|

| By Gavin Magor |

It turns out that it’s not just the rich getting richer and the poor getting poorer. Everyone seems to be a little worse off this year.

Since the end of 2022, after growing at a record pace following the pandemic and monetary relief packages, wealth expansion has reversed direction.

By December of last year, total global household wealth dropped by 2.4%, or $11.3 trillion, to $454.4 trillion.

The culprits: worldwide inflation, rising interest rates and local currency depreciation against the U.S. dollar. Yes, the greenback has that much power.

The three-pronged combination has turned the expansion of global wealth upside down — an almost century-long uninterrupted cycle of growth. The last time we saw such a decline came during the Financial Crisis in 2008.

The dollar holds that much power because of its unique status as the world's primary reserve currency. The perceived value stems from the economic might of the U.S. (despite the recent Fitch credit downgrade, which I still view as unwarranted), its stable political environment (relatively speaking, of course) and the widespread use of the dollar in international trade and finance.

Today, the dollar is in the middle of a rally that could extend for years, bolstered by a strong macroeconomic picture and, surprisingly, reignited by the recent downgrade of the U.S.’ credit by Fitch Ratings.

Why? You ask. Well, the answer is similar to how the S&P’s downgrade of U.S. credit in 2011 sparked a long run of gains for the dollar.

First, U.S. investors dumped their weakest assets by buying more liquid Treasurys. Then, foreign countries, which fared even worse than the U.S., drove even more investors to U.S. Treasuries.

On top of that, from foreign top central banks to pension funds, all types of entities hold trillions of U.S. government debt because the dollar is still seen as a safe haven, and that's unlikely to change simply because of Fitch's downgrade.

China’s yuan or Japan’s yen certainly aren’t going to take the dollar’s place. The yuan just fell to its weakest level since November after a series of disappointing economic figures added to concern about the nation's anemic growth. The currency has now tumbled about 5% this year, the worst performer in Asia after the yen.

Of course, I’d probably have my English accent stripped if I didn’t address the British pound sterling, the official currency of the United Kingdom. It’s the best-performing major currency against the dollar in 2023, up 6.6% as price rises in Britain prove stickier than inflation elsewhere, prompting investors to bet that the Bank of England will raise rates higher than other central banks.

So, those folks who believe the Fed is done raising rates, might keep an eye on what’s happening in the U.K. Strong economic data against a backdrop of sticky inflation equals a strong currency.

It certainly seems as though all the stars are aligned for continued strength in the U.S. Dollar. Is that good or bad? Well, it depends …

At first, you’d think that news would lift investors’ spirits and give people reason to jump for joy.

I mean, if you bought imported goods in the U.S. or traveled abroad — staying in luxury hotels, eating international cuisine or purchasing souvenirs to bring back to the folks at home — you’re getting the biggest bang for your buck in about 20 years.

On the other hand, many companies that rely on a large percentage of revenues from overseas sales are bracing for a painful period. Dollar strength is making their products more expensive for holders of other currencies.

We saw a similar strengthening in the dollar in 2015. Janet Yellen, now the Treasury secretary, was the Federal Reserve chair that year.

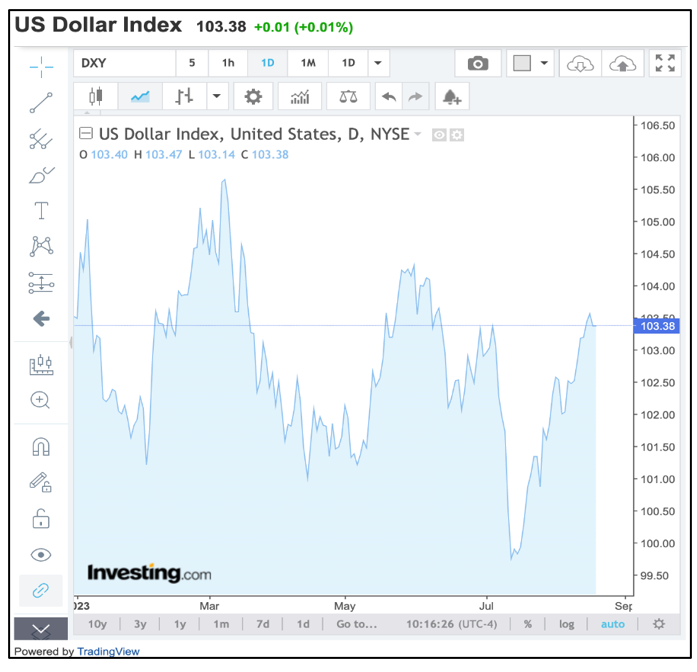

During that time, the U.S. Dollar Index (DXY) rose by 14.2%. DXY is widely used to gauge the greenback's performance against the euro, the Japanese yen, the British pound, the Canadian dollar, the Swedish krona and the Swiss franc.

In the first three months of 2015, companies in North America lost nearly $29 billion because of currency swings, according to research.

After weakening during the first year of the pandemic, the dollar strengthened in 2021. It gained even more steam after Russia invaded Ukraine in February. In just three months, the dollar appreciated by 7%, 5.6% and 10.8% against the pound, the euro and the yen, respectively.

Today, about 40% of sales from S&P 500 companies come from overseas, according to S&P Dow Jones Indices. Many industries in which America leads, such as technology, energy and heavy equipment, get roughly half or more of their total sales beyond our borders. The tech sector specifically is greater than 50%.

DXY is about flat for the year. But with much uncertainty left for the second half of 2023 and up a little over 2% in one month, it’ll be interesting to see if the trend upward continues.

It’ll be even more interesting to see if some of the big multinational companies that rely on foreign sales, specifically in technology, report weaker earnings moving forward.

One Way to Play Uncle Sam’s Strength

One way to look to profit from this trend is with the Invesco DB US Dollar Index Bullish Fund (UUP).

This exchange-traded fund is crafted to track the level of the U.S. dollar index and is essentially a pure currency play, without the hassles of trading in the forex market.

The fund has an expense ratio of 0.75%, $524 million in assets and is up around 14% over the past two years. We currently rate it a as a “Hold” with a “C” rating.

In an investing sense, always try to row with the tide. When the dollar’s strong, use it to your advantage.

Cheers!

Gavin Magor

P.S. For more specific ideas on how to play this strong dollar environment, be sure to check out my All-Weather Portfolio.