|

| By Gavin Magor |

Happy President’s Day!

The markets may be closed for the holiday, but new opportunities for the week ahead are wide open.

Today, I want to focus on some of our incredible Weiss Rating features … and some that you may not realize are on our site.

I passionately believe that Weiss Ratings should be a one-stop destination for a majority of your investment research needs.

Currently, we have 53,923 investment ratings for stocks, ETFs, mutual funds, cryptocurrencies, banks and insurers. That’s a massive amount of data, but the Weiss systems (and some very bright analysts) make it possible.

The Weiss Ratings history is well regarded. Here are some of our best stock ratings over the past few decades …

As of November 2023, those include:

- 33,503% gains on Apple (AAPL) — first “Buy” rating on Nov. 18, 2003.

- 12,560% gains on Tyler Technologies (TYL) — first “Buy” rating on April 2, 2003.

- 11,129% gains on Nvidia (NVDA) — first “Buy” rating on March 10, 2023.

- 4,927.98% gains on Manhattan Associates (MANH) — first “Buy” rating on April 2, 2003.

Those are some of the most notable “Buy” ratings for staggering returns. But ultimately, the Weiss Ratings take even more pride in having a massive bias toward safety.

Easy Features, Enormous Potential Results

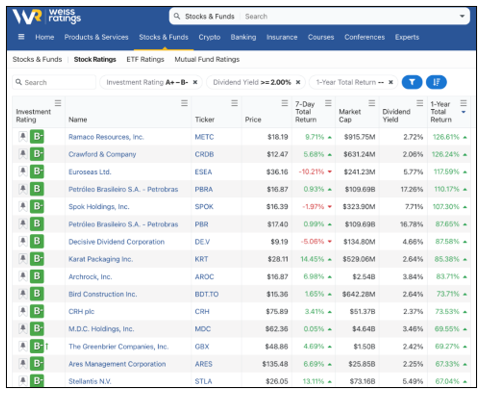

Say, for example, you wanted to look on our Weiss Investment page for stocks that are currently rated as “Buys”, pay a nice dividend, with a current yield greater than 2% and have high returns over the past year. I then sorted by “1-Year Total Return.”

You can easily do that on our stock ratings page.

Here are some of the names that populated:

So, whilst we filtered for all “Buy”-rated names within the “A” to “B-” range, these names are all only in the “B” grading range.

A “B” rating is defined as:

“A company’s stock that has a good track record for delivering a balance of performance and risk. While the risk-adjusted performance of any stock is subject to change, we believe that this stock is a good value, with good prospects for outperforming the market. Although even good investments can decline in a down market, Wall Street analysts interpret our “B” rating as a Buy.”

I included the dividend yield filter just as a hypothetical for this example. Certainly, the Weiss Rating “Buy” grade is important, but I was also looking for stocks paying a nice dividend.

I also included, “1 Year-Total Return” to further prove my point that there are some really incredible opportunities for investors.

Just within this simple criteria, we saw 126.61% gains on Ramaco Resources (METC), 126.24% gains on Crawford & Company (CRDB) and 67% gains on Stellantis (STLA), among the others.

And, say you wanted to take an even closer look at one of these names. You can find a plentiful amount of information for each individual stock.

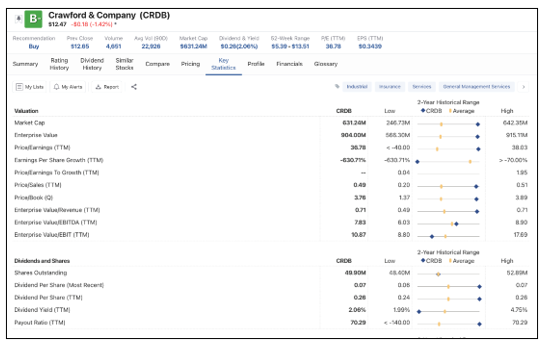

Speaking of Crawford & Company, let’s look at that name.

Here are some of the stock’s “Key Statistics” being compared to its two-year historical range:

Market cap, P/E ratio, price-to-sales ratio, price to book ratio and several other important financial metrics are all there for your easy investing research needs.

And that’s really just the tip of the iceberg when it comes to the research you could be doing on just this one stock.

You can also see the summary tab, ratings history tab, similar stocks tab and so much more. You see, even if this particular name didn’t suit your fancy, you could research other similar names.

So, while the market is closed for Presidents’ Day, use this opportunity to explore our ratings research and prep for the new week. Get started here.

Cheers!

Gavin Magor