|

| By Gavin Magor |

If you’re not familiar with the term “falling knife,” it’s any asset that plummets in price over a short period of time.

Just as catching an actual falling knife can cause serious physical damage, buying a stock with swift downward momentum can result in a great deal of financial pain.

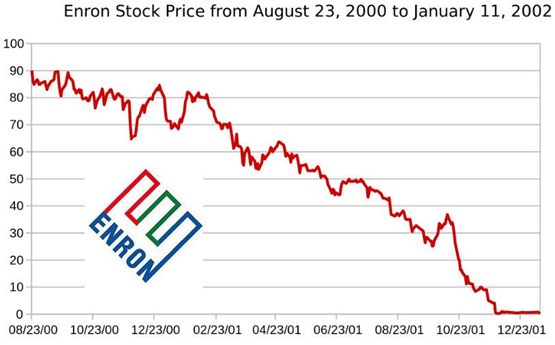

Enron illustrated this perfectly. In the months leading up to its collapse in 2001, shares of the American energy company plunged from $90 to less than $1.

Investors who thought they were buying a pullback ended up riding it all the way to zero.

Living with missed opportunities is one thing. Taking a chance on a rapidly sinking stock is an easy way to bleed money.

That strategy goes against my natural bias toward safety.

I’d rather err on the side of caution than throw it to the wind, especially when it comes to falling knives. Failure happens all too frequently, but …

Weiss Ratings Can Sharpen Your Investment IQ

One reason many investors buy bad stocks is that they don’t closely monitor a company’s fundamentals or a stock’s technical metrics. Things like good relative strength or trading above their moving averages tend to be green flags.

But those can change in the blink of an eye in a volatile market like this one.

Still, even if those traits look positive, any number of factors can cause a stock to do the opposite of what you want. Negative global or domestic news, a scandal, CEO switch … or even good-but-not-great news like a small earnings beat or a tepid outlook for the upcoming quarter.

It’s even more important to conduct your due diligence on companies you already own that may be losing momentum quickly.

Don’t worry. Weiss Ratings does that work for you.

When our stock rating system assigns a letter grade to an asset, it takes all the available data into consideration — growth in stock price, valuation, volatility, solvency, risk metrics, monthly trading volume and more.

But no rating is forever. Every day the market is open, that asset has to prove it is worthy of re-earning … or improving … its standing in our eyes.

If our models determine that the probability of risk increases and reward falls extensively, we will downgrade a stock accordingly. Of course, we do the same on the upside, but that’s not where I want to focus your attention today.

Use Weiss Ratings to Let the Knife Fall

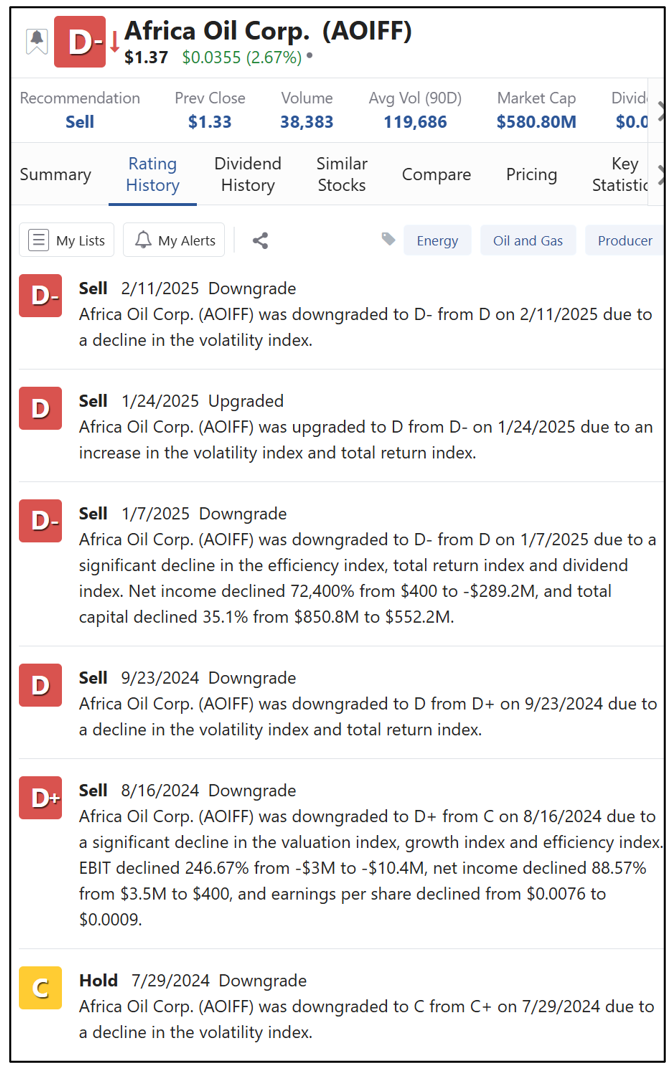

Let’s say an investor owns shares of Africa Oil (AOIFF). That person was in great shape in July 2024 when the share price rose to around $1.66. Then, shares fell to $1.36 by November for a quick 18% loss.

This could have been avoided.

As you can see from the screen below, since July 29, 2024, five out of the last six ratings changes have been downgrades.

The most recent one came on Feb. 11, from a “D” to a “D-.”

The downgrade to “Sell” would have let the investor bail before the worst of the fall. Further downgrades drive the point home.

Whilst that was just an example, I’d suggest checking the ratings on any stock you own or want to buy.

Just plug in the name or ticker symbol in the search box at Weiss Ratings.

Once you’re on that page, click on the Ratings History tab.

I conducted a search for stocks in our database that were recently downgraded to a “D+” and that Weiss Ratings is now recommending you sell instead of hold.

If you own any of the seven stocks listed below, it might behoove you to lessen your exposure or sell your shares outright.

But make sure you check back often for any further changes in ratings — up or down — so you can best determine your next moves.

Cheers!

Gavin

P.S. Here at Weiss, we have ratings on far more than just stocks. We cover ETFs, banks, insurance companies and even crypto. It’s in this last asset class that we discovered something strange. I think you’ll want to know about it, so I urge you to click here before 2 p.m. Eastern today.