|

| By Gavin Magor |

From the entire Weiss Ratings family to yours, Merry Christmas!

I hope had a terrific holiday if you celebrated. Always remember, the greatest gifts are the presence of loved ones.

The markets are back open today. But there are only a few trading days left in 2023. We’ll see if history repeats itself.

Sorry to be so skeptical, but it’s my nature to question. ‘Tis the season that Wall Street anticipates that Father Christmas — aka the bearded, fat guy in the red suit — will deliver a year-end rally to the stock market.

The Father Christmas Rally, one of many seasonal patterns throughout the year, specifically refers to the last five trading days of the year and the first two days of the new one … in other words, the period we’re in right now.

In a few trading days, we’ll see if it’s still possible for Santa to deliver the average 1.3% gain for the S&P 500, according to the Stock Trader’s Almanac, during that period.

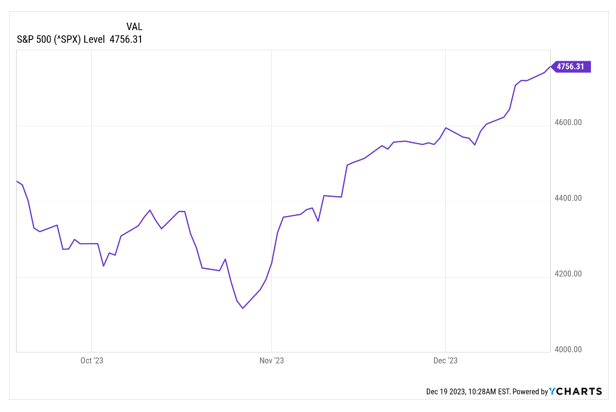

What we do know for certain is that these past two months have been very merry for the broader market, with the S&P up nicely since late October.

However, this rally often has little to do with the market climate heading into the final trading days of a given year or how it will impact the near future.

Weak or strong, bear or bull, Father Christmas doesn’t discriminate. Why? Because there’s more sugar plums than beef behind the reason for the rallies in the first place.

Theories range from simple holiday cheer (optimism and brandy-spiked eggnog) to investors sinking their year-end bonuses into the stock market.

Let’s visit recent history and how the Santa Claus Rally played out in 2008, the first year of the Great Financial Crisis and ensuing stock market crash.

Between the five days post-Christmas and first two days of Jan. 2009, the S&P 500 gained 7.5%. However, it crashed again shortly after and declined to lows on March 9. Once the dust cleared from the financial fiasco, the broad market index gained 23%.

The same pattern happened in 2018, when the Santa Claus Rally set the stage for further gains of 29% and a bull market in 2019.

Rudolph, his reindeer friends and investor optimism clearly led Santa’s sleigh in those years. But today, the Federal Reserve is in the driver’s seat.

Yes, the S&P 500 delivered 1.4% gains during the seven-day period in 2021-2022. But the market peaked on Jan. 3 and entered a bear market in June — falling more than 20%, as the Fed aggressively raised interest rates.

Here we are approaching that special seasonal time, waiting with bated breath for the Father Christmas Rally to materialize (or did it already come?), especially if we're putting any weight on the bonus theory.

With the Fed still steering the proverbial economic sled into the ground and the unemployment rate to the North Pole, many folks might find pink slips — instead of greenbacks — in their stockings before year’s end and into 2024.

I mean, the Fed had one task to achieve with the tightening monetary policy … to slow inflation and bring down prices.

Sure, inflation is rising at a slower rate, but prices are still sky-high.

Just take a look at your grocery bill, or amount of rent you pay and tell me inflation is under control if you beg to differ.

Now, ING Economics is saying, “The Federal Reserve is poised to cut interest rates six times in 2024.”

Any interest rate cuts would be in response to a slowing U.S. economy. So, cutting rates too much and prematurely is just as much a bah-humbug as the Fed raising rates too fast. Extremes rarely work.

The Fed remains in a balancing act. If past performance is any indication, we should all remain very skeptical.

If the Fed sees the need to cut rates to the extents being reported, it’ll be because of a severe slowdown in manufacturing and retail spending, high unemployment and lower wages.

That’s the same recipe that led to the decade of zero interest rates after the Great Financial Crisis and Great Recession in 2008-2009.

I just can’t imagine the powers that be would be so unwise as to unwind all the monetary tightening they’ve done and over such a short period.

Then again …

As much as I wanted to spew optimism about a year-end rally, a 1.3%, seven-day uptick isn’t going to make a dent in anyone’s Christmas list.

But since you’re not steering the sled either, the best and safest strategy is always to control what you can and keep the coal out of your portfolio.

Just don’t sit idle ho-ho-hoping for a Father Christmas Rally to come to the rescue and the Federal Reserve to comes to its senses.

What you can and should do is keep looking at all of our amazing Weiss ratings. We extensively cover stocks, insurers, banks, mutual funds, ETFs and cryptocurrencies. It can easily all be found on our Ratings Screener Page.

So, whilst your stockings may be hung by your chimney with care, we’ll see if we get another St. Nicholas Rally or something more “bear.”

Cheers to a happy and healthy year’s end!

Gavin