|

| By Tony Sagami |

My father paid me slightly more than nothing for working on his farm. Heck, I made more money collecting discarded Coca-Cola (KO) bottles.

I used most of that Coke bottle money on baseball cards and Wiffle Balls. The bats would last most of the summer, but my friends and I would destroy a Wiffle Ball in a couple days.

We’d meet at a pasture owned by a friendly dairy farmer who didn’t mind a bunch of loud kids enjoying themselves. Field hazards included cow pies, but we had epic Wiffle Ball battles.

Boy, did we have fun!

This will make you feel old: The Wiffle Ball turns 69 years old this year. Yikes!

Despite its age, Wiffle Balls are more popular than ever. There’s even a World Wiffle Ball Championship held every year, featuring five-person teams playing on miniature ball fields.

Wiffle Ball was invented by David Mullany after watching his son and his friends playing a makeshift game of baseball with a plastic golf ball and broomstick. The name came from “whiff,” a slang term meaning to swing and miss. Originally named “whiffle,” Mullany had to drop the “h” because of trademark rules.

Today, a Wiffle Ball and bat cost around $15, which is considered cheap entertainment in this day and age.

In fact, entertainment is very big business.

How big, exactly?

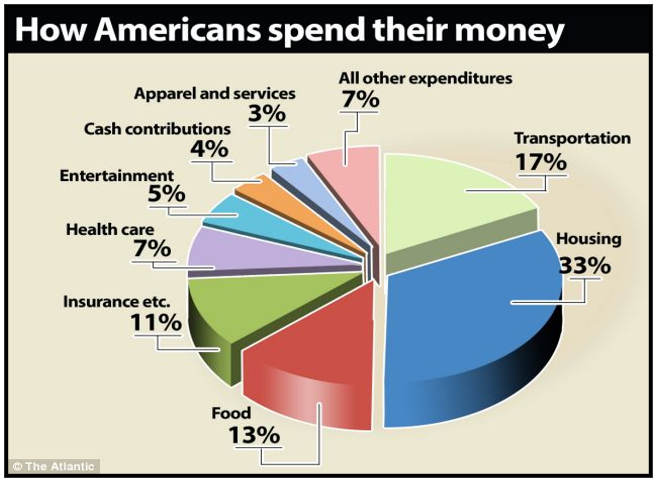

Americans spend an average of 5% of their total income on entertainment, which includes things like golf, movie tickets, airfare, camping, hotels and sporting events.

To put that into perspective, Americans spend more on leisure and entertainment than the entire GDP of Canada!

We even spend more on entertainment than we do on clothes and almost as much as healthcare. So, how can you profit from America’s entertainment obsession?

If you’re an exchange-traded-fund-type of investor, take a look at the Invesco Dynamic Leisure and Entertainment ETF (PEJ) — its top holdings include McDonald’s (MCD), Marriott International (MAR), Live Nation (LYV), Airbnb (ABNB) and Dave & Busters (PLAY).

You could also zoom in on specific types of entertainment stocks, such as:

• Golf: Callaway Gold (ELY) and Acushnet Holdings (GOLF).

• Camping: Camping World (CWH), Yeti Holdings (YETI) and Johnson Outdoors (JOUT).

• Cruising:Carnival Corporation (CCL), Norwegian Cruise Line (NCLH) and Royal Caribbean Cruise Lines (RCL).

• Boating: MarineMax (HZO), Malibu Boats (MBUU), Brunswick Corporation (BC) and Marine Products Corporation (MPX).

• Movie & Streaming Entertainment: Netflix (NFLX), Disney (DIS), Imax Corporation (IMAX) and Cinemark Holdings (CNK).

• Travel: Airbnb (ABNB), Expedia (EXPE), Marriott International (MAR) and Hilton (HLT).

• Fitness: WW International (WW), Dick's Sporting Goods (DKS), Planet Fitness (PLNT), Garmin (GRMN) and Nike (NKE).

Spending on entertainment is only going to increase. Every year, millions of baby boomers who are retiring have both the time and the means to enjoy it. More so than any previous generation of retirees.

These retiring baby boomers may not be playing Wiffle Ball or collecting baseball cards but they’re spending billions on entertaining themselves, and that means big profits for the companies that cater to them.

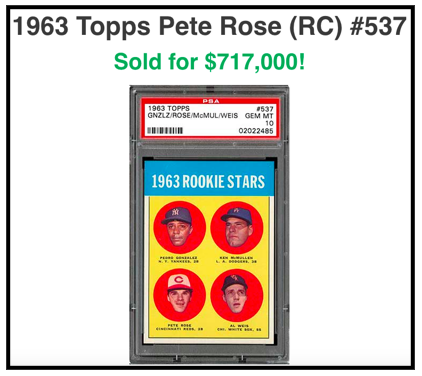

Those baseball cards of mine would be worth a pretty penny today. Sadly, my mother threw away all of mine when I went to college, including my prized Mickey Mantle and Pete Rose rookie cards.

That Pete Ross rookie card sold for $717,000. Darn you, mom!

Best wishes,

Tony

P.S. If you liked my entertainment picks in this article, consider joining my service, Disruptors and Dominators. Members are currently sitting on open gains of over 58%, 44% and 32%.