Put These 3 Surging ‘A’-Rated Names on Your Radar

|

| By Gavin Magor |

There’s a clear-cut reason Weiss Ratings has been in business for over 50 years: We remain unbiased and better than most.

No matter which investment ratings you need, we’ve got you covered. These range from stocks to ETFs, mutual funds, banks, insurance companies even cryptocurrencies.

But today, I need to show you some of our newly rated “A” stocks.

Out of the 12,660 stocks we currently rate, only 17 have the quite elusive “A” rating.

Let’s take a look at those 17 companies, sorted by 90-day Price Change:

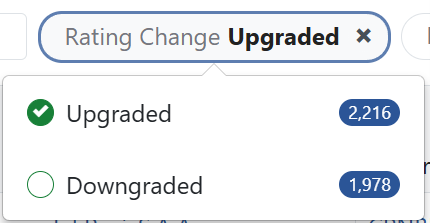

And whilst I see an incredible 17 names above, I want to introduce a feature you may not be familiar with — the “Rating Change: Upgraded” feature.

Trio of Names You Need to Know

After an easy filter for the stocks in this list that were recently upgraded, here’s what populated for me:

After that further reduction of companies, we can see that all three were upgraded within the past week. Please, put them on your investment radar.

But for today, I’ll just highlight two of them …

RLI (RLI) is an insurance company that offers a wide array of insurance products. RLI has been able to prove to Wall Street that it has strong underwriting profitability.

You can check out the stock for yourself on its ratings page. There is a lot to love.

Additionally, I really like Enterprise Products Partners (EPD). The company is a midstream energy company that we’ve rated as a “Buy” since March 25, 2022.

Since that time, shares are up 22%, excluding its attractive 6.7% dividend.

Its business generates a bulk of its revenue from long-term contracts, which makes it generally safer.

EPD also has a diversified asset base, rock-solid financials and consistent dividend growth. You’re being paid to wait even in periods of sideways trading.

Certainly, EPD is not the name you will find bunched together with the flashy tech names of this world. But you most likely won’t get burned on it like you possibly could with those tech names.

And I would apply that exact same sentiment to most, if not all, of our “A” rated names.

They have all been put through a rigorous stress test. And they have earned their high ratings.

Remember, we are unbiased, accurate and always up to date.

So, whilst any internet user can easily access our incredible ratings, I’d be remiss if I didn’t mention our more tailored investing strategies.

Let me show you what I mean …

Returns Hedge Fund Managers Dream About

I’ve been in this business for a long time. And I’ve never felt as passionate about an investing strategy as I do about this one right now.

Most hedge fund managers love to perform right in line with the market during strong years. They take a nice commission off the profits and happily go about their day while stuffing their pockets.

I have never had that laissez-faire mentality. I want to always overachieve.

So far this year, my premium investment service has blown the doors off the historically strong performance of the S&P.

Sure, the S&P 500 is up around 25%. But what you may not realize is — as of Thursday last week — the S&P 500 was only up 12.5% when excluding the Magnificent 7 stocks.

Year to date, my service is up around 40% when following our recommended trading size.

Surely, that is blowing most traders out of the water. But I’m not surprised in the slightest.

And that is precisely because we strongly “trust our data” and never invest with an emotional bias.

This is in conjunction with our time-tested Bull/Bear Timing Model to help us capitalize no matter what the market is doing.

Unsurprisingly, we’ve been in Bull Mode for a majority of this year. And it has paid off big time.

I feel so strongly about this service that I am hosting an event tomorrow, Tuesday, Nov. 19 at 2 p.m. Eastern.

I would hate for you to miss it. So please, click here now to sign up.

Your best investing self is just a few clicks away.

Cheers!

Gavin Magor