|

| By Gavin Magor |

"I think I can, I think I can, I think I can.”

Just when you think this market is finally about to run out of steam, it just keeps pushing ahead.

Since the start of 2023, the broad-market index is up a turbocharged 58.4%.

But unlike “The Little Engine That Could,” which ultimately pulled the train over a giant mountain, this market will eventually run out of steam. And it could look more like a sci-fi novel than a beloved children’s book.

When that might happen remains unknown. But there appears to be a lot of froth out there. And if history is any indication, this run will not sustain itself forever.

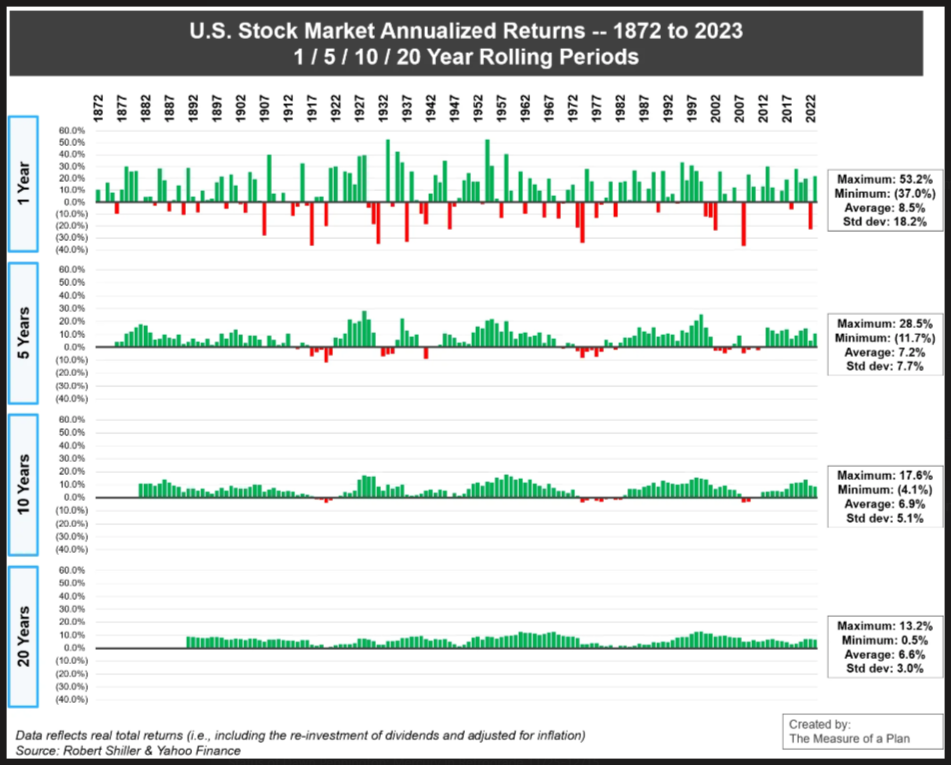

Here’s a snapshot of S&P 500 returns over one-, five-, 10- and 20-year rolling periods from 1872 to 2023:

I understand that’s a lot of data fit into one image. (You can click to see a larger version on our website.)

What I want you to take away from it is that the past two years have been historically strong for the market.

One market that’s seemingly unstoppable right now is crypto. Bitcoin just notched its latest all-time high at $107,000.

As America prepares to inaugurate its first “crypto president” next month, there should be more upside to come for select digital currencies.

And so, I strongly urge you to consider grabbing one of our Weiss Crypto All-Access Passes. We’re only making 350 available, and only through Monday, Dec. 23.

My team has notified me that there are no plans to offer All-Access Passes in 2025. So, claim yours now before that window closes for good.

Now, even if the stock markets take a pause before their next trip up the mountain, take heart.

Cryptos tend to travel together — either they go up as a group or down. It’s not often that there are groups showing strength while others show weakness, and vice versa.

However, there’s always a bull market in stocks. Even when there’s a bear market. And, again, vice versa.

That’s because there are 11 sectors that make up the markets. And if one (e.g., energy) isn’t firing on all cylinders, that doesn’t mean another (e.g., tech) isn’t taking off.

We see this in our Weiss Ratings all the time.

In fact, we just saw our list of “A”-rated stocks get bigger. That’s thanks to the recent upgrade of two stocks into this top-tier category.

These 2 New ‘A’ Names Not Playing Games

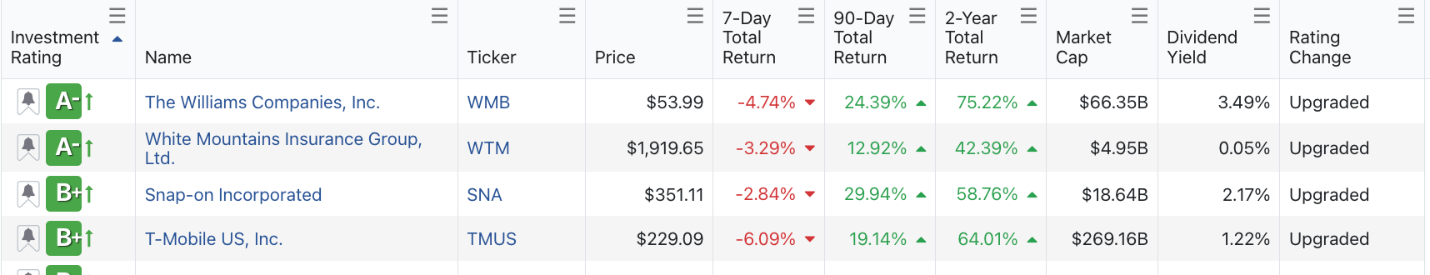

After a few simple clicks on our Stock Ratings Page, I searched for stocks that were “Upgraded.”

Then I sorted those by “Investment Rating,” which lists the stocks with the highest Weiss ratings near the top.

Here are the top four stocks that populated for me:

- The Williams Companies (WMB), an energy company based out of Tusla, Oklahoma.

- White Mountains Insurance (WTM), an insurer based on Bermuda.

- Snap-on (SNA), a Wisconsin-based maker of hand tools, power tools, tool storage and diagnostic solutions for professional, government and industrial users.

- T-Mobile U.S. (TMUS), the Washington-based wireless subsidiary of Deutsche Telekom with the unmistakable magenta logo.

Without even clicking a further button, you can see on the right-hand side that several of these names have enjoyed market-beating performance over the last 90 days.

As evidenced by their “A”-range ratings, these stocks appear financially healthy.

The ratings clearly view them as having a strong track record and as trading at a price that represents good value.

Our methodology, which churns a head-spinning amount of data daily, has a strong bias toward safety.

I think that’s very important when investing.

Think about it this way: Formula One vehicles are among the fastest on the planet. They can be because they also have the best brakes.

So even if the markets stop and sputter for a bit, always remember that using the Weiss Ratings is like putting premium fuel in your tank.

Used right (and often), our Ratings can lead you far beyond those Little Engines that Could.

They can show you those stocks that have the absolute best probability of getting up those mountains AND safely down the other side.

All aboard!

Cheers!

Gavin Magor

P.S. We’re looking at the biggest crypto opportunity since the launch of Bitcoin itself 15 years ago. Discover how to put it to work for you starting at 2 p.m. today with the kickoff of our Crypto All-Access Summit. Not on the list to attend? No problem! You can do that right here.