Play the Biggest 'A-'-Rated Winner on the Fed's Proclamation

|

| By Gavin Magor |

The Fed’s most recent remarks mean a new opportunity for investors.

This week, Federal Reserve Chair Jerome Powell hawkishly announced the Fed is “close to done” raising rates, which was widely expected. But what wasn’t entirely expected was that he expects interest rates to remain higher “for longer than the market expects.”

Ultimately, his view of what “longer” means is what caused a majority of this week’s market sell-off.

To me, this isn’t news, and the fact that traders are reacting to it as such means they are a step behind the pack.

We knew interest rates would stay high and have been saying for months that there was little to no chance of any cuts in 2023 or early 2024.

High rates are here to stay, and navigating these current choppy waters and looking for opportunities is what matters.

Banking on Profits

I’ve previously worked in banking, and I can confidently say it’s very hard to be a bank and not make money … and it’s even harder to be a bank and not make money when interest rates are high.

Assuming the overall economy remains stable — which I strongly believe it will, although I am not entirely sure about the “soft landing” narrative — banks can and will continue to use higher rates to their advantage.

In a very broad nutshell, banks profit from the net interest margin … the difference between the interest they pay on deposits and the interest rates they collect on loans. Net interest margins end up increasing, ultimately boosting profits.

I’m an avid proponent of strong asset allocation and portfolio diversification. That is part of the reason why I’ve recommended many financial stocks to my All Weather Portfolio subscribers over the past year. Indeed, they’ve done quite well on many names.

In general, I love stocks in the financial industry, but especially in markets like the one we’re in. The banking industry is quite resilient, and I expect it to remain so.

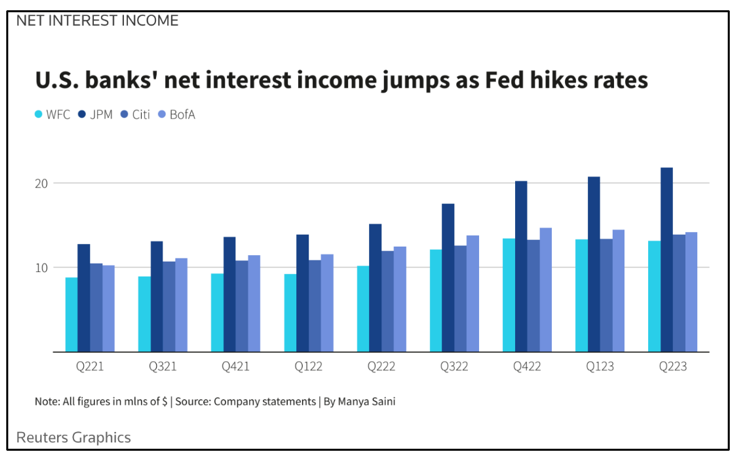

As you can see above, net interest income has been steadily rising as the Fed has hiked rates. And whilst we may not know what the Fed is going to do next … we do know that the Weiss Ratings are always going to predictably provide us with 100% accurate and unbiased financial information.

Let’s turn to the latest ratings to find some highly-ranked stocks within the banking industry.

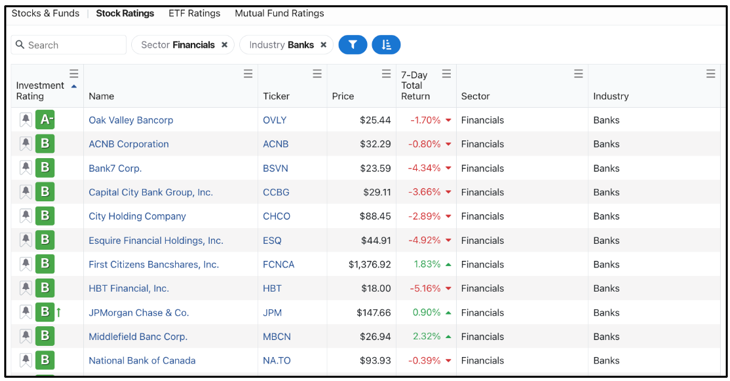

After a quick search on the Weiss Ratings Stock Screener, I then filtered by sector using “Financials” and then by Industry by choosing “Banks.”

Here’s what I got after sorting by “Investment Rating:”

What populated was a magnitude of strong, highly-rated banking stocks. I am sure you are familiar with some of these names like JPMorgan Chase (JPM) and First Citizens Bancshares (FCNCA) … but you may be unfamiliar with a name like Oak Valley Bancorp (OVLY), which is not only “A-” rated, but also the highest-rated name on this list.

Barking Up the “Right” Oak Tree

Oak Valley has been on my radar since we upgraded it last month to an “A-” rating. The Oakdale, California-based bank holding company (for Oak Valley Community Bank) has conservatively guided its way to consistent profits and is using this market environment to capitalize.

Don’t just take my word, let’s look at the chart:

Click here to see full-sized image.

Shares are up around 97% over the last three years.

In regard to its financial health, we’ve seen solid, consistent profits, with net income of $8.4 million in its most recent quarterly earnings report. That’s up from $4.2 million in the same period a year ago.

It’s an attractive dividend payer, bullishly increasing its payout on a consistent yearly basis, which is currently yielding 1.26%.

Oak Valley seems to be operating very well in its regional California market and is growing very strategically.

As I already mentioned, it has earned an “A-” in our database, and I also give it a thumbs up. Whether it deserves a spot in your portfolio is something you have to decide.

That said, I encourage you to look at all of our highly-rated bank stocks … and all of our stocks for that matter.

Wall Street may be a step behind, but you don’t have to be.

Cheers!

Gavin Magor