|

| By Nilus Mattive |

If you think lawmakers don’t abuse their powers …

Or you somehow believe Wall Street is a fair place …

I would like to talk about the actions of — and regulatory reactions to — two fairly famous investors.

First, we have Keith Gill, better known as “Roaring Kitty” on various online forums and social media accounts.

Gill was a registered broker at MassMutual when he began posting about his bullishness on GameStop (GME) back in 2020 and rallying other investors to target the stock.

All the increased buying created a huge “short squeeze,” which caused hedge funds and other institutional investors to experience massive losses because of their negative bets on GameStop.

Gill, and certainly others, made fortunes in the process.

Although he was eventually forced to testify before Congress because of the ensuing “meme stock” craze, Gill wasn’t ever charged with anything … because he didn’t do anything wrong. (His now-former employer did have to pay a fine for not disclosing his substantial position in a security.)

Fast forward to a few weeks ago, when Gill — or at least “Roaring Kitty” — resurfaced with a new post on social media after roughly three years of radio silence. It was a simple picture of a man leaning forward in his chair, which most people interpreted to mean “pay attention” or that Gill himself was now doing so.

The day after that post, GameStop jumped more than 70%.

The following day it jumped another 60%.

Then Roaring Kitty posted a picture that suggested he had built a $175-million position in the stock and related call options.

GameStop jumped another 21% the next day.

We could keep going, but all of this already has people asking whether Gill could, or should, be investigated for market manipulation.

During a recent appearance on CNBC, SEC Chairman Gary Gensler wouldn’t say if his agency was investigating the matter or not. But Massachusetts state regulators have already said they’re looking into the situation, while E-Trade was considering kicking Gill off its trading platform.

Now, for me, the whole “meme stock” thing is just another massive sign that we are in a tremendous risk-on, asset-bubble-type environment right now.

However, in what world is it a problem if a person — regardless of their fame — buys an investment and then tells everyone else they did it or even encourages those people to do the same?

It’s literally the opposite of a deceptive practice!

Indeed, plenty of famous and influential Wall Street investment firms do it all the time.

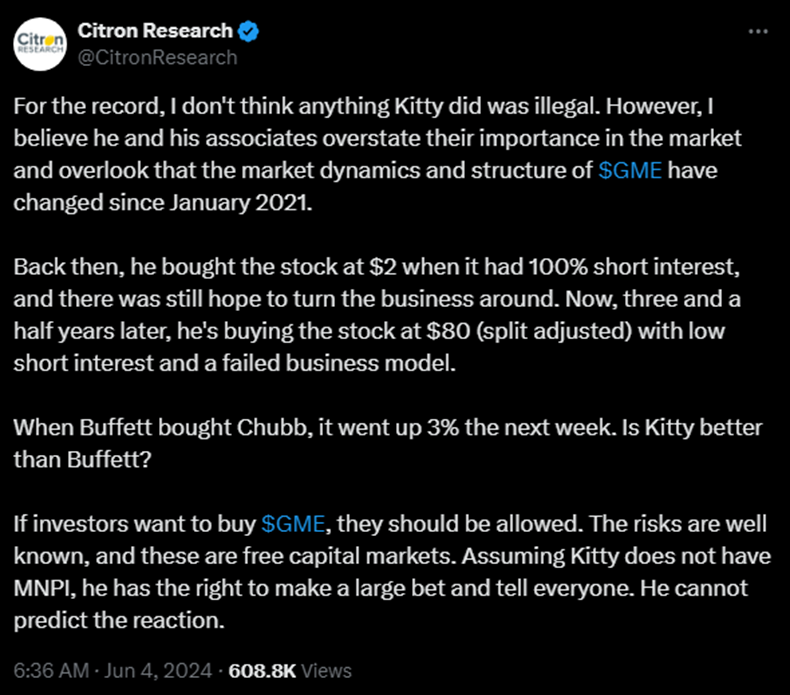

This is probably why, Citron Research — a company that lost its entire short bet on GameStop last time around — came out in defense of Gill’s right to “talk his book.”

