|

| By Sean Brodrick |

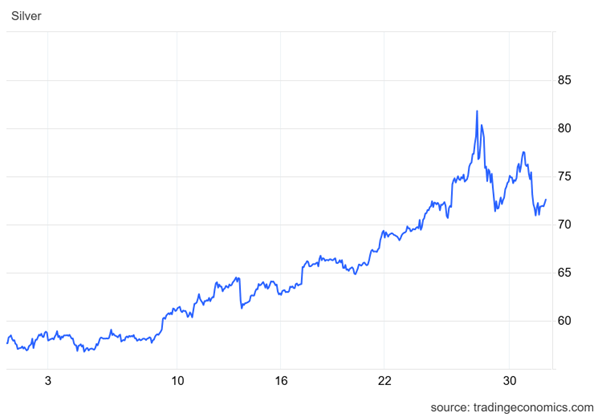

Gold and silver ended 2025 with huge gains. But this past week saw prices tumble thanks to profit-taking and CME margin hikes.

If you’re one of my paying subscribers, you’ve been long silver and gold miners for quite some time.

But plenty of people are just waking up to the action in precious metals.

Should they buy silver’s dip? Or wait for a better opportunity?

Just to recap, on Sunday, silver briefly blasted above $80 an ounce.

That great, lumbering beast we call Wall Street is finally waking up and noticing what I’ve been saying for a long time — silver is white-hot. Gold also pushed higher.

Then the metals gave back some of their recent gains.

Nothing moves in a straight line, including silver and gold. Of course, the metals were going to take a breath.

The Bearish Forces

The biggest near-term bearish force is the Chicago Mercantile Exchange.

The CME just raised margin requirements on silver futures again, and the pattern is eerily familiar to anyone who lived through past silver manias.

I say again because this wasn’t a one-off.

On Dec. 12, the CME raised initial margins by roughly 10%, from about $20,000 to roughly $22,000 per standard 5,000-ounce contract.

Then on Dec. 29, margins jumped again — to roughly $25,000 per contract, or about 6.25% of notional value.

Each hike forces leveraged traders to post more collateral. In a vertical market, that almost always hits speculators first.

We’ve seen this in past rallies.

In the 2011 silver spike, the CME raised margins five times in 10 days.

Maintenance requirements jumped from $11,745 to $16,200 — and higher after that — with silver trading near $49.

The result was forced liquidation, cascading sell orders and a brutal collapse.

Silver dropped roughly 30% within weeks of the final hike and then slid into a multiyear bear market.

I expect more margin hikes to push silver prices lower in the short term.

However, it’s NOT the end of the bull market.

The Bull Will Dip — Then Run Again

Why? In 2011, the silver rally was driven by heavy speculation in futures.

This time around, the surge in silver is driven by physical demand.

The single biggest driver? Solar.

Silver accounts for roughly 10% of the cost of a solar panel.

Annual silver demand from solar manufacturing is now around 200 million ounces per year, or roughly 19% of total global silver demand.

That figure jumped about 20% to 25% over the past year, and most mainstream forecasts see it climbing toward 250 million ounces or more by 2030.

Then there’s supply …

Up to 75% of silver production comes as a byproduct of mining other metals.

That means supply is slow, inflexible and largely unresponsive to higher prices.

Some people say, “Solar manufacturers will just switch to copper.”

People who say that have heads so full of cheese, they should legally change their names to Cheddar.

Silver is the best electrical conductor on Earth.

Reengineering solar manufacturing lines would take years.

And copper prices are already soaring too.

There is no quick or easy substitution.

China Weaponizes Silver

Starting yesterday, China began to require export licenses for silver with strict criteria that effectively push small and midsize exporters out of the market rather than a blanket export ban.

In 2024 — the latest data available — China exported about 4,244 metric tons of refined silver.

That’s roughly 136 million troy ounces.

Remove even part of that flow, and an already tight market gets much tighter.

The Silver Institute and related forecasts put the 2025 silver deficit in the 95-120-million ounce range, marking the fifth consecutive year of shortfall.

So, let’s connect the dots …

- The market is tight.

- Prices surged.

- The CME is reacting — correctly — by raising margins.

That sets the stage for a pullback.

A 20% correction or more would not surprise me at all.

Frankly, I’d welcome it.

That pullback will likely create the buying opportunity of a lifetime.

What Happens Next?

Between Washington’s spend-now-worry-later fiscal insanity and a growing global rejection of fiat currency, the long-term backdrop for hard assets remains exceptional.

A weakening dollar is poison for purchasing power — and rocket fuel for precious metals.

So, while I’m expecting a deeper pullback in silver, it will find a new, higher floor.

It will go higher. That’s when you buy.

Meanwhile, the obvious solution for hard-pressed solar manufacturers is equally bullish — secure supply.

One way to do that is by buying silver miners outright, locking in production at below-market prices.

Two ways to trade this are the iShares Silver Trust (SLV), which holds physical silver, and the Global X Silver Miners ETF (SIL), which holds a basket of leading miners.

Over the past five months, silver — and SLV — are up more than 100%, while silver miners are up about 80%.

Since miners are leveraged to the metal, that shouldn’t be happening.

The market is severely undervaluing silver miners — for the moment.

Their day will come.

Owning both physical silver exposure and silver miners is the smart move.

The pullback will end.

Short-term traders will want to buy the next bottom.

Investors — with their eyes on much higher prices longer term — can buy when they feel like it.

So, good luck in these wild precious metals markets in 2026.

We are going to see higher prices for both gold and silver.

The next leg of the rally could be incredible.

All the best,

Sean

P.S. While a basket of silver miners is a great way to play this extended bull market, there’s a better way — the best individual miners.

I’ve put together several reports identifying exactly which ones are poised for the biggest gains in this new year. You can get those here.