|

| By Jim Nelson |

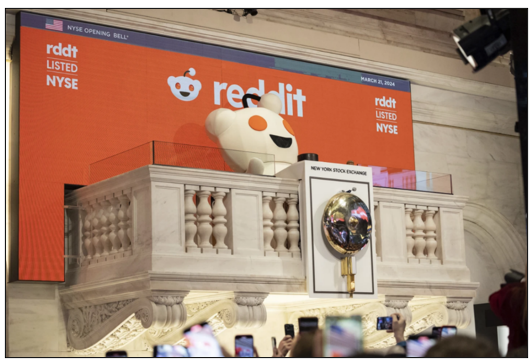

One of the biggest stories circling around the market this week was the debut of Reddit (RDDT) shares on the NYSE.

Its shares shot up once trading officially began on Thursday afternoon, sending its market cap near $11 billion. They have since retracted but are still seeing a flood of volume.

So, why is this such a big deal? After all, it wasn’t the largest IPO of the year so far. In fact, it wasn’t even the largest IPO this week — a title belonging to Astera Labs (ALAB).

Reddit is in the spotlight simply because of what it is — a social network. It functions a bit differently from others, however.

Its execs fancy terms like “user owned” and “user driven.” That sounds good. But the truth doesn’t necessarily match up with those ideals.

While users were able to participate in the IPO, the largest owners include the Newhouse family, the owner of Conde Nast, Chinese internet company Tencent and Sam Altman.

Yep, that Altman. You’ll recall he runs OpenAI and had a falling out — then falling in — with his old board of directors.

That brings me to the second erroneous phrase — “user driven.”

This one is closer to the truth. But it might not be for long. At least, that’s not how CFO Drew Vollero sees its path to growth.

He told Barron’s this week that one major way to grow sales will be from selling its users comments to developers of large language models, or LLMs.

Essentially, he sees about $66 million in annual sales coming from selling users’ discussions to AI developers.

It might need every dollar of that too. The company reported just $804 million in 2023 revenue in its SEC filings — all from advertising. For a currently $7.6 billion company, it needs that AI growth to keep investors interested.

Around Weiss, there are a few mixed opinions on this newest publicly traded social media platform. Weiss Ratings, of course, currently lists it as “unrated.” That’s standard protocol for companies hitting the market for the first time.

Our ratings rely on data and lots of it, which there simply isn’t enough of yet.

We’ll certainly continue to watch Reddit as it continues trading. And you’ll certainly hear more about it from our editors over the next several weeks and months.

Speaking of which, here’s what those editors had to say this week …

A Key Difference Between Weiss Stock & Bank Ratings

Our ratings team scrutinizes publicly traded companies, banks, insurance groups and cryptocurrencies. But what if one entity is both? Like, say, a publicly traded bank. Our Ratings Director Gavin Magor highlights exactly what happens … and why the ratings can differ.

With the now-certain rate cuts on our horizon, everyone is going to be looking to find their income outside of safe, fixed-income investments. But you don’t have to sacrifice potential moonshot gains to lock in dividend income. We’re sharing three moonshot/high-yielding opportunities to consider.

This Will Trigger Gold’s Next Big Move

Gold’s stellar 2024 isn’t nearly finished, according to Sean Brodrick. He’s been thumping the table saying, “buy, buy, buy” for over a month. Now, he has serious data that says exactly how high you can expect gold to head in the next few months. It’s probably higher than you think!

In case you haven’t been following, our tech guru Jon Markman has a bit of a beef with market bears … especially when it comes to AI stocks. He highlights what they are getting wrong about Adobe’s (ADBE) earnings flop … and what to buy to play it.

Buy These Funds Ahead of the Fed’s Dollar Weakening

Senior Investment Writer Karen Riccio lays out what happens when the Fed cuts rates and the dollar loses value. She also has just the right way to play it, complete with three funds you might want to add ahead of those rate cuts.

Enjoy your weekend,

Jim Nelson

Managing Editor, Weiss Ratings Daily