|

| By Sean Brodrick |

Many on Wall Street are very down on natural gas. Not only did the Natural Gas Supply Association forecast that U.S. natural gas prices would decline this summer, but the U.S. nat-gas benchmark traded near a 27-year low as recently as April.

That was then. Now, things are changing. Prices are jumping.

Wall Street is slow to recognize it. And that is your opportunity right there.

Here’s the deal. Weather analysts say that the Western U.S. will see severe heat this summer.

This means everyone will run their air conditioners on “high,” which means more electricity demand.

And a lot of those power plants run on nat-gas.

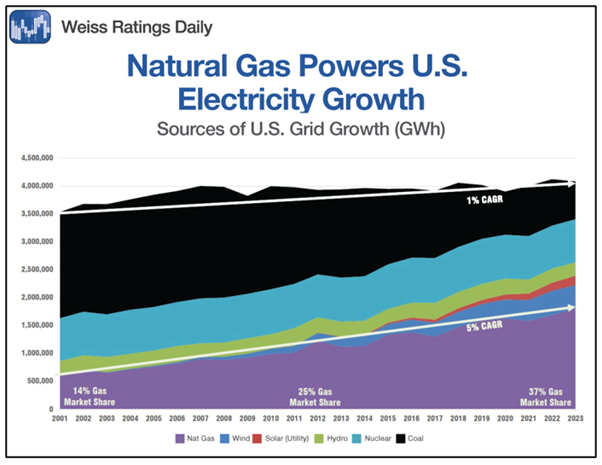

In fact, nat-gas makes up more and more of America’s electricity-generation mix all the time.

You can see that since 2001, nat-gas has risen from 14% of power generation to 37%.

That’s a compound annual growth rate of 5%.

And it’s not just the U.S. Around the world, demand for natural gas is rising at a rate of about 4% per year.

Now, add in an unplanned outage at Norway's massive Nyhamna gas processing plant, which caused European natural gas prices to spike to their highest levels of the year.

To be sure, America is producing a lot of gas. A lot of it comes as a byproduct of oil production.

The United States broke production records in 2023, producing 37 trillion cubic feet of natural gas.

However, on the consumption side, Americans consumed 89.1 billion cubic feet per day (Bcf/d) of natural gas last year.

Last year’s consumption was “the most on record,” the U.S. Energy Information Agency (EIA) said in a recent report.

America set new monthly records for natural gas consumption every month from March through November 2023.

The largest monthly increases were seen in July and August, which set monthly records, “despite cooler-than-normal temperatures than during those months in 2022,” the EIA said.

Global Consumption Is Climbing, Too

Asian imports of natural gas jumped by more than 20% in Q1 of this year compared to the same period in 2023.

While Asia can buy gas from anyone, America is the global superstore of low natural gas prices.

The U.S. exports more natural gas than anyone. We became the world’s largest liquefied natural gas (LNG) exporter in the first half of 2022.

There is competition from other parts of the world, but our cheap gas finds plenty of buyers. And it’s a good outlet for America’s rising domestic production.

Meanwhile, while last summer was cool, this is likely to be a hot one. May was the 12th month in a row that global monthly surface air temperature records were broken.

The hotter it is, the more natural gas demand goes up to power everyone’s air conditioners.

So, I expect natural gas prices to remain higher for a while. How can you play this?

Here are a couple of ideas … but only one real winner.

3 Ways to Play the Rally

There are a couple of ETFs that aim to track the price action in natural gas.

Those are the U.S. 12 Month Natural Gas Fund (UNL) and the U.S. Natural Gas Fund (UNG). Both have performed pretty poorly over the past year — as has natural gas — but rallied recently.

UNG has an expense ratio of 1.06%, which seems high. UNL has an expense ratio of 0.90%. Both have dismal Weiss Ratings.

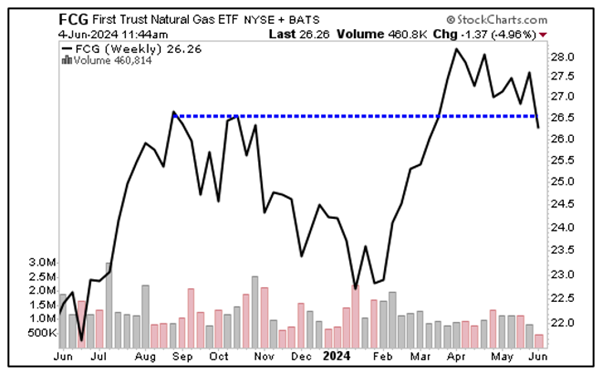

A better buy may be the First Trust Natural Gas ETF (FCG).

It has an expense ratio of 0.60% and a Weiss Rating of “C+.”

FCG tracks a basket of 50 companies that make most of their money in the natural gas value chain.

Some of these companies are also in the oil business because a lot of natural gas is a byproduct of oil production. It also has a dividend yield of 2.43%.

And in the past year, FCG is up 19.89%. Compare that to a loss of 20.72% for UNL and 22.37% for UNG over the same time frame.

Here’s a weekly chart of FCG …

You can see that FCG broke out in March and has since pulled back to consolidate, testing that former overhead resistance as support.

I believe it will bounce from here. And the next rally could carry it 50% higher.

It’s probably going to be a sweltering summer. You can’t beat the heat, but you can beat the market.

And FCG will help you do that.

All the best,

Sean

P.S. While a 2.4% dividend yield is a nice bonus for this unique natural gas opportunity, it isn’t great on its own.

Fortunately, Dr. Martin Weiss and Marija Matic are working on a presentation that will blow that piddly yield — and all others — out of the water. Sign up for free here.