ETF (SPY) has sunk 14% year to date, while the Invesco QQQ Trust (QQQ) has shed 23%?

Or that even supposed safe-haven assets are getting creamed? The iShares 20+ Year Treasury Bond ETF (TLT) has fallen 23% YTD.

Not really. But you can still find opportunity ... if you know where to look!

And that’s where our Weiss Ratings battle-tested “All-Weather” strategy comes in. In fact, it would have outperformed Buffett's Berkshire Hathaway (BRKA) by 5.3-to-1 in both good markets and bad. Click here for access to a FREE tutorial on this game-changing strategy now.

Until next time,

Mike Larson