|

| By Jon Markman |

Leadership at Disney (DIS) used to hate gambling, but times have changed. In fact, on-air personalities at ESPN will soon be hawking sports betting.

However, that is not the real story.

Disney CEO Bob Iger announced last week that its ESPN sports broadcast network entered into a $2 billion online betting deal with Penn Entertainment (PENN).

Sports wagering is too big to ignore. That’s exactly why investors should buy DraftKings (DKNG) to place their own bet on the biggest development in sports in years.

Disney is no longer an innovative company. The House of Mouse has become a follower. Predictably, the results for shareholders have been poor.

Disney’s Streaming Folly

The Burbank, California-based company followed Netflix (NFLX) into media streaming. Hopes were high initially, as Iger spent 15 years acquiring media content.

He engineered, from 2005 through 2021, the buyouts of Pixar, Marvel, Lucasfilm and Twentieth Century Fox. The strategy landed film franchises such as Toy Story, Avengers, Star Wars and Avatar, among others.

In the era of endless sequels and marketing glitz, Disney execs assumed popular box office content would ultimately triumph over Netflix, the biggest company in media streaming.

Iger and his lieutenants missed the point.

The secret of digital streaming, both in music and video, is not about catalogs — it's about virality.

Netflix is winning streaming because executives at the Los Gatos, California-based company figured out long ago how to use data analytics and network effects to develop content that constantly piques public interest. A global paid subscriber count of 238 million helps.

The Queen's Gambit, Squid Game and the recent Depp vs. Heard are viral, episodic shows with modest budgets about chess, a dystopian game show and the Johnny Depp and Amber Heard defamation trial. The storytelling is tailored to subscriber interests based on what shows are being consumed on the vast digital network. Netflix is innovating.

Disney is expected to lose $800 million on its streaming business next quarter. And Forbes noted last week that Iger's film studio is set to lose a cool $1 billion in 2023 on three mega-budget flops: Ant-man and the Wasp: Quantumania, The Little Mermaid and Indiana Jones and the Dial of Destiny.

Now Disney is following DraftKings into sports betting.

Disney’s $220 Billion Mistake

The deal with Penn Gaming will see the smaller company pay Disney $1.5 billion over 10 years. Disney will also get a $500 million option to purchase Penn shares, according to a filing at the Securities and Exchange Commission.

Ironically, Iger spent the past decade denigrating sports betting. And he said in 2019 that gambling would tarnish Disney's family values branding. He also pulled out of a 2015 deal between DraftKings and ESPN. That deal, valued at $250 million, would have put Disney on the ground floor of sports betting.

Executives at DraftKings didn't bemoan the lost ESPN agreement.

DraftKings CEO Jason Robins hunkered down and continued to build the business through partnerships. Robins set up Daily Fantasy Sports arrangements with professional sports leagues. DFS is a form of granular betting based on fantasy sports leagues.

The DraftKings innovation is paying out daily. Each of the NFL, MLB, NHL, NBA, PGA Tour, UFC and NASCAR franchises have become DraftKings DFS partners. This is a huge competitive advantage over newcomers to sports betting.

DraftKings Sportsbook is currently available on mobile and retail locations in 19 U.S states and in Ontario, Canada. DraftKings’ DFS is available in six countries internationally.

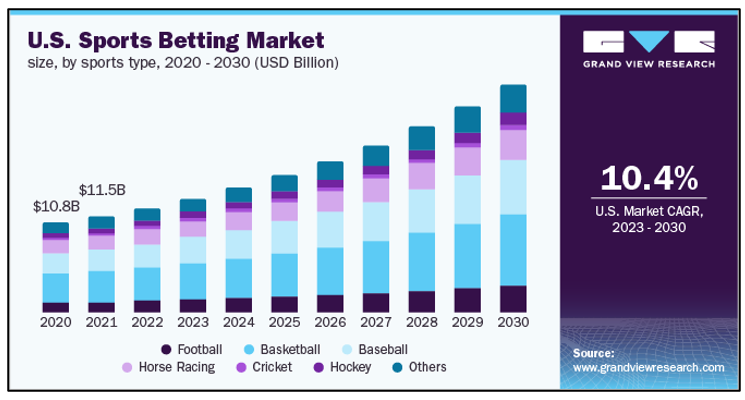

Americans have spent $220 billion on sports betting since 2018. Worldwide film box office receipts in 2022 amounted to only $26 billion.

Sports betting is too big to ignore. And the biggest players — like DraftKings — are using data analytics innovations and instant payouts to make it impossible to look away from.

ESPN on-air personalities are not going to disrupt DraftKings.

At a share price of $27, DraftKings stock trades at 4.2 times sales. The company is not currently profitable as Robins continues to build out the foundational elements of the network.

This investment story is eerily similar to Netflix. DraftKings is spending to innovate, building a business around digital data rather than belatedly trying to squeeze competition like Disney.

The stock could easily trade toward $45 during the next 18 months, a gain of 66% from current levels.

For adventurous investors, this is a way to bet on the larger sports betting world.

That’s all for today. I’ll be back with more soon.

All the best,

Jon D. Markman

P.S. I’ve already shared this play with my Weiss Technology Portfolio readers, who have 24% open gains on it so far. Recently, I’ve discovered something much bigger. Click here to check out the latest revolutionary trend I can only share in one place.