Power Up with Newly Upgraded Weiss Ratings Stocks

|

| By Gavin Magor |

“Spend each day trying to be a little wiser than you were when you woke up. Day by day, and at the end of the day — if you live long enough — like most people, you will get out of life what you deserve”

— Charlie Munger

Some people like to roll the dice — heavily gamble on speculative investments — but that’s not how I invest. It’s also not how Charlie Munger viewed his investing.

Last week, the investing world lost a titan in Munger. He was Warren Buffett’s right-hand man at Berkshire Hathaway. I’ve learned a lot from him over the years, and I really appreciate what he taught the world.

In terms of how he invested, I marvel at his strategy of trying to find and buy well-run companies at reasonable prices. He emphasized buying companies you not only understand on a deep, fundamental level, but that you also truly understand how they make their cash. I strongly agree with that sentiment, and always have.

Often referred to as the “abominable no-man” for his tendencies to say no to certain investments, his investment philosophy rings extremely true to the sentiment that sometimes your best investment decisions are the ones you don’t make.

And in regard to that sentiment, the first step of understanding a stock begins and ends with our ratings system. Whether it's with a blue-chip stock I’ve owned for years and am just doing some recent research on or a micro-cap stock that I’ve never heard of, the Weiss Ratings Stock Screener should be any investor’s premier first destination.

New Dazzling Data, New “A”-Rated Stocks

At the moment, we currently rate 13,011 stocks, and they are updated daily. Today, I want to turn your attention to some of our newly upgraded “A”-rated stocks and then show you some very useful features that you can use for any stock we rate.

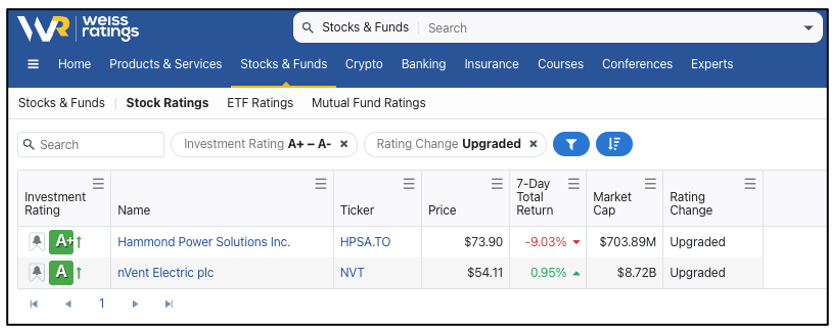

After heading to the Weiss Stock Screener and then entering two very easy filters of “Investment Rating of A+ to A-” and “Ratings Change: Recently Upgraded,” two results populated.

Coincidentally, they are both companies in the electricity business. As a reminder, you can do this for all of our rated stocks. It doesn’t just have to be “A”-rated names.

Hammond Power Solutions (HPSA.TO) is a Canadian-based manufacturer and distributor of transformers, and nVent Electric (NVT) is a London-based electric company that designs, manufactures, markets, installs and services electrical connection and protection products worldwide.

I want to focus on nVent, primarily because of the fact that it was in our “Buy”-rated territory for slightly longer, and I am more familiar with the organization.

nVent Electric’s most recent upgrade came on Nov. 27 due to an increase in its efficiency, total return and solvency indexes. And most notably, we saw its debt-to-equity ratio decline from 0.69 to 0.64. Our ratings system found this reduction of debt to be a major positive for the stock.

Over the past five years, NVT shares are up around 132%. And over the past year, shares are up 32%. Especially for an industrials stock, that is very impressive.

It has a very solid balance sheet, as well as a nice record of profitability and cash flow generation. The company appears to be doing very well on capitalizing on the growth of the electrical market.

Be sure to explore all of our “Buy”-rated names to see if they belong in your portfolio.

One thing is for certain … to me, that beautiful green “A” and “B” next to the name of a stock on the Weiss Ratings Stock Screener is akin to a strong health physical at a doctor’s office. Our database has a strong bias toward safety, and that’s why it’s so beneficial for investors.

We want safety, reliable information and a strong conceptional overview of stocks. And that’s exactly what you’re getting to a tee with the Weiss Ratings.

So, get out there, invest with confidence, invest with pride and most importantly, have the safety and stability of the Weiss Ratings at your side as a compass on your investing journey.

Cheers!

Gavin Magor