|

| By Sean Brodrick |

In all the pre-Christmas hullaballoo, something happened in early December that went unnoticed by the market.

However, it could have massive implications for America’s future energy security.

Kazakhstan’s national uranium company, Kazatomprom, reported that in the first nine months of the year, uranium sales to China rose 58% to a whopping 47.5% of ALL of Kazakhstan’s sales. Meanwhile, sales to the U.S. fell 19% to a low of just 8.7%.

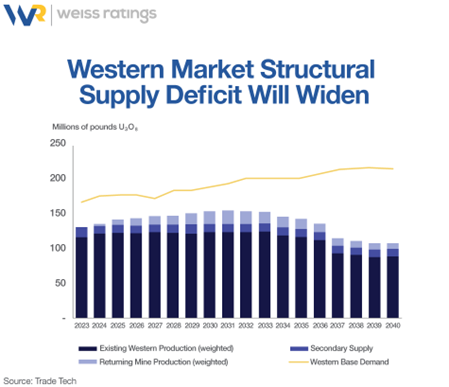

That should tell you that Western utilities' supply/demand squeeze is about to get more acute!

Indeed, we are seeing the global uranium market bifurcating. The world’s top producer, Kazakhstan, is aligning with Russia and China.

We can’t blame them — Kazakhstan is under Russia’s thumb — but it will likely worsen the coming supply squeeze.

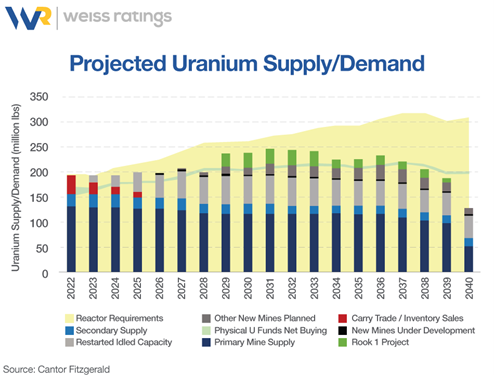

We can already see a massive supply deficit building in the uranium market.

For years, most Western utilities have underbought the uranium they need. They probably figured they could pick it up in the spot market, which was depressed for years as utilities in Japan sold uranium into the market after the terrible disaster at Fukushima.

But even with that Japanese supply, a supply/demand squeeze was building.

In 2024, the global uranium mine supply is expected to be 156 million pounds, which is not enough to meet the 176 million pounds needed by nuclear reactors. The rest will come from stockpiles.

The supply/demand gap is getting worse every year as nations around the globe rush to build nuclear power plants.

Now, though, as the West loses access to more and more uranium produced by Kazakhstan, the supply-demand gap for Western utilities will yawn even wider.

The West has plenty of uranium. The U.S. used to be the world’s top producer decades ago. However, American production was shuttered as cheap foreign uranium flooded the market.

Now, the race is on to bring more production online in North America, friendly nations like Australia and parts of Africa and South America. And those American companies that can bridge the supply/demand gap could do very well indeed.

When I recently attended the New Orleans Investment Conference, I talked to one of those companies: Uranium Energy (UEC).

UEC is already a position in the Resource Trader portfolio, and we have a nice open gain.

So, I jumped to interview Scott Melbye, UEC’s executive vice president.

In my talk with Scott, he points out that Uranium Energy spent the uranium bear market accumulating significant assets on the cheap. Now, it’s going into production. It has four producing assets!

Scott also says eight to 10 new mines must come online worldwide in the next decade to meet demand.

However, he also mentions two miners that have announced delays in their latest production. This business ain’t easy, and more delays for new projects could bring higher prices.

Scott mentioned that UEC’s all-in cost of producing uranium is $40 a pound, and it’s selling uranium into the market at $80, $90 and even $100.

That profit margin will lead to excellent cash flow as UEC’s operations ramp up.

There are plenty of ways to play the coming bull run in uranium. UEC is just one of them. And it’s a good one!

As I said, it’s in the Resource Trader portfolio, and I’d recommend it today.

If you buy something else, do plenty of research.

And always be aware that things can change. But don’t miss out on this incredible opportunity in the energy metal.

All the best,

Sean

P.S. Yesterday, we held the “Crypto All-Access Summit.” And if you’ve been following me here at Weiss Ratings Daily, you know that I believe we still have a long way to go in the current crypto bull rally.

I urge you to watch this event today. It won’t last long.