If you look at every trading day of the year over the past few decades, patterns emerge. One of the more significant patterns is that buying stock lows in the second week of October — specifically, October 13— can pay off.

In this segment, I interview Senior Analyst Jon Markman about seasonality and cycles, the first $10 trillion stock and why he believes the Fed's plan for 2023 is “to murder the economy.”

You can watch the video here or continue reading for the full transcript.

Jessica Borg (narration): Volatility has become a hallmark of this year.

How can you best adjust your investments?

Senior Analyst Jon Markman, editor of The Power Elite, Crisis Profit Trader and Weiss Technology Portfolio, has been studying market patterns over decades.

JB: Jon, we know things right now are not pretty. What should investors expect in the coming months?

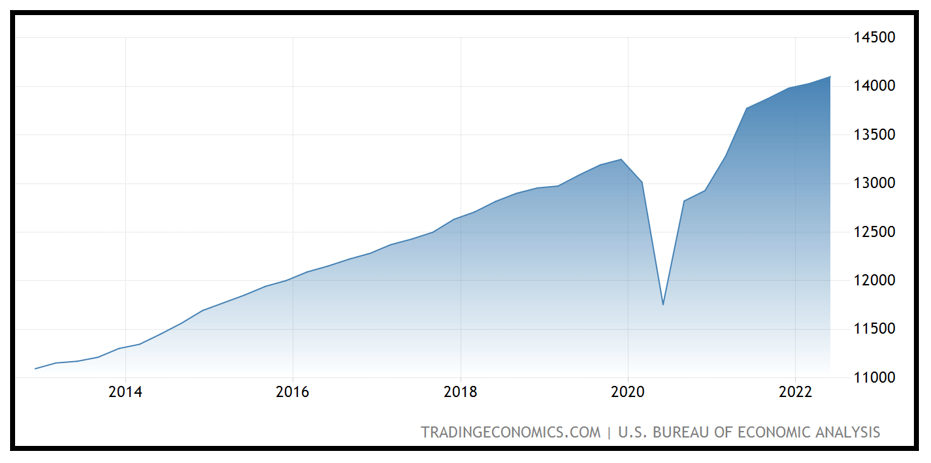

Jon Markman: People are working. They’re buying things. All the consumer data shows people are going to stores.

Source: Trading Economics.

Click here to see full-sized image.

So, I think that we are probably not in a recession at this time. But the Fed seems intent on creating one.

So, just because we’re not seeing a recession at this time doesn’t mean it won’t actually be here in three to six months.

JB (narration): The Federal Reserve is expected to continue raising interest rates over the next few months to tackle inflation.

JM: It’s the Fed’s desire to push down demand to beat inflation.

That’s their goal. Their goal is not to increase consumer activity. The idea is to squash it.

So, you can see that the delta between where we are and where we’re probably going is quite large, and that’s pretty scary.

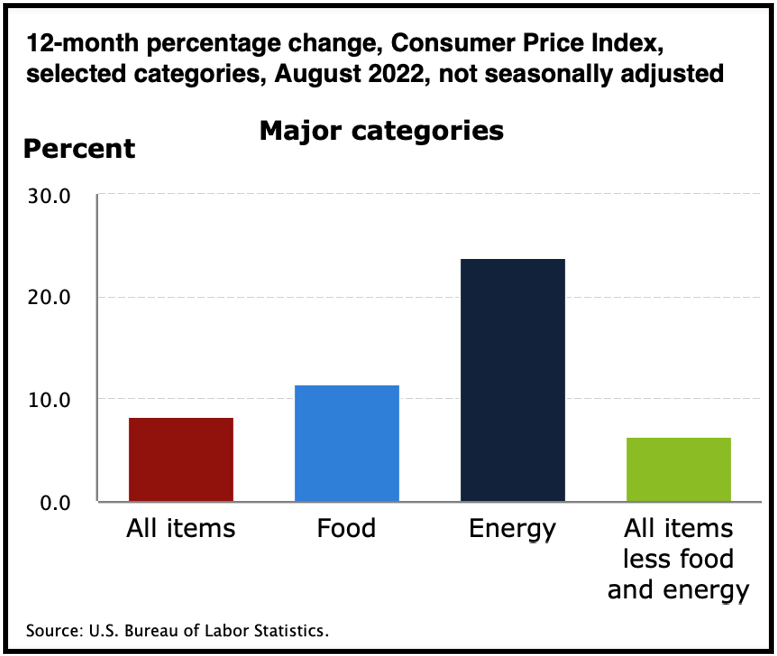

JB (narration): Inflation is at 8.3%, with the food-at-home index — measuring grocery prices — up 13.5%, year over year.

JM: It’s like we’re watching a murder, but it’s not a mystery. It’s not a murder mystery. It’s just a murder. The Fed wants to murder the economy to beat inflation.

