|

| By Jordan Chussler |

My birthday’s next week. I’ll be turning 40, which oddly coincides with the recent 40-year high in inflation.

But I digress …

The landmark occasion — my birthday, not the inflation — got me thinking about indulgences.

I’ve been known to eat shrimp by the dozen, and on celebratory occasions, a few bottles of Yuengling make times more festive.

But I’m not alone in having vices. We all have them … and companies know exactly how to capitalize on that.

A former colleague of mine used to talk about “sinvesting,” the act of investing in goods that cater precisely to those indulgences we can’t get enough of.

These products — be it alcohol, sugary foods or tobacco — are considered consumer staples. And of the S&P 500’s 11 sectors, consumer staples have performed the best over the past three months.

Regardless of the relatively strong performance of late, consumer staples aren’t a cyclical sector. No matter how the economy is performing, they’re essential and always in demand.

In fact, they play such an enormous economic role that they account for 70% of America’s gross domestic product.

And before you start wondering if things like chocolate, lager and cigarettes are in fact essential, consider the following:

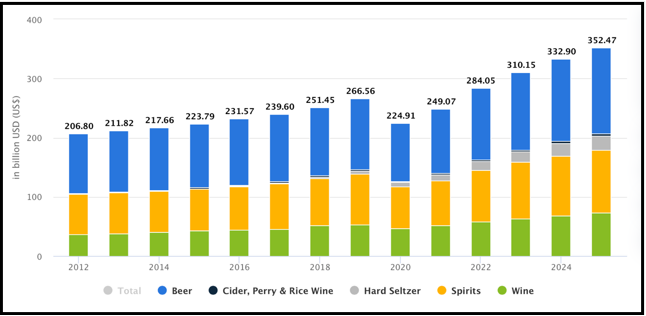

• Revenue from alcoholic drinks will amount to $284.1 billion in 2022. Of that, beer accounts for the largest market volume with $121.3 billion.

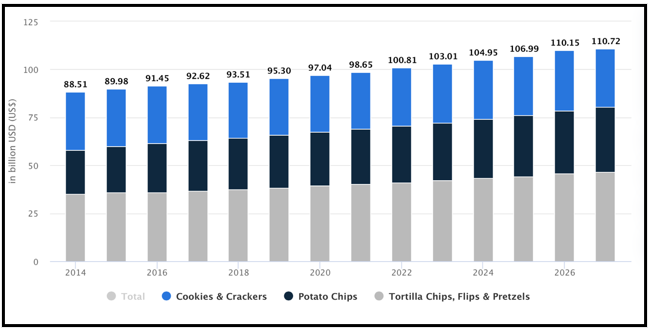

• Snack food — or what our mothers maligned as junk food — is expected to grow from a $97 billion industry in 2020 to over $110 billion by 2026.

• And tobacco sales, which fell from nearly $400 billion in 2001 to $203 billion in 2019, saw a pandemic-induced resurgence in 2020. Revenues from just the cigarette market in the U.S. topped $80 billion and are expected to increase slightly in 2023 to $81 billion.

Smoke ‘Em If You Got ‘Em

Some companies have become so successful, their brands are now synonymous with the products they — and other companies — sell. Think Band-Aid, Kleenex, Astroturf and Aspirin.

And while others haven’t been given proprietary eponyms, their market dominance is known globally. (Try to find a smoker who’s never heard of Marlboro.)

So I ventured over to the Weiss Ratings to see how some of the biggest names in sinvesting are doing.

1. Anheuser-Busch InBev (BUD)

Many self-respecting beer drinkers turn their noses up at Budweiser, me included. But just because I won’t drink it doesn’t mean I shouldn’t invest in it. (I share that sentiment with oil, as well.)

Bud’s maker, Anheuser-Busch InBev, is a brewing behemoth that receives a “C” rating. The company produces more than 500 brands, including Beck’s, Corona, Hoegaarden, Modelo and Stella Artois.

With the increasing popularity of craft beers and microbreweries, the company’s seen its market share decrease from 46.9% in 2011 to 38.6% in 2022. But 38.6% is still a massive slice of the pie, and Anheuser-Busch InBev likely won’t be reducing its allotted budget for the $6.5 million Super Bowl commercials we’ve all come to love.

Shares are down over 14% year to date, but the company reported over $54 billion in year-over-year revenue for 2021, good for a 11.2% increase after seeing two consecutive years of declining revenue.

BUD also offers a strong dividend yielding 2.16%, or $0.28/ share quarterly.

2. Hershey (HSY)

If I come home from the grocery store with a Mr. Goodbar, you’d guess by my wife’s reaction that I brought her a dozen roses. (Pro tip: Roses don’t taste as good.)

The company, which has dominated the global chocolate market since its inception in 1894, receives a “B+” Weiss Rating. Shares of Hershey are up over 13% YTD.

In 2021, the maker of 5th Avenue, Almond Joy, Good & Plenty and a slew of other confections saw YoY revenue increase from $8.15 billion in 2020 to $8.97 billion — good for growth of 10.05% from the year prior. In the 12 months ending March 31, 2022, Hershey saw an 11.1% increase in revenue with $9.34 billion.

Additionally, Hershey has a fast-growing line of healthier snacks like Skinny Pop, gluten-free Pirate’s Booty popcorn and ONE Bars.

How fast is it growing? The snacks division reported an 87% year-over-year increase in revenues.

Icing the cake, the company’s dividend spins off 1.68%, or $0.90/share quarterly.

3. Philip Morris International (PM)

Philip Morris is the maker of Marlboro, Virginia Slims, Benson & Hedges, Parliament and 126 other brands. In 2021, the company generated over $82 billion in net revenues, up $76 billion from the year prior.

The forward-thinking company isn’t strictly focusing on tobacco products, either. It recently dipped its toes into the vaping and e-cigarette trend, touting smokeless products as effective smoking cessation tools. Since doing so, Philip Morris claims that 12.7 million adult smokers have switched to its vapor products and quit smoking.

The company receives a “B” rating, and shares are down just over 1% YTD. But in a turbulent market where investors are looking for safe-haven investments — particularly in defensive stocks that produce income — PM’s massive dividend yield of 5.04%, or $1.25/share quarterly, is particularly alluring.

If you’re looking for recommended picks in the consumer staples space, Members of Senior Editor Sean Brodrick’s Wealth Megatrends are enjoying double-digit gains on numerous positions in a market laden with volatility and sell-offs fueled by recession fears.

No matter what you decide, be sure to conduct your own due diligence before entering any trade.

And remember, don’t let anyone make you feel bad about enjoying your vices. If done right, each time you unwrap a Reese’s Peanut Butter Cup, you can claim that you’re passively investing.

Until next time,

Jordan Chussler

Managing Editor

Weiss Ratings Daily