Rising Used Car Prices Make This Stock a ‘Buy’

|

| By Kenny Polcari |

If all the different interpretations of January’s Consumer Price Index report are driving you crazy, my newest revelation might put you over the edge.

The CPI numbers released this past Tuesday indicated that used vehicle costs decreased by 1.9% last month.

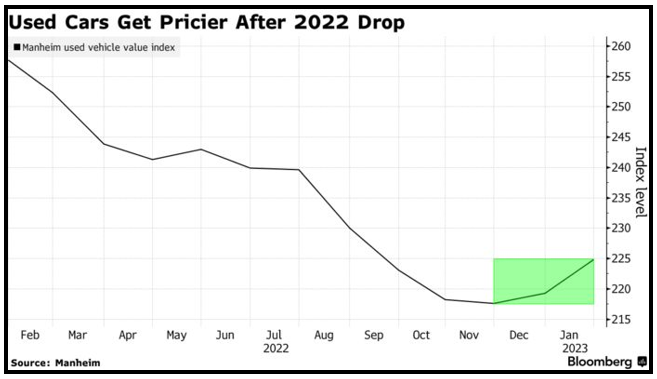

However, the wholesale market suggests otherwise. Manheim, an auctioneer and one of the world’s largest wholesaler of autos, released an update on its Used Vehicle Value Index a week before the CPI came out.

It’s something the 75-year-old company makes public on the fifth business day of each month. And many analysts have come to rely on its independent gauge for an accurate read on used car prices.

And Manheim says that:

• Prices of wholesale used cars rose 2.5% from December 2022 to January 2023.

• This is after prices declined 12.8% for six straight months last year.

• Compared to December, six of the eight major segments’ performances were up between 0.8% and 3.6%, with pickups having the strongest showing.

• Only full-size and luxury cars were down compared to December.

Here’s a look at Manheim’s Used Vehicle Value Index since February 2022:

Click here to see full-sized image.

Another stalwart in the industry, Hertz (HZ), also reported big price hikes over the past five weeks at auction and on the used car retail market. The company, which sells one-quarter of its fleet through its own retail business and via online retailer Carvana (CVNA), said buyers paid 5%–7% premium over auction prices and all cars sold for more than book value.

While retail prices don’t follow in step with wholesale prices, they certainly can be impacted by them. If the major sources of used car inventories like Manheim and Hertz pay more, it stands to reason that it’s just a matter of time before …

Higher Costs Are

Passed onto Consumers

That’s not good news for the Federal Reserve or for people looking to buy used cars.

Fed Chair Jay Powell had good reason to believe the rate hikes were working, at least for the auto industry. Some analysts even called the downtrend in car prices “undeniable” at the end of December, adding that the next two to three months would provide a sense of how far and how fast prices would drop.

Consumers climbed right back in the market after prices dropped, as retail sales rose 16% in January over December and 5% from a year ago.

Analysts blame unseasonably high demand for used vehicles and lingering semiconductor shortages for the higher costs. Industry experts are predicting that chip shortages will continue through 2023, causing many automakers to cut back on production.

If that plays out, new cars are going to be hard to come by, just as they were during the pandemic. That’ll add demand for used cars. So will rental companies retiring fewer of their fleets, as well as people keeping Old Betsy longer than ever.

A continuation of rising used car prices could prove quite troublesome for the Fed.

I read an interesting article that pointed out that because used car prices make up 4.5% of core CPI, every percentage point increase from used cars means a five-basis-point rise in the overall inflation rate.

Let that sink in.

So, used cars — the poster child for the Fed’s battle with inflation — now joins rent, gas, eggs, meat, fish, cereal and other foodstuffs as driving forces behind the month-over-month 0.5% increase in inflation. However, prices for fruits and vegetables dipped if that’s any consolation.

It’s important, however, to be mindful that …

1 Month Does Not

Make a Trend

It’s entirely possible that used car prices could return to their downward slope as the year continues. Or they just might go up more.

So, if you’re in the market for a used car, you might consider buying one soon in case the latter happens. Not putting off a purchase also means you’ll avoid having to pay even higher interest rates as the Fed tries to steer inflation in the other direction.

Or you could consider investing in one company that’s firing on all cylinders and should benefit if demand grows further, inventories shrink and prices continue to rise.

Here’s more on why …

AutoNation (AN) Is a ‘Buy’

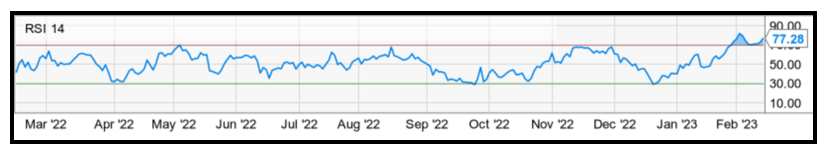

Since breaking through both its 50-day moving average and 200-day MA in mid-January, the stock has been on a tear. At the time of writing, shares of AutoNation are up 27% year to date.

Click here to see full-sized image.

The $6.6 billion company is the largest car dealership chain in the U.S. While we’ll find out the most recent earning numbers for AutoNation on Friday, Feb. 17, it posted a 23% year-over-year increase in Q3. Revenue also increased 4% over the same period.

In 2021, revenue from used cars surged 55% from a year earlier while sales of new cars slipped 7%, a reflection of the chip shortage that choked off supply of new inventory.

AutoNation is also on the verge of creating another revenue stream from a pending acquisition for RepairSmith, a full-service mobile solution for repair and maintenance with a significant footprint in the southern and western U.S.

Founded in 1996 with just 12 locations, the automotive retail giant now boasts more than 250 lots that sell new vehicles as well as used vehicles.

The retailer also celebrated the sale of its 14 millionth car in 2022, a feat no other car dealers can claim.

Technically speaking, shares of AN are trading well above their 50-day and 200-day moving averages, and its relative strength index, which currently sits at 77.28, is solidly in overbought territory, meaning it could see a near-term correction.

Click here to see full-sized image.

But most importantly, AutoNation is rated a “B-” — or “Buy” — by Weiss Ratings, which bodes well no matter how the stock performs in the short term.

Tomorrow, we’ll get a clearer picture of AutoNation’s financial health after the company announces its Q4 2022 and full-year earnings. But shareholders and potential investors will likely focus more on the company’s forward-looking statement.

It could really shed some light on which direction the auto industry is headed —another topic no one seems to be able to agree on.

I know. It drives me crazy, too.

Consider using near-term weakness on a pullback to secure shares. But as always, conduct your own due diligence before entering any trade.

To your Wealth & Wisdom,

Kenny Polcari

P.S. The Federal Reserve’s actions should have investors concerned for their financial well-being.

Starting as soon as May 2023, their insidious “Fed Control” powers could go live, which means that any accounts linked with the U.S. banking system could soon be at risk for surveillance of all transactions … or worse.

Investors who want to take action to protect their money should click here for four steps to take now to stay safe and grow their wealth.