As the firm posted on its X account:

“For the record, I don’t think anything Kitty did was illegal … Assuming Kitty does not have [material non-public information], he has the right to make a large bet and tell everyone. He cannot predict the reaction.”

This is exactly right.

And it brings up a massive irony …

Even as Congress was grilling Roaring Kitty last time around, some of those very same elected officials were possibly profiting from all types of insider knowledge they acquired during their time in Washington … or at least making boatloads of money from their investments while providing very little transparency to the people they supposedly represent.

Consider Nancy Pelosi, from my current home state of California.

In case you don’t know, she’s married to real estate investor and venture capitalist Paul Pelosi … and the couple has made a killing in the stock market.

According to a report from Unusual Whales, which tracks Congressional investments among other things, the Pelosi recently had a $4-million profit from a series of call options her husband purchased back in November of 2023. They also note this is 20 times her Congressional salary.

Okay, fine. Good market timing, right? Nothing wrong with that.

Yet it isn’t the first time they’ve made a fortune trading options in Nvidia (NVDA), and a previous time certainly raised a lot of eyebrows.

See, back in 2022, Paul Pelosi also made a big bet on Nvidia call options — about a $1 million worth — right before Congress was about to vote on subsidizing the chip industry. He ultimately sold the position because the scrutiny was so intense.

Shall we keep going?

Well, another interesting situation happened around Visa (V) back in 2008.

The company was about to IPO and offered Paul Pelosi early access to its stock. His shares were purchased at $44 and traded for $64 just a few days later.

This was right around the same time that Congress was considering new legislation that would negatively impact credit card companies.

Indeed, the transaction was so questionable that 60 Minutes did an entire episode about it.

There have been other examples involving Pelosi, too — including a Tesla (TSLA) trade that appeared well-timed ahead of a big government contract being announced by Joe Biden.

And to be clear, it isn’t just Paul and Nancy Pelosi. Nor is it just Democrats.

Researchers have discovered that strategies attempting to follow Congressional trades tend to outperform the market by 6% a year.

