Profit from the ‘Bicycle Engine’ Behind a $120 Billion Sector

|

| By Michael A. Robinson |

When we spoke last week, I noted how President Trump had convinced NATO to more than double its defense spending.

That is one of the biggest changes to rock global defense in decades.

Turns out, the White House has another ace up its sleeve.

This time, Trump is stepping up his commitment to defense-centric robotic technology.

Don't scoff.

This tech has already changed the nature of modern warfare.

Indeed, we've seen it play out daily in the Ukraine-Russian conflict.

For investors, there are two pieces of good news.

- First, this is a sector on pace to hit $120 billion in less than eight years.

- And second, I've found a small-cap pure play that is a great way to target this unstoppable trend.

Did I mention the firm is on pace to double its earnings in as little as 15 months?

Let me show you …

The Game-Changing Moment

Ukraine just proved much of what the Pentagon thought it knew about modern defense was wrong.

In early June, Ukraine's Operation Spiderweb launched a highly coordinated stealth attack on Russian bomber bases deep inside Russia.

Media accounts suggest the attack wiped out nearly half of Russia's bomber fleet.

Here's the kicker: They did it with simple, cheap drones that slipped right under Russia's most advanced air defense systems.

Ukraine showed that basic drones could penetrate just about any defensive umbrella without being seen on radar.

That's why U.S. Secretary of Defense Pete Hegseth recently announced a massive shift in military buying.

From now on, drones will be considered as vital for troops as ammo.

This isn't just a policy tweak. It's a completely new mindset about how the U.S. will wage war.

And just think, it all began nearly 50 years ago with a contraption that seemed to be put together with duct tape and bubble gum.

More on that in a moment …

The Mars Advantage

The company poised to profit from the DoD’s new paradigm is AeroVironment (AVAV).

Founded in 1971, the firm ranks as the world leader in small, tactical defense drones.

Want proof of their technical know-how?

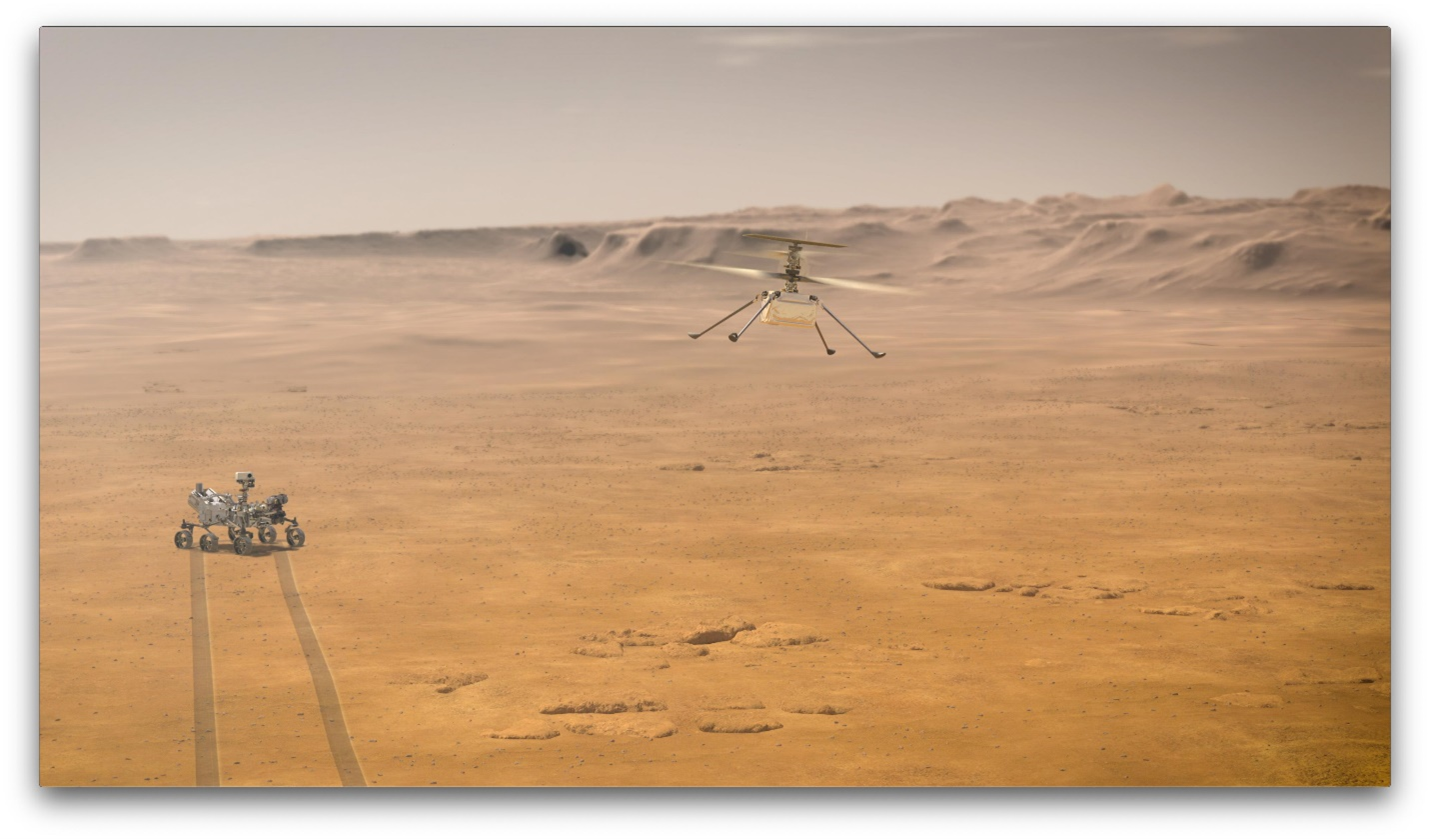

AVAV built Ingenuity, the helicopter exploring Mars. It was expected to complete five flights over 30 days.

