|

| By Sean Brodrick |

Crude oil slipped into the doldrums for months, but prices finally seem to be breaking out to the upside.

There are a bunch of undervalued stocks and ETFs in the oil space, the best of which pay fat and growing dividends. Now’s your chance to get on board for what could be a great rally.

So, after snoozing for most of the summer, why is oil moving higher? Let’s take a look ...

Production Cuts

Russia finally appears to be fulfilling its pledge to cut supply to international markets. Russia's seaborne crude flows plunged to a six-month low in the latest four-week period, down 780,000 barrels per day from their peak in May.

Russia is part of OPEC+, the original Organization of Petroleum Exporting Countries (led by Saudi Arabia) and an expanded alliance of global oil producers led by Russia.

OPEC+ already cut oil production by 2 million bpd in October, then added another cut of 1.6 million bpd in April. Then in June, OPEC+ extended those cuts into next year. On top of that, Saudi Arabia added its own additional 1 million bpd production cut starting in July.

One of the problems was some members, particularly Russia, were cheating. But this latest news shows Russia is finally falling into line. And that means global supply is tightening even though the global economy is picking up steam.

Global Boom

Here in the U.S., there were widespread calls for recession. Those fears, though, got tossed in the trash as America reindustrializes, and spending from the $1.2 trillion Infrastructure Investment and Jobs Act flows through the economy.

The number of manufacturing jobs has climbed by 800,000. Overall, more than 13 million new jobs have been created, as America currently has the lowest peacetime unemployment rate since World War II. People with jobs tend to drive more, and that’s ramping up oil demand.

And it’s not just the U.S. The International Monetary Fund raised its forecast for global growth this year to 3%, from 2.8% in its April projection. While growth is slow, it seems to have bottomed, and many forecasters have canceled their previous calls for an imminent global recession.

A bottom in the global economy means oil demand is likely going higher. In fact, many on Wall Street are looking for tight oil supply/demand to send prices soaring in the second half of this year.

On CNBC, Daan Struyven of Goldman Sachs (GS) said, “We expect pretty sizable deficits in the second half, with deficits of almost 2 million barrels per day in the third quarter as demand reaches an all-time high.”

A shortage of supply is usually resolved with higher prices.

No Cushion for U.S. Consumers

One of the things weighing on U.S. oil prices so far this year is that U.S. oil production is at an all-time high. Over the past year, America’s oil field production has jumped to 12.7 million bpd.

But Goldman Sachs, among others, thinks that U.S. oil production is near a peak. And sure enough, Goldman cites data from Baker Hughes (BKR) showing that the U.S. oil rig count recently hit its lowest level in 16 months, down 15% from its late 2022 peak.

Oil is a non-renewable resource. If companies aren’t exploring and developing new wells, production trends lower.

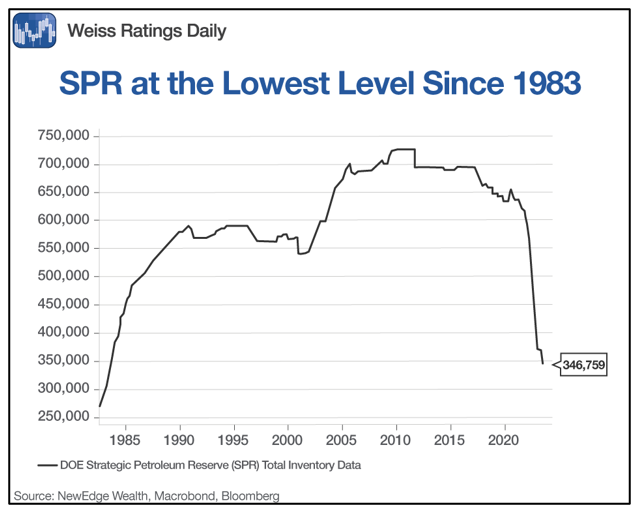

And then there’s the U.S. Strategic Petroleum Reserve. That’s nearly tapped out!

At its high point in 2010, the SPR stored 727 million barrels of oil. Former President Trump took some oil out of it every year during his administration, but the real sell-off started during the Biden administration, related to the Ukraine-Russia war. A whopping 557 barrels were sold out of the SPR, bringing it down to 346.75 million barrels. That’s the lowest level since 1983.

The U.S. uses on average 20 million barrels per day. So, that means we have just 17 days of supply in the SPR right now.

What that means is the U.S. no longer has the cushion in the SPR that it used to rely on to smooth out price swings. When the next crisis hits — and there’s always a crisis eventually — oil prices could go ballistic.

And THAT’s why you should be long oil and oil producing companies right now.

Many oil industry stocks pay excellent dividends. And if you prefer ETFs, the Energy Select Sector SPDR Fund (XLE) sports a dividend yield of 3.95%! This fund is already breaking out, as you can see from this chart …

Click here to see full-sized image.

The XLE broke through one layer of overhead resistance and seems on its way to test the next. With an expanding global economy and tight global supplies to power it along, it could head much higher.

And if there’s some kind of oil shock — with no SPR to cushion the blow — we could see a blastoff.

Just something to keep in mind as you make investing and trading plans for the second half of the year.

All the best,

Sean

P.S. Dividend-paying energy stocks are just one of the things we profit from in my monthly newsletter, Wealth Megatrends. We’re also riding the reindustrialization of America, which is powering up select stocks left and right. There are plenty of opportunities available if you know where to look. Check it out here.