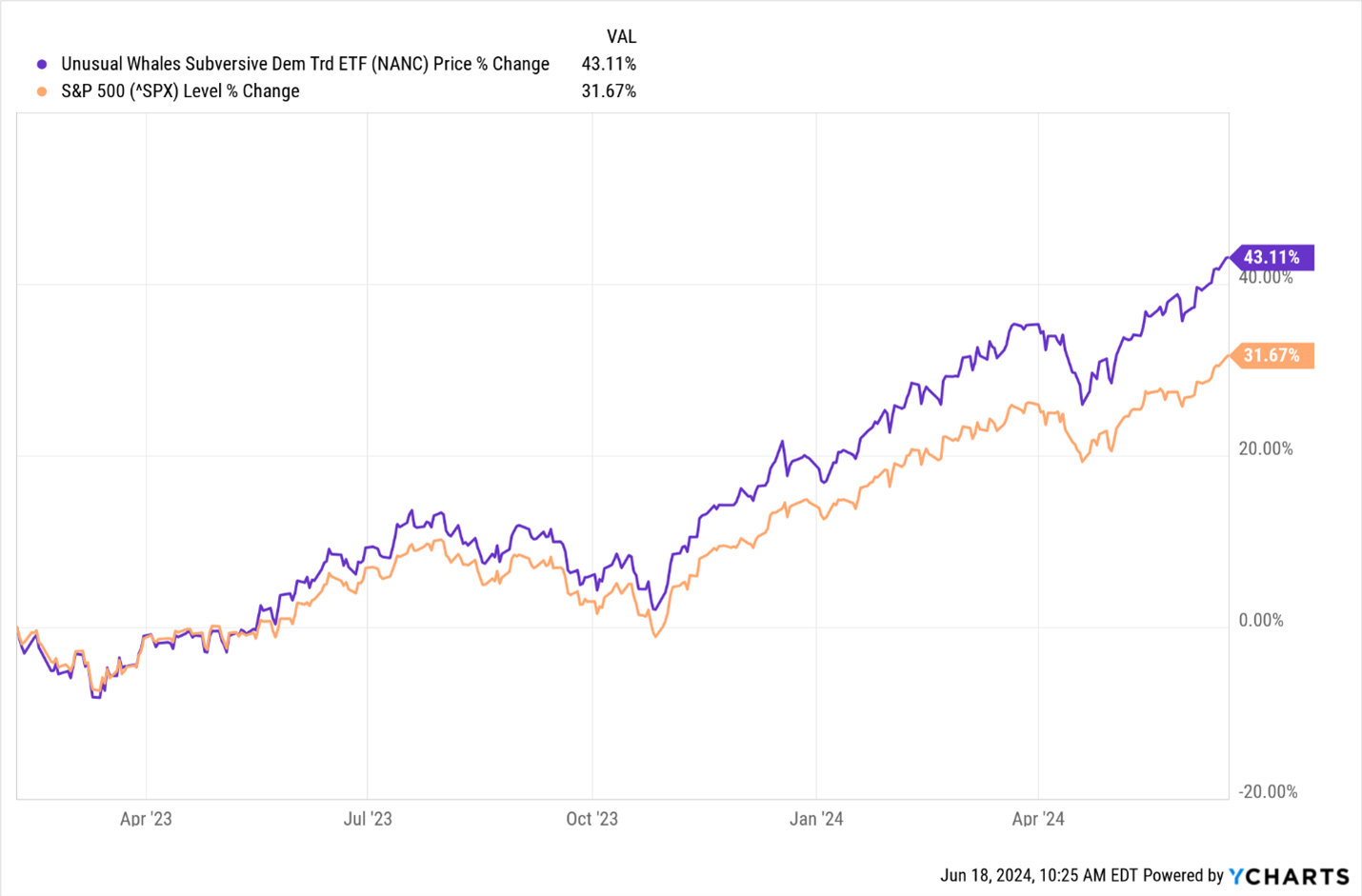

Indeed, there are now even ETFs — using data from the aforementioned Unusual Whales — that try to track the performance of Democrats (NANC) and Republicans (KRUZ), respectively.

The NANC fund has been trading for a longer period and has outperformed the market quite handily …

Of course, tracking the moves themselves is actually a lot harder than you might think.

Before I explain why, it’s worth noting that members of Congress only made their first attempt at self-policing their bad investing behavior back in 2012 after public outcry reached a fever pitch in the wake of that 60 Minutes reporting.

That piece of legislation was called The Stop Trading on Congressional Knowledge (STOCK) Act, and it was designed to prohibit lawmakers from making investments based on material non-public information that they received during the course of their duties.

Of course, roughly a year after it passed with almost unanimous support, Congress quietly made amendments that rendered much of the original STOCK Act useless.

For example, the original legislation required all trading disclosures to be filed in an online, searchable database.

After the subsequent bill, which was signed into law by President Obama on April 15, 2013, went into effect … the records are only available if you go to a basement in an office in Washington, D.C.

If you want to know just how hard it is to access and use this information, I recommend checking out this article.

Lawmakers also have 45 days to disclose what trades they’ve made. Doing so is still basically on the honor system.

Most experts agree it would be very easy to sidestep the entire process. And the penalties for non-compliance amount to a whopping $200.

In one particularly egregious case three years ago, Representative Pat Fallon from Texas failed to disclose 122 different securities transactions with a value between $9 million and $12 million.

What happened to him?

He was forced to pay $600 in late filing fees. The Congressional Office of Ethics also tried to investigate, but he wouldn’t cooperate.

And, sure, there have been recent calls to get more restrictive — perhaps banning members of Congress from trading individual stocks altogether.

One such piece of legislation was circulated back in 2022. Nancy Pelosi refused to bring it to the floor.

I guess it’s just more fun to point the lights back toward regular individual investors like Roaring Kitty.

Best wishes,

Nilus Mattive