|

| By Michael A. Robinson |

Washington could do a whole lot better if it subscribed to Silicon Valley’s mantra that “data is the new currency.”

No doubt, you know that tech firms — from social media to marketing to fintech — gather tons of data every single day.

That data they collect on us now has a dollar value.

Grand View Research says all that intel will have a market value of $862 billion by 2030.

Unfortunately, one of the key federal agencies has been running what I believe is the data equivalent of counterfeit currency.

Let me explain …

Counterfeit Currency?!

You see, data that’s gathered and reported on by our nation’s top agencies is often wrong.

And this information is what many in the media and on Wall Street use to assess the health of our nation’s economy and even make major investment decisions.

So, maybe it’s time to turn those duties over to a tech leader with deep expertise in data.

Let me show why that’s a big money idea.

And why one firm is on pace to double profits in three years …

Garbage In, Garbage Out

Just to be clear. Those federal mistakes are no small matter.

Consider that the media — from CNBC to The Wall Street Journal — runs big stories every time an agency like the Bureau of Labor Statistics (BLS) issues a new report on jobless numbers.

Those early BLS estimates are almost always wrong … eight out of the past 12 monthly reports were revised … and often by a mile.

The problem came to light in a big way earlier this month.

That’s when President Trump fired (now former) BLS Commissioner Erika McEntarfer.

He said she had rigged jobs figures to make Republicans and himself look bad.

And while there’s no evidence that she mishandled the report, there’s an important point to note:

Agencies like the BLS do publish wrong numbers. In fact, it happens far more than it should.

Alarmingly, the stats from this agency are almost always wrong.

It must be revised and adjusted time and again.

I’d argue that the whole data collection system at the federal level is antiquated.

Irony abounds. We’ve got AI and high-performance computing all around us.

It can churn out data with pinpoint accuracy at blinding speeds.

An Outsourcing Solution

Yet, when it comes to assessing the real health of the $70 trillion economy, we rely on data from the BLS and other agencies that is often in need of heavy revisions.

To me, the solution is obvious.

We should at least think about turning the job over to a firm with deep expertise in AI.

After all, accuracy is vital, especially when we’re talking about information that guides decisions in Washington, as well as Wall Street and Main Street.

Imagine if every time I wrote to you about a stock or a profit claim, I had to send revised numbers a few days later.

I’m pretty sure I’d be looking for a new gig.

If that’s the path, we need to find a company that specializes in AI and data.

The thing is, I’ve found one …

And not only is it the right firm for the job, but it’s also enjoying eye-popping growth.

It’s a company you’re undoubtedly familiar with …

From PCs to AI Leader

Microsoft (MSFT) ranks as one of the world’s largest and most influential tech companies.

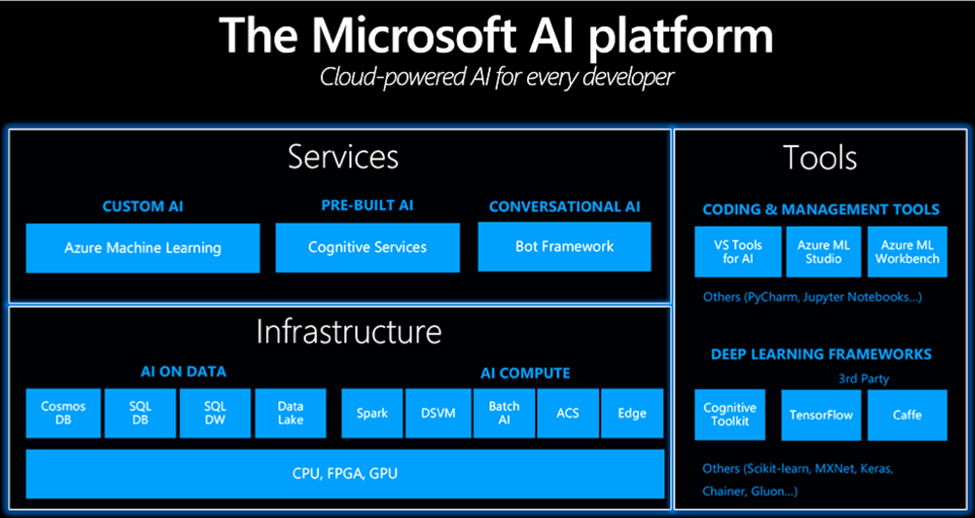

It makes a range of software, hardware and services.

Microsoft is the second-largest firm in the world by market cap (trailing only Nvidia).

It’s also among the top 20 in terms of yearly sales.

Of course, it’s known for core products like its Windows operating system, Word, Excel and Outlook, not to mention its Azure cloud computing platform.

And it’s also a major player in the AI Supercycle that we talk about a lot here.

Just days ago, Microsoft CEO Satya Nadella wrote to his employees with an important declaration.

The company’s decades-old identity as a software manufacturer was no longer enough.

It needed to transform into what Nadella calls an “intelligence engine.”

He declared that Microsoft’s future lies not in building software for specific tasks, but in creating AI systems that let anyone build their own intelligent tools and solutions.

It was an announcement that demonstrated just how much Microsoft has invested in AI.

For example …

The company has a strong partnership with OpenAI, an AI research and development startup.

It’s embedded AI across nearly all its products.

And it’s investing a whopping $80 billion into AI-enabled data centers for fiscal year 2025, to power AI model training.

Editorial Director Dawn Pennington wrote about this just last week.

This is important to note. Because remember, I see Microsoft as a data expert that could solve the problem of inaccurate reporting when it comes to vital economic data.

Let’s take a closer look at how Microsoft became such a data-harvesting machine.

Wow — That’s a Lot of Data!

Microsoft owns platforms where vast amounts of data are generated every day.

For example, its Office 365 products capture enterprise productivity data — emails, messages, spreadsheets, etc.

And its LinkedIn business is a gold mine of hiring and industry network data.

Meanwhile, its GitHub platform helps developers store and manage software projects.

It also hosts one of the largest developer code repositories in the world.

And then there’s Azure.

Through this cloud unit, the firm provides one of the world’s top hyperscale cloud platforms.

It hosts everything from corporate databases to Big Data.

Not only does Microsoft gather and store data, but it also analyzes it.

That’s thanks to AI, which enables real-time data analysis and AI model training.

Its AI can also interpret data faster, more accurately and more efficiently than the competition.

Sounds like the ideal solution for all this government data, doesn’t it?

I have no idea if Washington would ever take my advice and turn to Microsoft for help with its data needs.

But I’m certain there’s plenty of upside ahead.

Over the past three years, its per-share profit has grown by 24%.

At that pace, profits would double in just about three years.

So, even if Trump doesn’t hire Microsoft to handle the nation’s data need, you can count on the Big Tech leader for the long haul.

Best,

Michael A. Robinson

P.S. But it shouldn’t come as a surprise that Microsoft isn’t actually the best way to play the AI Supercycle.

Instead, it’s the lesser-known ones with the most room to run during AI’s “second wind.”

If you watch this to the end, you’ll get the name and ticker symbol of three such AI stocks set to surge to close out this year.