|

| By Sean Brodrick |

I’ll be at the Las Vegas MoneyShow next week, and one of my hot topics is precious metals. One metal that is really poised to shine is silver.

Today, I’m going to give you a sneak peak at my presentation and an idea of how you can ring your own bell on sterling silver profits.

I can give you plenty of fundamental reasons why gold and silver should go higher. But the big thing — the infuriating thing — about precious metals now is their action in the short term depends on what the Fed says.

Both gold and silver came under pressure last week when Federal Reserve Gov. Christopher Waller said that the U.S. central bank needs to continue raising interest rates because inflation is “still much too high.” This boosted the dollar, which drove gold and silver lower … in the short term.

That short-term rise in the dollar hit a wall on Tuesday, even though President of the Federal Reserve Bank of St. Louis James Bullard said that because there hasn’t been much discernible progress on inflation, interest rates must continue to rise.

Gold and silver shrugged off Bullard’s comments. This tells me the bad news may be priced in ahead of the next Fed policy meeting on May 2–3.

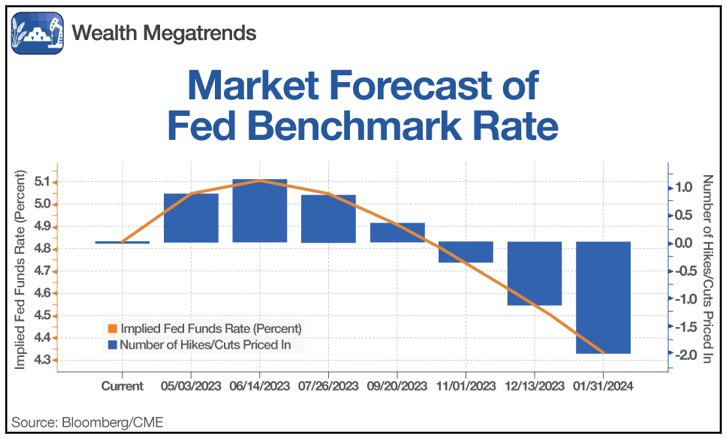

To be sure, I believe the market was too optimistic about Fed rate cuts between now and the end of the year, even as Fed members kept talking about holding rates “higher for longer.” Here’s what the market is pricing in now for Fed hikes/cuts:

Click here to see full-sized image.

Traders used to be even more optimistic, pricing in an end to hikes at the May meeting. After Waller spoke, the market started pricing in a rate hike in June. And yet, despite tough talk from a number of Fed presidents, the market still believes rate hikes will end in June. This is, in fact …

A Picture

of Optimism

The market is pricing chances of rate hikes in May and June of 88% and 22%, respectively, and the current implied peak rate is 4.8%. So we have 30 basis points to go. Then, starting at the July meeting, traders expect cuts to start.

Is the market right? Is the Fed all just tough talk?

I guess we’ll see. But for now, bad news (a June hike) may be priced in, and gold is still above $2,000 an ounce.

Citigroup Likes

Silver, Too!

In addition, Citigroup (C) released analysis on Tuesday morning stating that there will be more dollar weakness ahead … and the best way to play that is through silver. Citigroup analyst Maximilian Layton wrote:

“Silver has already rallied 20% in a short period of time, but we think it has another 10%+ move in the tank over the coming months to $30 per ounce, with our bull case of $34 per ounce still a distinct possibility over the next 6 to 12 months.”

I agree … to a point. But I believe Citigroup’s target on silver is too low. I think silver is going to at least $38 and potentially much higher due to not only dollar weakness, but also a good ol’ supply-demand squeeze.

Peak Silver

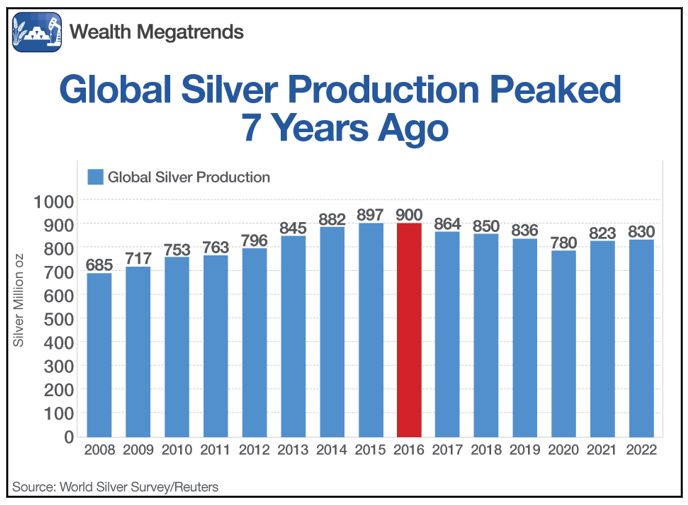

Let’s look at a couple of charts I’ve made for one of my presentations at the Las Vegas MoneyShow next week. First, here’s a chart of global silver production through last year:

Click here to see full-sized image.

