Editor’s note: Your startup specialist, Chris Graebe, just introduced a new private equity deal to members of his Deal Hunters Alliance on Thursday.

And it might be the fastest deal he’s introduced to fill up. Meaning, soon, no one else will be able get into this round.

In just the first 90 minutes, $1 million was already invested.

But if you act immediately, you may be able to grab one of the last spots on this game-changing company.

It has a breakthrough biomaterial gel that could make millions of lives better.

Find the details here, while you can.

|

| By Nilus Mattive |

Last week, I told you how Donald Trump was already changing the retirement planning landscape.

Based on recent comments, he could soon change the real estate market, too.

These changes sound pretty extreme.

Whether that’s in a good way is up to you to decide.

Let’s start with a little background.

Ever since 1913, the U.S. government has collected a capital gains tax whenever someone sells an asset like a stock, bond or piece of real estate and collects a profit in the process.

Now, I personally reject that entire idea.

That’s because all those gains are being generated by money that was previously taxed — sometimes multiple times already.

From 1913 through 1921, the capital gains rate was the same as a person’s ordinary income tax rate — which capped out at 7%. (Yes, you read that right.)

I will spare you much of the ensuing history because it’s a convoluted mess with myriad changes.

But unsurprisingly, rates generally went up overall. And the ins and outs got far more complicated.

By the time the 1990s rolled around, a person could generally avoid paying capital gains taxes on a house by using the proceeds from a sale to purchase another home of equal or greater value.

This followed the same logic as the long-standing 1031 exchange rule that allowed investors to exchange one piece of property for another and avoid taxation in much the same way.

There was also a one-time capital gains exclusion with a $125,000 cap for anyone age 55 or older.

So basically, you could always trade sideways or up. And once you were nearing retirement age, you could avoid taxation on at least some part of the final profit.

Then, in 1997, the “Taxpayer Relief Act” changed the rules into what they are today.

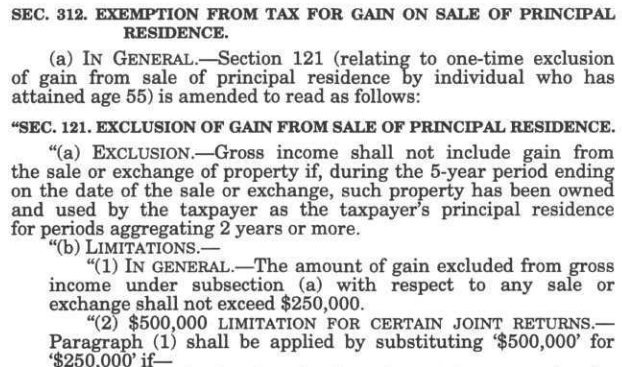

The like-kind exchange is gone. In its place, a single homeowner can exclude up to $250,000 in appreciation from capital gains taxes. The amount doubles to $500,000 for married couples.

To qualify, the home has to have served as a primary residence for at least two of the last five years in aggregate.

At the time, this might have sufficiently covered most people and most houses.

And it probably seemed like a better deal than what came before it.

Almost 30 years later? Not so much.

It’s a rather common thread:

Lawmakers come up with arbitrary numerical lines and then never adjust those numbers for all the inflation that ensues.

On top of that, the fact that married couples get a higher exemption amount hurts both single Americans and surviving spouses looking to downsize after a partner’s death.

Which brings us to today and a residential housing market that is effectively locked up because of several factors that include massive interest rate changes … huge price gains … and yes, a punitive tax code that makes it imprudent for many people to ever consider selling.

Without getting into all the details, many people in my neighborhood certainly fall into that latter category.

Homes in Santa Barbara, Calif., have appreciated quite substantially over the last decade.

Between the state and federal taxes that would be owed on a possible sale, many people I know would potentially lose several hundred thousand dollars in the transaction … making even a lateral move impractical if not impossible.

Someone in that situation would be far better off renting their existing home at an exorbitant rate and holding it forever.

Why forever? Because when they die, their heir could inherit the home and benefit from what’s called a step-up in basis.

Essentially, their cost basis would become the value of the home at the time of the original owner’s death, and they would only owe capital gains on any appreciation that happens from that point forward.

You can see why people are reticent to sell properties if they don’t have to … and sometimes even if they actually want to.

Now, I’ll be the first to admit this is only an issue for lucky people in expensive real estate markets.

But there are more and more of them, especially after the big boom in prices after 2020.

According to a 2025 study by the National Association of Realtors, 34% of homeowners would be above the single exemption amount and 10% would be above the married amount.

If the IRS is willing to forgo capital gain taxes after they die, why not forgo them altogether?

It might not solve the housing affordability issue, but it is at least a step in the right direction.

Personally, I would accept a return to the 1031 exchange concept for primary residences so people could at least move from place to place without incurring undue financial penalties.

That said, recent comments from Donald Trump suggest he might go even further and eliminate the capital gains tax on primary residences altogether.

When asked by reporters about the idea, Trump said “we’re thinking about that.”

Doing so would require Congressional approval.

It’s not clear how much momentum such a policy might garner. But I would note that there is at least one proposal already circulating on Capitol Hill.

I certainly hope it ends up becoming law.

Best wishes,

Nilus Mattive

P.S. Real estate is just one of several alternative assets you should consider investing in.

It’s one of the major asset classes I always recommend when talking about diversifying my portfolio.

Another is private equity. And you’re in luck on this front.

My colleague and friend, Chris Graebe, recently found a company that is pre-IPO but could move from its spot in a $20 billion industry to one worth $600 billion.

But you need to learn about it immediately and make your move quickly. We will be forced to pull this offline by midnight tonight.

In just the first 90 minutes that this deal was open for investments, it received $1 million. Click here now to find out more.