Put the Company Taking Out Oracle on Your Radar

|

| By Jon Markman |

Chief financial officers at Fortune 500 firms are ramping up spending, according to the latest financial reports from cloud computing companies.

Last week, executives at International Business Machines (IBM), Microsoft (MSFT), Amazon.com (AMZN) and Alphabet (GOOGL) reported that spending for cloud computing is accelerating as CFOs build out digital strategies.

But how that money is being spent is the real opportunity. I have a company for you today that is already winning this game. But first …

It’s no secret that the corporate world is in the middle of a digital transformation.

This process began with CFOs simply trying to digitize more of their paper records. Paper is expensive to store, secure and ultimately destroy.

Digital files can be easily moved and manipulated. These files can also create a permanent record that can be combined with software to draw inferences.

The public cloud is the logical extension of this process.

Corporations all over the world have been dutifully moving their digital workloads to the public cloud, where pay-as-you-go billing provides flexibility for storage needs, data analytics and computing power. Running programs against big datasets can be compute-hungry. Then …

ChatGPT Changed Everything

The popular chatbot put generative AI into the conversation about enterprise tech spending.

It’s not so much that corporations needed bespoke chatbots, although many are going that route. The larger story was about data, specifically the kind that would be required to train future AI models.

OpenAI, the parent of ChatGPT, was able to build the chatbot by using vast amounts of unstructured data to train large language models. These LLMs are the foundation of generative AI platforms.

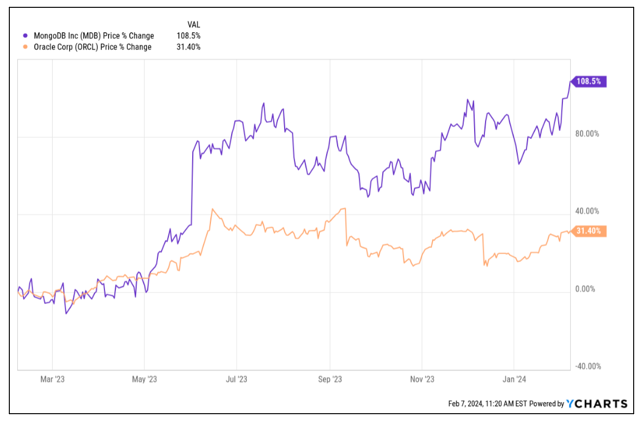

MongoDB (MDB) was founded in 2008 by Dwight Merriman, Kevin Ryan and Eliot Horowitz — the same trio who built and later sold DoubleClick to Google. They saw an opportunity for a developer-friendly database to compete with Oracle (ORCL), a relational database that quickly became the industry standard.

The product Merriman, Ryan and Horowitz ultimately built was jokingly called MongoDB, short for “humongous database.”

The strength of its approach is that the data is stored in collections called documents, not the traditional tables like Oracle. These noSQL databases offer better scaling and the ability to store both structured and unstructured data. The latter has become a prerequisite for LLMs.

MongoDB is wildly popular with developers because it is open source and free to get started. The product has been downloaded 250 million times through the first quarter of 2023 — and likely many more times since.

The database resonates with large enterprises because it is portable, can be scaled infinitely and the same code runs everywhere — from hyperscale data centers to tiny edge networks. This malleability prevents lock-in, a big disadvantage to using Oracle.

Toyota (TM), Uber (UBER), Lyft (LYFT), Accenture (ACN), Coinbase (COIN), Expedia (EXPE), Alibaba (BABA), Cisco (CSCO), China Mobile, Verizon (VZ), AT&T (T) and 46,400 other firms use MongoDB, according to a report filed in December with the Securities and Exchange Commission.

Investor’s Business Daily notes that more than half of the Fortune 100 are MongoDB customers. Penetration is particularly high in financial services, where 19 of the top 20 U.S. banks use the software.

Increased spending from financial firms makes sense. Companies within the sector are now embracing AI as a powerful tool to cut head count. American Banker reports that banking jobs in the United States are expected to shrink by 1.2 million people by 2030.

Cloud sales growth from customers in the banking sector was a recurring theme during quarterly conference calls last week from IBM, Microsoft, Amazon and Alphabet. Business is robust as the CFOs go all in on job cuts.

Executives at MongoDB reported in December that Q3 revenues reached $432.9 million, up 30% year over year. And revenue for MongoDB Atlas, its cloud platform, is now 66% of total revenue, up 36% year over year in Q3.

The future for MongoDB is extremely bright. Sales should continue to grow as the company takes market share from Oracle.

While MDB shares trade at above-market valuations — hence the “D-” rating — its future is bright. Keep this name on your radar.

All the best,

Jon D. Markman

P.S. AI development has fundamentally flipped the script on many aspects of the tech world. In fact, we recently learned about a $200 trillion AI “Superproject” that could have an incredible impact. Click here to see our presentation on it.