|

| By Gavin Magor |

Our offices are closed today and tomorrow for Thanksgiving.

Still, I want to send you this brief message.

Of course, I’m celebrating Thanksgiving like most of you — except I’ll eat lingonberries (not cranberries) with my turkey.

I’ve been in the States since 1997, when millions of Americans watched the NFL’s Detroit Lions devour the Chicago Bears 55-20 that year.

And the same two teams square off again later today with the 10-1 Lions favored.

I just hope that similarities between 1997 and 2024 begin and end with a football game and lingonberries.

That may not be the case, though. The word “exuberance” has been used to describe both years.

Twenty-seven years ago, investors bought into the Dot-Com explosion big time.

In a now-famous speech by then-Fed Chair Alan Greenspan, he coined the phrase:

"But how do we know when irrational exuberance has unduly escalated asset values, which then become subject to unexpected and prolonged contractions as they have in Japan over the past decade? And how do we factor that assessment into monetary policy?"

He was already cautioning against the absolute freefall that was still a few years away.

By 1998, sentiment pushed markets to new highs, while more cautious investors prepared for the end of the bull market — which ended nastily by 2001.

Today, exuberance has been linked to AI investments, a quick and decisive presidential election and temporary “Trump trades.”

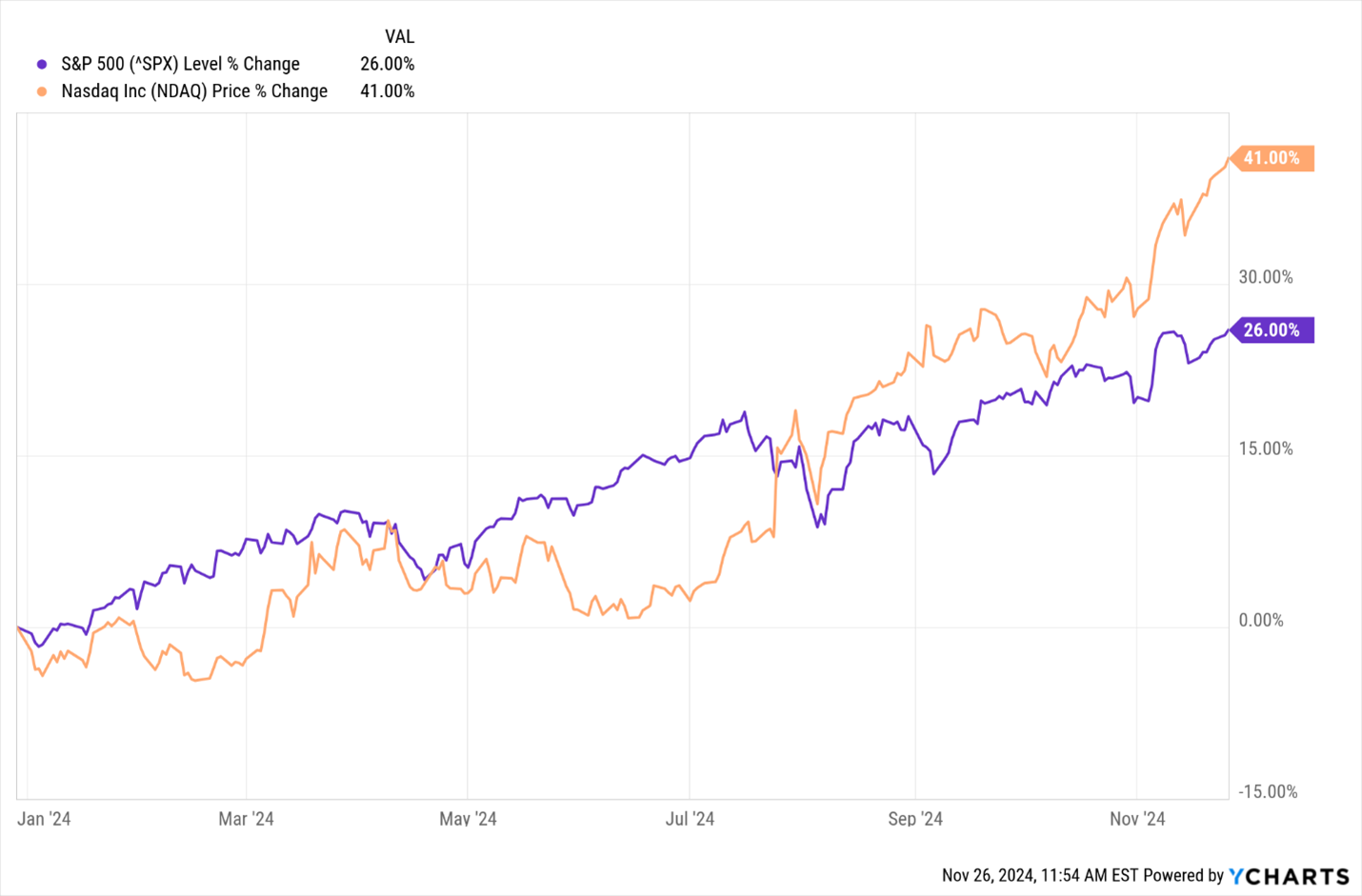

As a result, we’ve seen markets hitting higher highs as we near the end of 2024.

The S&P 500 now sits right around 6,000. And the Nasdaq is up 41% year to date.

Will the markets suffer the same fate as they did post-1997? No one knows …

What I do know is that you don’t need to worry about the answer. Preparing for whatever comes our way is our job. We take pride in doing the heavy lifting for you, always.

Weiss Ratings survived — and thrived — during the Dot Com Bubble and Burst, the Financial Crisis of ‘08-’09 and the recent pandemic.

No matter what the market throws at us, we’re prepared … and you can be, too … with our ratings.

For that, we are thankful. But we are more thankful for you.

We couldn’t do what we love doing without you, dear reader.

So, I’ll be sure to keep you in mind even as I tuck into my lingonberries and turkey.

Tomorrow is a half-day of trading in the markets. The NYSE and major exchanges close at 1 p.m.

We’ll be watching, even as the office is officially closed. And, again, thank you for being part of the Weiss Ratings Daily family!

Cheers!

Gavin