|

| By Gavin Magor |

Hey there, I’m Gavin Magor.

If you’re a member of any of Weiss Ratings financial newsletters, you’re probably familiar with some of my work as director of Weiss Data Services and editor of the All-Weather Portfolio.

As director, I oversee a global team of research analysts and data scientists responsible for combing through data on 10,000 listed stocks, 2,000 ETFs, 25,000 mutual funds, 5,000 banks, 5,000 credit unions, 3,000 insurance companies, thousands of Medigap policies and 1,000 digital assets.

We then mine that vast database to determine ratings, develop models, create institutional reports and much more.

Our most important goal is to make sure our ratings provide members with the best possible opportunity for safety and profit — with emphasis on safety.

I won’t go into the nitty-gritty details about how we determine which companies deserve A’s or F’s.

What’s most important for you to know is the higher the rating, the lower the risk — based on current market conditions and cycles, of course. Bear or bull, it doesn’t matter. The ratings are just as dynamic as the stock market.

That’s why I can safely say, “We’ve always got your back.”

So, if you’ve been listening to your neighbors, the talking heads on TV or a financial adviser who’s managed to turn your portfolio a deep shade of red over the past couple of years, I’d suggest being extra cautious.

I don’t have to tell you that we just experienced the worst year in the stock market since 2008, but Weiss Members had the opportunity to be spared from the worst. Since launching the All-Weather Portfolio in August, the portfolio is up 1.1% while the S&P 500 and Nasdaq were down around 2.7% and 8.5%, respectively.

That’s all thanks to our forecasting models and ratings. They’re designed to predict booms and busts in the economy, help warn about stock declines and corporate failures ahead of time and identify the best investments to own even in the worst of times.

In fact, Weiss ratings are so accurate that they've been praised by members of Congress, the U.S. Government Accountability Office, Forbes, Barron's, The New York Times and many others.

Here are a couple of examples why …

Weiss Ratings Is Top-Rated

In the late 1990s, on the eve of the great dot-com bubble, all major brokerage and research firms on Wall Street touted internet stocks with glowing ratings. Over 98% of their ratings were "Buys" and practically none were "Sells."

But here at Weiss Ratings, we said precisely the opposite. Not even one of these stocks was a "Buy." Nearly all were "Sell" ratings. And just as his father had done 70 years earlier, Dr. Martin Weiss told everyone to "get the heck out of the market."

Again, all those who were enjoying the raging bull market laughed, refusing to get out.

But the Nasdaq fell 75%, and hundreds of companies went bankrupt.

Those who listened ended up saving millions while those who didn't lost nearly everything.

In 2008, it happened again.

Dr. Weiss was the only one who specifically named — and gave advance warning in writing about — the two worst Wall Street bankruptcies of the Great Financial Crisis.

In fact, he warned people about:

- The big Bear Stearns failure 102 days in advance.

- The even bigger Lehman Brothers failure 182 days in advance.

Now, as bad as things are in the world today, I think they're about to get worse. People who make unwise investment decisions in this high-risk climate wrought with volatility are almost certain to see their portfolios lose value.

But instead of being one of those people, you can …

Be a Smart Investor in an Uncertain Market

Sometimes I feel like there’s a Category 5 hurricane sweeping across the investment landscape. I live in Florida, where Weiss Ratings is headquartered, so I’m often reminded of natural disasters — although this one is definitely man-made.

And while disastrous conditions are wreaking havoc on lives and livelihoods, investors under the Weiss Ratings umbrella are far more protected in the eye of the storm.

That’s because they’re not chasing profits in the same stocks that delivered so well for them pre- and post-pandemic — stocks in sectors such as technology, consumer discretionary, real estate, Bitcoin and others.

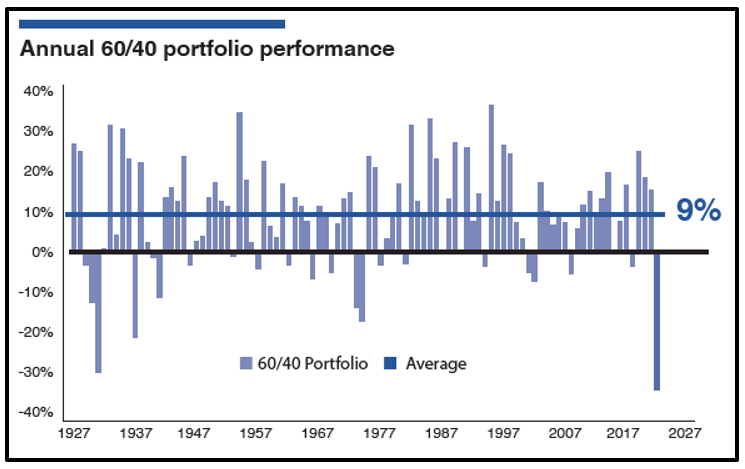

They’ve abandoned the 60/40 split between stocks and bonds because for only the third time in 100 years, both stocks and bonds posted negative returns.

Click here to view full-sized image.

Last year, the S&P 500 dropped 18.1% and the Bloomberg U.S. Treasury Index fell 12.5% — the biggest decline in its 40-year existence. That means anyone following the typical financial adviser’s game plan likely lost a lot of money.

Instead of letting losers roll, Weiss Members were told to sell them and raise cash for the next buying opportunities. Now, they’re in the perfect position to pounce on the best performers in the best sectors and find some real value in the process.

I’m sure you’ve heard the saying, “The definition of insanity is doing the same thing over and over and expecting different results.”

Well, smart investors have adopted new strategies that can handle all market conditions, because the 60/40 model certainly hasn’t weathered the storm.

Some of those smart investors are those who sought out unbiased, accurate, ratings-based recommendations from Weiss’ team of experts.

In uncertain and unfavorable conditions, that’s one very wise way to seek safety and sanity in a market that’s anything but.

Until next time,

Gavin