As you can see, global silver production topped out seven years ago, despite a rise for the past two years. Silver production seems to have peaked, at least for now, until higher prices spur more production.

And even if prices go higher, it’s hard to ramp up global silver production. That’s because most silver is produced as a byproduct of other metals.

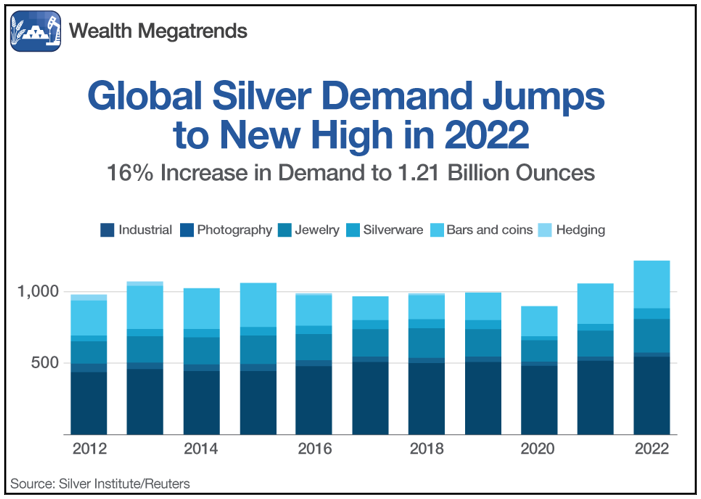

Now, let’s look at silver demand:

Click here to see full-sized image.

Last year saw global demand surge 16% to 1.21 billion ounces, pushed along by rising demand in automotive electronics and solar power.

The result is silver is heading for its biggest deficit in years. Sure, stockpiles can make up the difference … for a while. But that will only bridge the gap for so long.

How You Can Play It

This week in my trading service, Resource Trader, I recommended a new silver pick to my members — a pick that I believe has at least six-bagger potential. That’s the kind of return you can find in small, underfollowed stocks, at least when the precious metal bull market gets rolling.

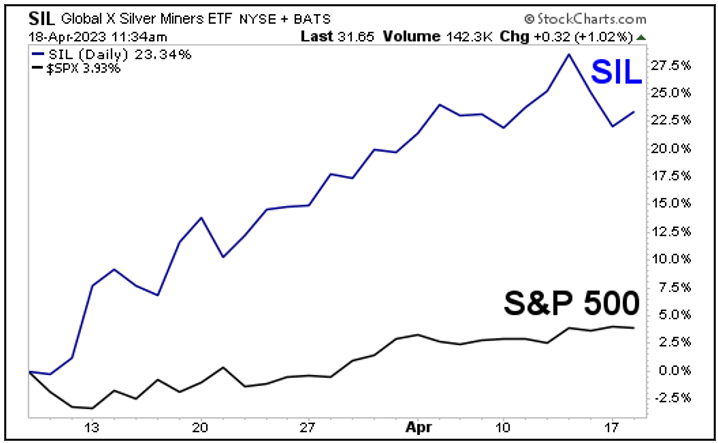

If you’re doing this on your own, consider putting some money in the Global X Silver Miners ETF (SIL). This billion-dollar ETF holds a basket of 33 stocks and has an expense ratio of 0.65%. And since the most recent bottom in precious metals on March 9, the SIL has roared higher, far outpacing the S&P 500:

Click here to see full-sized image.

You can see that the SIL is up 23.34% over this time frame. The S&P 500 is up just 3.93% at the same time.

The SIL holds some great silver producers. Its top three holdings are Wheaton Precious Metals (WPM), Pan American Silver (PAAS) and SSR Mining (SSRM).

The biggest returns will still go to individual names that outperform. But SIL gives you a great piece of the action without the stress.

If you’re at the MoneyShow in Vegas, be sure to come say “Hi!” Either way, don’t miss out on this opportunity in silver.

All the best,

Sean

P.S. According to my friend, colleague and Weiss Ratings Startup Investing Specialist Chris Graebe, the recent banking panic is already driving promising companies to equity crowdfunding, an alternative funding that allows regular, non-accredited investors to invest in early, pre-IPO companies. This presents a huge opportunity for Weiss Members. Click here to learn more about how to claim an early stake in a well-vetted startup.