|

| By Sean Brodrick |

Electric vehicle sales are booming. And thanks to the recent market pullback, you’ve got an opportunity to climb aboard before things shift into higher gear.

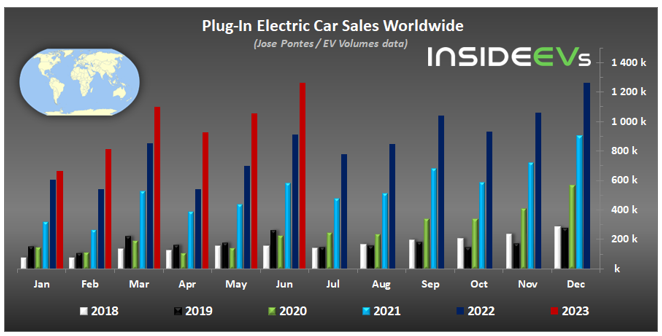

Not that sales aren’t zooming along already. According to the latest data from InsideEVs.com, 1,260,470 new passenger plug-in EVs were registered globally in June.

That's an increase of 38% year over year. Putting it another way, 19% of the total global car market — nearly 1 in 5 new cars — is now an EV.

The red bars on this chart show 2023 EV sales. You can see they tower over sales in previous years.

The best-selling EV is the Tesla (TSLA) Model Y. But other automakers are revving their engines, ready to see if they can wrest first place from Elon Musk’s car company.

For example, General Motors (GM) — which has the largest share of the U.S. car market — has committed to selling only “zero emission” vehicles by 2035.

And U.S. carmakers are bringing good ol’ American innovation to the industry.

Ford (F) just filed a new patent in July to charge EVs while driving. In this patent filing, Ford discusses embedding charging coils in a road surface, allowing cars to charge wirelessly as they zoom along.

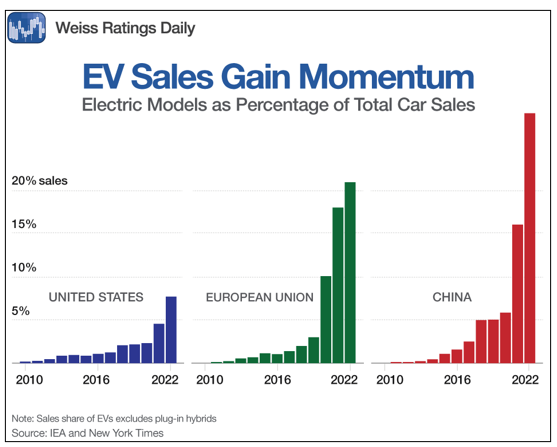

Now, detractors will point out that one-fifth of auto sales is still small. And they’re right. But the way sales are accelerating should grab some eyeballs. Not only in the U.S., but all around the world.

From 2020 to 2022, EV market share rallied from 2% to 7% — more than a triple. In the European Union, market share for EVs jumped from 10% to 21%. And in China, which has more than half of all EVs on the road, the market share soared from 5% in 2020 to 28% in 2022.

We won’t get full-year 2023 numbers until sometime next year. But It’s probably going to be another record-breaker. Let’s look at some fun facts:

- More than 2.3 million electric cars were sold in Q1, about 25% more than in the same period last year. That’s according to data from the International Energy Agency.

- For the full year, the IEA expects 14 million EVs will be sold, an increase of 35% year over year.

- Looking forward, the IEA has raised its forecast for EVs to take 35% of the car market by 2030, up from less than 25% in its previous forecast.

- Due to this, the IEA expects fuel demand for vehicles to peak in 2025, with the amount of oil displaced by EVs to be more than 5 million barrels a day in 2030.

Again, detractors will point out that the world uses more than 97 million barrels of oil per day. But this trend is just getting started. And it should be reassuring to oil and gas investors that demand for those products aren’t going away anytime soon.

To be sure, you can’t have EVs without chargers. And seven carmakers —General Motors, Stellantis (STLA), Honda Motor (HMC), Mercedes-Benz (MBGYY),BMW, Hyundai and Kia (KRX: 000270) — are spending $1 billion in a joint venture to build 30,000 charging stations on major highways and other locations in the U.S. and Canada.

What’s more, as part of the bipartisan infrastructure law pushed by President Biden, $7.5 billion will be invested in EV charging.

Along with that, there will be $10 billion invested in clean transportation, and over $7 billion in EV battery components. Heck, they’re even investing $5 billion in electric school buses and $10 billion in electric mail trucks.

To me, that sounds like more vroom vroom for the EV boom. And for your portfolio …

How to Ride the Trend for Profit

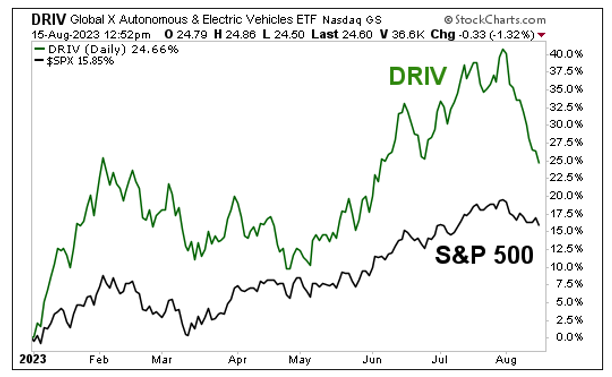

An easy way to ride this trend is to buy one of the popular EV exchange-traded funds. There are a bunch of them, and they have been on a wild ride this year, with a steep pullback in August as the broad market sells off.

Here’s a list, along with their year-to-date performance:

Global X Autonomous & Electric Vehicles ETF (DRIV) — up 23.6%.

iShares Self-Driving EV and Tech ETF (IDRV) — up 16.3%.

SPDR S&P Kensho Smart Mobility ETF (HAIL) —12.5%.

KraneShares Electric Vehicles and Future Mobility Index ETF (KARS) —up 5.5%.

Of these, the one with the most volume is DRIV. In fact, it’s in my personal portfolio for that very reason. But it also has the best performance for the year, even after the big pullback (so far) in August …

Click here to see full-sized image.

You can see that DRIV is up 23.6% so far this year, much better than the 15.88% in the S&P 500. Corrections end eventually, and when it does, I expect DRIV to vroom vroom again.

DRIV has an expense ratio of 0.68%, and big names like Nvidia (NVDA) and Teslaare among its top holdings.

So, the EV megatrend is rolling along. We’ve seen a big dip as the broad market pulls back. But that won’t last forever, and a smart investor would use that as an opportunity … an opportunity to get on board before EV shares hit the accelerator again.

That’s all for today. I’ll be back with more real soon.

All the best,

Sean

P.S. While hot trends like EVs continue to drive the news, there’s another more insidious problem facing investors and savers alike that’s not covered. Click here for our soon-to-disappear presentation on “America’s Great Income Emergency.”