Instead, it achieved 72 flights over three years … on a planet 140 million miles from Earth.

That's the kind of extra power and performance that wins wars — and makes money.

AVAV has cemented its place as the Pentagon's go-to drone supplier, serving more than 55 U.S. allies worldwide.

But they're not resting on past success.

In May, AVAV completed a $4.1 billion merger with AI and space tech firm BlueHalo.

The move adds abilities in electronic warfare, signals intelligence, laser communications and other cutting-edge sectors.

The Gossamer Albatross Connection

And just think, we have Paul MacCready to thank for it all.

He built the Gossamer Albatross.

That’s the human-powered flying machine that crossed the English Channel in 1979 that I noted a moment ago.

The pilot literally used bicycle-style pedals connected through a chain and gears.

But in this case, they weren't powering wheels. They literally turned a propeller to provide thrust — just like an airplane engine does.

For over two hours, cyclist Bryan Allen pedaled at 80-90 rpm to bring the fragile winged aircraft airborne across 22 miles of open sea.

MacCready founded that company — AeroVironment — on that same principle: Eliminate complexity to maximize utility.

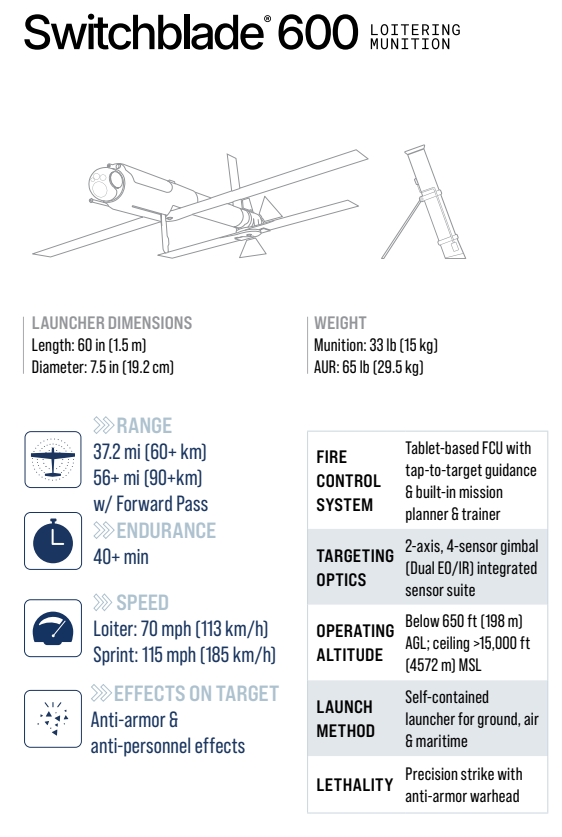

Today, that company's Switchblade drones embody that exact philosophy.

Troops have loved them since the first Gulf War, when the hand-launched drones were intentionally loud to warn potential ambushers that American forces were incoming.

Now, Switchblades are silent, stealthy and packed with AI systems that track targets even when they lose visual contact.

They fly themselves, letting operators focus on picking targets rather than controlling flight.

They’re easy to teach, easy to ship, easy to use — and making a huge dent in Russia's war effort.

From Complex to Consumable

Here's what this means for the drone industry — and your portfolio.

From now on, drones will be treated as "consumables" like ammo and hand grenades.

Squad leaders won't need to run requests up the chain of command anymore.

They'll order drones just like any other essential equipment.

This shifts everything about how the military buys these systems.

No more complex, over-engineered solutions that take years to deploy.

Now they want simple, reliable and deadly effective.

Make no mistake. This is a company uniquely set up to profit from it all.

Consider that at the end of its most recent fiscal year, it had $1.2 billion in bookings — a record figure that demonstrates surging demand for their drone technology.

It's a very impressive number for a company with a market cap of just $13 billion.

No wonder that profits jumped nearly fourfold to 274% in the most recent quarter.

Over the last three years, the firm has averaged per-share profit growth of 60%.

But let's just stick with the 60% to be conservative.

We'd still see earnings double in less than 15 months. For that matter, half that rate would still be a big win for us.

And as I often say, when earnings double, share prices often come along for the ride.

So, AVAV isn't just helping rewrite the rules of modern drone tech. It's an investment that will bolster your portfolio for years to come.

Best,

Michael A. Robinson

P.S. AVAV is a perfect example of how a company dating back several decades is now using AI to vastly improve performance.

Well, Weiss Ratings is another.

In fact, Dr. Martin Weiss said of our new AI trading system: “This breakthrough is the crowning achievement of my 54-year career and the 100-year legacy of my father’s life work.”

And early next week, he will share exactly how it works. Though, you need to grab your spot to hear about it. Here’s how.