Prepare Your Portfolio for Any Election Corrections

|

| By Gavin Magor |

These days, it seems like the three guarantees of life are death, taxes and chaotic election seasons.

Personally speaking, I’ve already received a novel’s worth of text messages. It’s quite exhausting!

With so much money pouring into advertisements … and with so many people probably already decided on who they are voting for … I think we can all settle down.

But I digress. My main goal is for you to be ready for whoever wins the U.S. election in a few weeks from an investment standpoint.

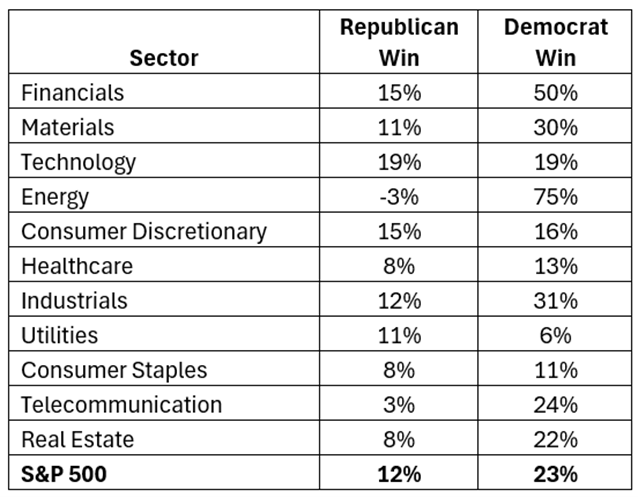

Historically, the stock market does well no matter which party wins. But there are more noticeable differences between which sectors tend to perform better.

Here’s what our research tells us how each sector performs for the first six months after each party has last won an election:

History doesn’t repeat, but it often sings to a similar tune. So, I feel like these differences among sectors are important.

Of course, as an aside, there are some important caveats with the returns following the last two elections. Energy, in particular, is almost useless here considering the pandemic lows and highs.

But the others are more reliable for guiding you this year.

Surely, do your own research. But I want to take a look at our currently top-rated stocks in the technology sector, as they tend to do well for both potential outcomes.

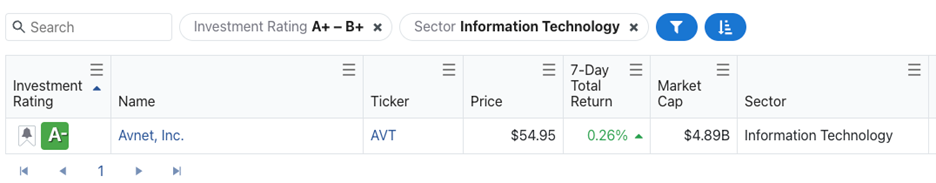

Here’s what populated for stocks within our “A” through “B+” for stocks in the technology sector:

Only one name populated. And it’s a name you may not already be familiar with, Avnet (AVT).

The stock has been successful the past couple of years, and it has been within our “Buy” range since Dec. 23, 2022.

Avnet is a global technology distributor that provides components, board-level assemblies and integrated solutions to customers in various industries.

It appears to have a strong market position and diversified revenue streams in high-growth areas. It also has had strong returns on capital. That’s how it has been able to pay for the fine cherry on top — its solid 2.27% dividend yield.

If your portfolio is in need of some tech exposure, Avnet seems to be an enticing name.

Additionally, it’s very important, and quite encouraged, to use these tools for any sector you may be looking into.

We here at Weiss Ratings take pride in trying to do all the heavy lifting when it comes to investment research.

We want your end of the bargain to be as simple as possible, just like I’ve shown you today with election sector research.

So, no matter who wins this November here in the States, you can have peace of mind knowing you’ve got some tested research behind your sails.

Cheers!

Gavin Magor

P.S. My colleague and private deal expert Chris Graebe has a time sensitive opportunity in a company that could disrupt a $1.8 trillion sector.

I believe this company could be a major opportunity for Weiss Members.

But today is the last day to accept this invitation to claim early private shares … even before angel investors can get their hands on it. I urge you to click here now.