|

| By Sean Brodrick |

Gold suffered a spring slump; now it’s having a sizzling hot summer. And I have an idea how you can play it.

So, why did gold slump? Why is it recovering now? Well, you can blame the Fed.

That collection of blind mice in gray suits kept raising the benchmark interest rate higher when many in the markets thought they should back off.

Anticipation of higher and higher rates powered up the U.S. dollar. Since gold is priced in dollars, that sent the yellow metal sliding lower from early May to the end of June.

But now? The U.S. dollar is currently falling through important support like a rhino through thin ice. Take a look …

Click here to see full-sized image.

The dollar is tumbling because inflation is cooling fast. U.S. annual inflation slowed to 3% last month, according to the latest Consumer Price Index.

That’s a sharp cooldown from June of last year, when surging energy costs helped inflation spike to 9.1%. It’s also closer to the Fed’s inflation target of 2%.

More recent data also points to a cooling economy, which reinforces the idea that inflation is coming down.

Industrial production fell 0.5% in June, capacity utilization is running at 78.9%, its lowest reading since December, and inflation-adjusted retail sales fell 2.5% in June. That’s down eight months in a row, and the longest down streak since 2009.

So, while many have baked in a Fed rate hike at the July 24-25 meeting, the market is also thinking that’s the last one, despite various Fed talking heads hinting at a couple more hikes.

Some traders are even starting to price in rate CUTS next year. That view on rate hikes chips away at support for the greenback.

Since the dollar and gold sit at opposite ends of the seesaw of pain, as one goes down, the other usually goes up.

In my thinking, the dollar’s action is the biggest driver of gold, period. But there’s one more I want to mention.

What Do Central Banks Know?

Last year, central banks added a whopping 1,136 tonnes of gold worth some $70 billion to their stockpiles. It turns out that was just a start.

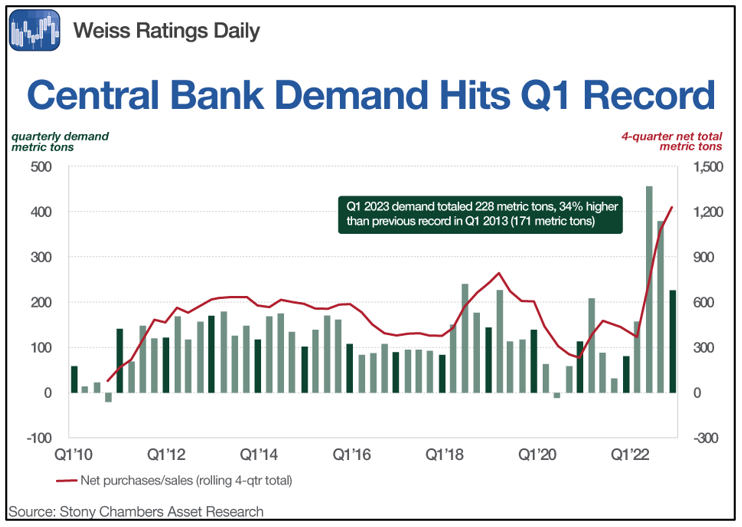

Central banks are still accumulating gold at a rate so fast and furious that they should star in a film with Vin Diesel. Sure, that would be the worst “Fast & Furious” movie ever. But check out this chart …

Click here to see full-sized image.

The green bars show quarterly accumulation of gold by central banks. Q1 data for this year recently came in, and it was the highest Q1 ever — up 34% year over year to 228 metric tons. That’s a new record.

This pushed the Q4 net total accumulation — the red line on the chart — to a new high.

Why are central banks doing this?

Some point to the fact that Russia announced there will be a new gold standard currency for the BRICs countries: Brazil, Russia, India, China and South Africa.

I’ll believe it when I see it. Doing business with Putin is like dealing with the Joker. The man’s absolutely untrustworthy.

I think it’s more likely that the BRICs countries saw how Western powers punished Russia for its invasion of Ukraine, using the U.S. dollar as a weapon.

I think they want insurance against that, in case next time, they’re the ones that tick off Uncle Sam.

In any case, central banks are scooping up gold hand over fist. We might be smart to follow their lead.

How to Play This

My target on gold this cycle is $2,931. That’s quite a move from recent prices. It’s based on cycle work. Here’s a chart …

Click here to see full-sized image.

This seems to be working out. Sure, the Fed could delay it, but it probably won’t be denied.

The easiest way to play a move in gold is the SPDR Gold Shares (GLD). It’s an ETF that holds physical gold, so it tracks the price of the metal pretty well. It has a C+ rating from Weiss Ratings, and an expense ratio of 0.40%.

Let’s look at a daily chart of the GLD …

Click here to see full-sized image.

You can see that the GLD (and gold) pushed above one level of overhead resistance, and now is testing another.

It could take some time to work through this resistance, but once it does, a move to the May high over 191 seems likely. That’s overhead resistance that has held gold (and GLD) in check since 2020. A push through that should send gold off to the races.

Could that happen? As I said, traders are starting to price in not just a pause to interest rate hikes, but CUTS starting next year.

That could kneecap the dollar, sending the greenback much lower. And the seesaw of pain would send gold much higher.

So, gold is looking better than it has in months. Currency flows and central bank actions are very supportive. It’s going to be a hot summer. You might as well add some sizzle to your portfolio with gold.

All the best,

Sean

P.S. I’ll have more to say about gold at the 2023 Weiss Investment Summit! Join us in beautiful Boca Raton, Florida, Sept. 10–12, for an unforgettable experience with our experts and incredible guest speakers. And I’ll give at least one pick at the summit that I’m not giving anywhere else.

For more information, call 855-278-9191 (or +1 561-409-8591 for international) to speak with a member of our VIP Executive Accounts Team and claim your discounted “Early Bird” ticket anytime between 8:30 a.m. and 5:30 p.m. Eastern Monday — Friday.