|

| By Sean Brodrick |

I have the best investment idea for you that you’ll hear all month.

Yes, I’m writing about uranium again. And yes, I really, really hope you listened to me when I started talking about uranium investing in June.

Even if you ignored me so far, it’s not too late. Uranium stocks are blasting off — I’ll explain why in just a bit. And you can still get your ticket on this white-hot rocket.

Because the uranium cycle is just getting started. As famed investor Rick Rule just said: “In uranium, the easy money has been made. The real money gets made now, and the big money gets made when it gets stupid.”

We’re in “making real money” time. Stupid is a long way off. Stupid comes when — as happened in the last bull market — companies that were exploring for other metals reinvent themselves as uranium explorers despite not having a uranium geologist on staff.

Yep, that was a thing. More than once.

Man, I’m so glad I went through the last uranium bull market — and bust. Because it seems obvious to me now what to buy … and what to avoid.

What’s Happening

The spot price bid for uranium just jumped to $74 per pound. This marks the highest price in more than 15 years.

Sure, most uranium is sold under long-term contracts. But contract prices are going up too. So, many utilities held off buying to fill new contracts, figuring the price would go down again. But now the price is at $74, and, well …

You can see what this is leading up to, right?

The Mother of All Short-Covering Rallies!

Cameco (CCJ) — the largest publicly traded uranium miner — just dropped earnings news that rocked the market like an atomic blast.

Along with reporting TRIPLE the per-share profit that analysts expected — despite a 9% drop in production — management said:

"We are seeing durable, full-cycle demand growth across the nuclear energy industry. These factors lead us to believe that we are experiencing the industry’s best-ever market fundamentals. These dynamics have also led the World Nuclear Association (WNA) to increase its demand forecast in their latest Nuclear Fuel Report to an average annual growth rate of 3.6%, compared to 2.6% in the 2021 report. Furthermore, the WNA has issued a call to action to triple nuclear capacity by 2050 to help the global drive to net-zero greenhouse gas emissions."

Cameco’s bullishness is driven by impossible-to-ignore fundamentals.

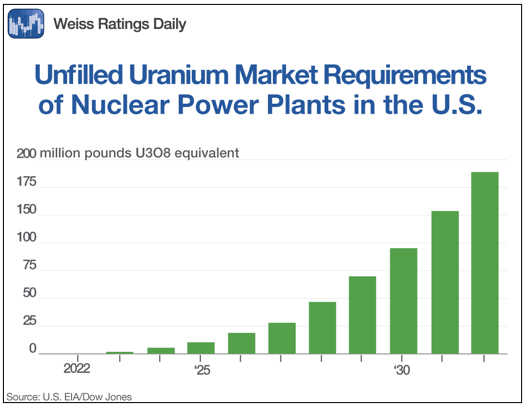

The plain fact is that the market is in a structural demand deficit that is currently 50 million pounds per year, while demand is growing at a 5% annual rate. There is more supply coming online, but not that much … and not nearly fast enough.

Global uranium production in 2022 covered only 74% of demand for that year. The rest comes from (depleting) stockpiles. And it takes YEARS to build a new uranium mine.

And THAT’s why uranium prices are zigzagging higher. The supply/demand squeeze is real, and it’s getting worse.

Heck, China plans to build another 44 nuclear reactors by the end of the decade … and may build another 154. Germany was shutting down nuke plants — now it is extending the lifespans of its remaining three plants. And even Japan, which suffered the Fukushima nuclear meltdowns more than a decade ago that sent uranium into a long slide, is reopening nuclear plants.

As of 2022, nuclear power was responsible for 9% of global electricity generation. Now, the International Energy Agency says that global nuclear capacity needs to double by 2050.

What’s more, the World Nuclear Association says 140 existing reactors could see operations extended. It also expects 35 gigawatt hours of small modular reactors could be developed by 2040. These small reactors can be used for everything from powering massive cloud server farms to remote mines. This could double uranium demand.

How You Can Ride This White-Hot Energy Trend

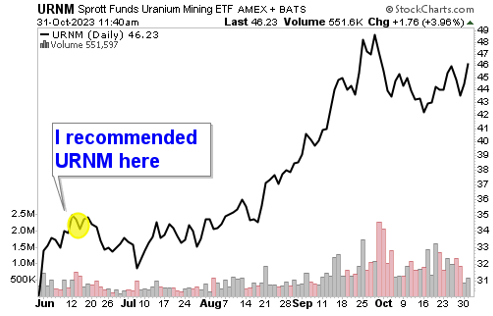

When I talked about uranium in June, my pick at the time was the Sprott Uranium Miners ETF (URNM). It holds a basket of leading uranium miners and charges an expense ratio of 0.85%.

I marked on the chart where I recommended URNM. If you bought it then, you’d be up 35%. Compare that to a drop of more than 18% in the S&P 500 at the same time.

So, maybe you didn’t buy it in June. That’s OK. That was just the easy money. The REAL MONEY is still ready to be made. I’m talking about double-digit percentage gains on URNM, and triple-digit percentage gains on select uranium stocks.

I’m already recommending those stocks to my Resource Trader Members. I’ll recommend more, soon.

If you’re doing this on your own, be careful. There’s a lot of dreck out there. But you shouldn’t sit out this potential for fortune-making gains.

All the best,

Sean