JB (narration): Jon says these are historic times, in that sense.

But an old investment saying comes to mind.

JM: It’s trite, but don’t fight the Fed, don’t fight the Fed, don’t fight the Fed.

JB: (narration): A strategy to consider?

JM: If you want to participate as a trader, sell the rallies. Every time the market is up 300-500 points in a day, sell it.

In a bull market, you want to buy lows, buy pullbacks, and in a bear market, you want to sell rallies.

JB: Jon, you pay a lot of attention to seasonality and cycles. What should investors focus on right now?

JM: One of the things I pay a lot of attention to is 12-month forward expectations of individual stocks and the market itself.

If you look at the entire year, you have 252 trading days.

If you look at the 12-month return of each one of those days over the past 50 years, you can see patterns.

One of the most important patterns is a low, which tends to happen in the second week of October.

JB (narration): Specifically, it happens on Oct. 13.

JM: If you look at every single day in the calendar, and you look at their 12-month forward return, the No. 1 date on the entire calendar is Oct. 13.

So, here’s my advice … if the market goes down Oct. 13, close your eyes and buy.

Most people don’t like to buy into lows because it’s hard. Stocks are going down, bonds are going down, commodity prices are going down.

It’s going to be really hard to buy, but it’s a short-term opportunity.

Try it, see if it works.

JB (narration): Theoretically, you’d want to hold it for a year, since that’s the forward expectation for buying on that date.

But, in this climate, if it spikes in price a few weeks afterward, take the profits.

JM: Even though the idea is for a one-year look-forward, if you get what you’re looking for in a year, in a month, take it.

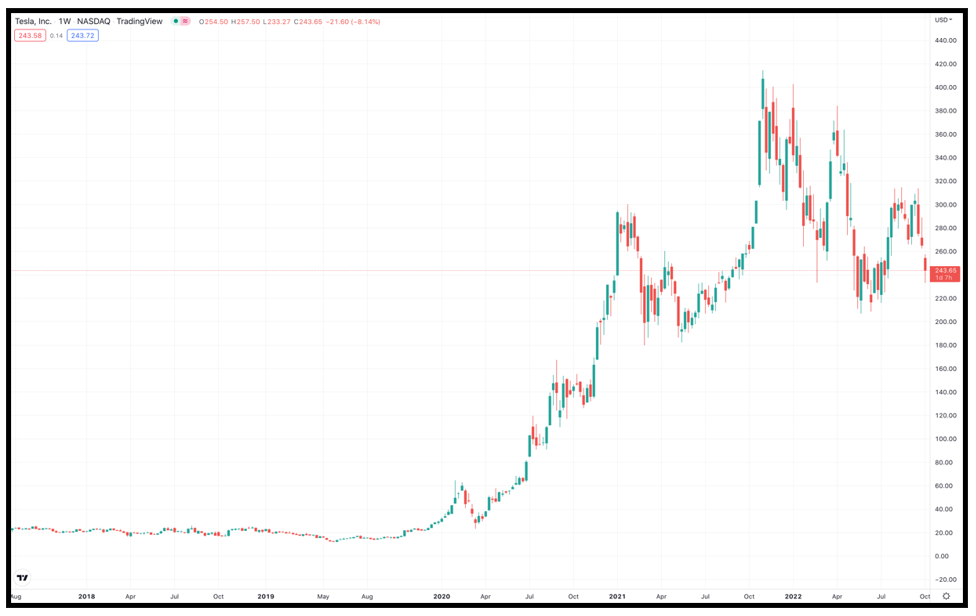

JB (narration): Last year, Tesla (TSLA) shot up about 45% one month after Oct. 13. Jon is a big fan of the company.

Source: TradingView.

Click here to see full-sized image.

He thinks it’s a credible claim that Tesla will become the first $10 trillion stock.

JM: That sounds impossible. What does that even mean? But, you know, at its peak, Apple (AAPL) was a $3 trillion stock.

And Tesla is selling computers on wheels. The products that they’re building will be the most important way people transport themselves 10, 15 years from now.

They’ll have autonomous vehicles in fleets, rather than us owning individual cars.

Tesla, I think, is something that you could buy for a one-year speculation.

Click here to see full-sized image.

JB (narration): Jon also favors other Big Tech names.

JM: I’ve been a big advocate for technology stocks and growth stocks for the last 30 years, and there are certain growth stocks that I would buy in any economic environment.

One of them would be Microsoft (MSFT). Another one would be Alphabet (GOOGL). Another would be Tesla.

JB (narration): Even if there is a sustained down market, there are strategies to keep your portfolio healthy.

JB: Senior Analyst Jon Markman, it’s always a pleasure speaking with you. Thank you so much for your time and insights today.

JM: Thanks for having me.

Best wishes,

Jessica Borg

Financial News Anchor

Weiss Ratings