|

| By Jordan Chussler |

On Wednesday, the Federal Reserve announced it will pause its rate-hiking cycle after 10 consecutive increases to the effective federal funds rate.

This could bolster the newly emerging bull market, which so far has been driven primarily by just seven tech companies, five of which are the largest by market cap in the S&P 500.

However, with inflation continuing to subside and interest rates on hold — at least in the short term — this presents the broader market with the opportunity to join Big Tech in this year’s rally.

For now, it appears there’s cause for both cautious optimism and momentum on the backs of the S&P 500’s 14.66% year to date gain, and the tech-heavy Nasdaq’s 37.81% YTD gain.

From a macroeconomic standpoint:

- Since President Biden signed the Inflation Reduction Act into law in August 2022, consumer prices have been cut by more than half, falling from 8.9% to 4% through May 2023.

- Unemployment claims are at their lowest level since 1969.

- And the job market added a robust 339,000 nonfarm jobs last month, up from 253,000 in April and 248,000 in February.

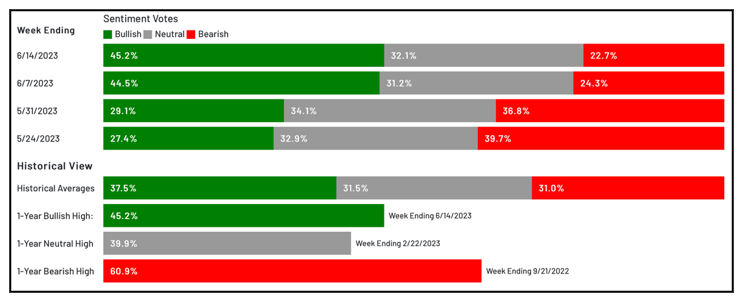

That positivity is being reflected in investor sentiment, which for the second week in a row, is showing significant bullishness.

Click here to see full-sized image.

To learn how to best capitalize on this momentum, here are this week’s top stories from your favorite Weiss Ratings experts.

For Investors, This Is a Once-in-a-Generation Moment

Last year, European utilities bought more uranium than they loaded into reactors — the first time that happened in more than 10 years, according to World Nuclear News. And this month, America’s first new nuclear reactor in 30 years, Vogtle Unit 3 located in Georgia, reached a critical power generation stage. Senior Analyst Sean Brodrick explains why the time to act on uranium investments is now.

An Investment Summit You Won’t Want to Miss

In a year that’s been proven unpredictable for the markets, the one constant has been how the Weiss team deploys safety-oriented strategies. This year, you can meet them in person to learn more about their methodology and tailored picks.

Hacker-Created AI Is No Stranger to This Cybersecurity Pioneer

Last week, Senior Investment Writer Karen Riccio addressed how the use and misuse of Open AI’s ChatGPT by 100 million+ people over just two months is setting the stage for a cybersecurity nightmare. This week, she discusses how it’s just a matter of time before more AI-based apps burst onto the scene, making cybercrime prevention and detection increasingly complex and absolutely necessary.

How to Fight Inflation Intimidation

Inflation has been cut by more than half since August 2021. But it’s still lingering around 4%, which is double the Fed’s target. This week, Director of Ratings and Research Gavin Magor explains how you can use the Weiss Ratings to insulate your portfolio from elevated consumer prices.

With the introduction of ChatGPT in late 2022, the AI sector took center stage … and every other sector took a back seat. And in the months that followed, the sector has been growing at an incredible rate, creating what Startup Investing Specialist Chris Graebe says is very much an arms race for AI startups looking to make their mark in the world.

Until next time,

Jordan Chussler

Managing Editor

Weiss Ratings Daily