|

| By Nilus Mattive |

Maybe you love Donald Trump. Maybe you hate him.

Either way, on July 31, he made an extremely good point when he posted the following to his Truth social media account …

“Seniors should not pay tax on Social Security!” Of course, in all caps:

Indeed, if you aren’t already affected by this ludicrous policy, you might be surprised to find out that Social Security benefits can even be taxed in the first place.

Up until 1984, they weren’t.

But for 40 years now, Washington has essentially been cutting the benefits promised to millions of retirees through this stealth method.

In fact, under current law you could owe federal taxes on as much as 85% of the Social Security benefits you receive — which effectively means the government is taking back most of the money it originally promised!

It all depends on how much “provisional income” you earn during retirement.

To figure this number out, you add up your adjusted gross income (not including S.S. payments), additional tax-exempt interest you’ll collect, plus half of your S.S. benefits.

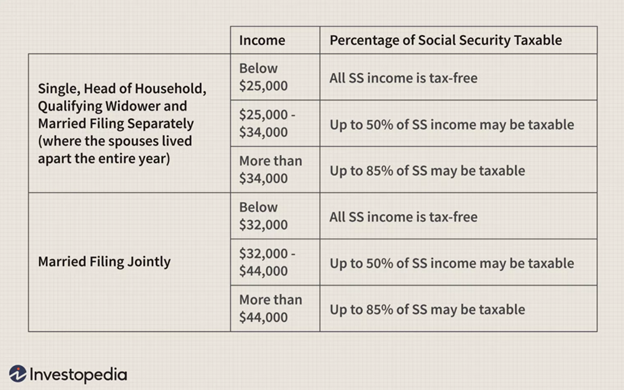

If you file a joint return:

- Your benefits are tax free if your provisional income is less than $32,000 …

- No more than half your benefits can be taxed if your provisional income is between $32,000 and $44,000 …

- And if your provisional income exceeds $44,000, it’s almost certain that 85% of your benefits will be taxed.

A couple of things to note:

First, if you file single or head of household, these thresholds go DOWN significantly — i.e., taxation begins at provisional income of $25,000.

Second, in that middle range, the actual methodology and exact amounts get tricky. But the result is that you will likely owe a good amount of money back to Uncle Sam.

Third, these thresholds have NOT been readjusted for inflation!

Given the massive bout of inflation we’ve recently experienced, that’s just another reason why more and more retirees are now getting snagged every year.

Originally, just 10% of Social Security recipients had any portion of their benefits taxed.

Now, it’s more than 4x that number … my own parents included.

And that brings me to another important point … plenty of regular folks like teachers, firefighters and low-level company employees are receiving enough retirement income to subject their Social Security benefits to taxation.

Heck, even a very modest pension would exceed the ranges I just outlined!

I don’t think this is right at all.

I believe it punishes people who have planned adequately for retirement … and only raises more questions about the overall fairness of our current Social Security system.

So, is there anything you can do to avoid having Social Security payments taxed?

You may be able to shift around certain retirement distributions and use certain types of investment accounts to control how much provisional income you receive in any given year.

I would recommend working with a tax adviser or financial planner to figure out what’s right for your particular situation. But here are a few starting points:

- No 1: Consider a Roth IRA over a traditional IRA since the former’s distributions are not taxable income.

- No. 2: Take distributions from your retirement accounts in such a way that they only push you into taxable range every other year.

- No. 3: Be careful how and when you sell stocks, real estate or other major assets.

Oh, and based on the rapidly deteriorating condition of our nation’s retirement system — and Washington’s finances in general — realize that this could still be just the beginning of a much larger, much nastier trend.

Indeed, this is precisely why Martin and I put together this free emergency presentation.

In it, we reveal:

- Three forecasts that should strike fear in the hearts of even the most secure investors and the biggest retirement accounts.

- The three steps you need to take now to defend yourself from the ravages of this undeclared war on you and your retirement.

- Plus, a little-known “instant income” strategy that may be your greatest weapon to defend yourself against the government’s wrong-headed war on retirees.

All you have to do is click here to watch it now.

In it, I reveal my No. 1 strategy …

A breakthrough, income-generating powerhouse with a four-year history of delivering consistent payouts of $1,000 or MORE — nearly every week of the year.

And when I say “consistent” I mean it …

Over the past four years, investors had the chance to close out 93% of these Instant Income investments for wins … better than nine out of every 10 trades.

And since May 2022, this system has produced zero losing closed trades.

I already personally use this strategy myself and so does my retired father (after I taught him how).

You can start using it right away, too.

All you have to do is click here to learn how it works.

Best wishes,

Nilus Mattive